During the plenary session held at the Grand Hall on the morning of November 11th, the National Assembly reviewed the revised Investment Law.

Minister of Finance Nguyen Van Thang – Photo: VGP/Nhat Bac

|

According to Minister of Finance Nguyen Van Thang, the revised law aims to institutionalize the Party’s resolutions, address institutional and legal bottlenecks, streamline investment and business procedures, and create a more favorable environment for citizens and enterprises.

It also seeks to refine regulations on conditional investment sectors, eliminate unnecessary or unreasonable industries, and improve the decentralization of management between central and local authorities to enhance state governance efficiency.

The law governs domestic and outbound investment activities, applying to investors and entities involved in such endeavors.

Investment approval processes should only be mandated in truly essential cases

Reviewing the draft, National Assembly Economic and Financial Committee Chairman Phan Van Mai supported the government’s rationale for expedited revisions. He confirmed the draft complies with legislative issuance regulations.

Chairman Phan Van Mai presents the review report – Photo: VGP/Nhat Bac

|

The committee recommended further aligning the law with Party policies on economic innovation, private sector development, technological advancement, international integration, and national security. It stressed synchronizing policies with concurrent legislative drafts.

For investment approval processes, the committee urged meticulous review to restrict such requirements to genuinely necessary cases.

It also called for careful justification of removing the National Assembly’s approval authority, ensuring alignment with decentralization principles.

Article 3(1) should be simplified to focus on broad policy directions and clarify state oversight needs through investment approvals.

The draft must clarify “planning alignment” criteria to address practical bottlenecks while ensuring consistency with concurrent legislation.

Suggestions included limiting initial approvals to high-level plans (e.g., master plans) and specific sectors, avoiding excessive detail.

On investment incentives (Chapter III), the committee recommended refining sector prioritization criteria and delegating detailed lists to the government for periodic updates.

Regarding foreign investment management (Article 20), cautious review was advised for allowing foreign entities to establish businesses without prior investment projects.

– 10:45 11/11/2025

Prime Minister Demands Ministry of Construction Clarify Causes of Delayed Social Housing Projects

Regarding the progress of social housing projects, the Prime Minister has requested the Ministry of Construction to provide a detailed report on the current delays in investment procedures and construction processes. The report should clarify the sequence of steps, identify the causes of bottlenecks, and address any obstacles hindering the timely implementation of these projects.

How Will the Sharp Rise in Land Prices from 2026 Impact the Market?

Crafting land price tables demands meticulous care, scientific rigor, and a well-planned timeline to prevent market disruption, according to the Vietnam Institute of Real Estate Research and Evaluation (VARS IRE).

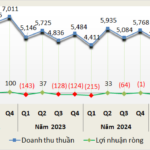

Cement Industry Profits Surge in Q3, Anticipating Strong Year-End Growth

Third-quarter revenue for 17 listed cement companies rose 6%, with industry-wide profits surpassing 70 billion VND, a stark reversal from the 60 billion VND loss incurred in the same period last year. This marks the second consecutive profitable quarter. Fueled by increased public investment disbursement and a gradually recovering real estate market, the sector is poised for accelerated growth in the final months of the year.

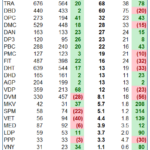

Q3 Pharmaceutical Sector: Sustaining Growth Momentum

The strategic restructuring of product portfolios, coupled with the advantages gained from the 2024 year-end policies, has significantly bolstered the performance of most pharmaceutical companies in Q3 2025.