Social Housing Prices Reach 5 Billion VND per Unit

According to the Ministry of Construction’s report, apartment prices in Hanoi continued their upward trend in Q3/2025, particularly in the mid-range and high-end segments.

For instance, in Hanoi, primary apartment prices surged, averaging 95 million VND per square meter, with over 43% of new supply units priced above 120 million VND per square meter.

This trend isn’t limited to commercial properties. In the secondary market, social housing—designed for middle and low-income earners—has also seen “skyrocketing” price increases.

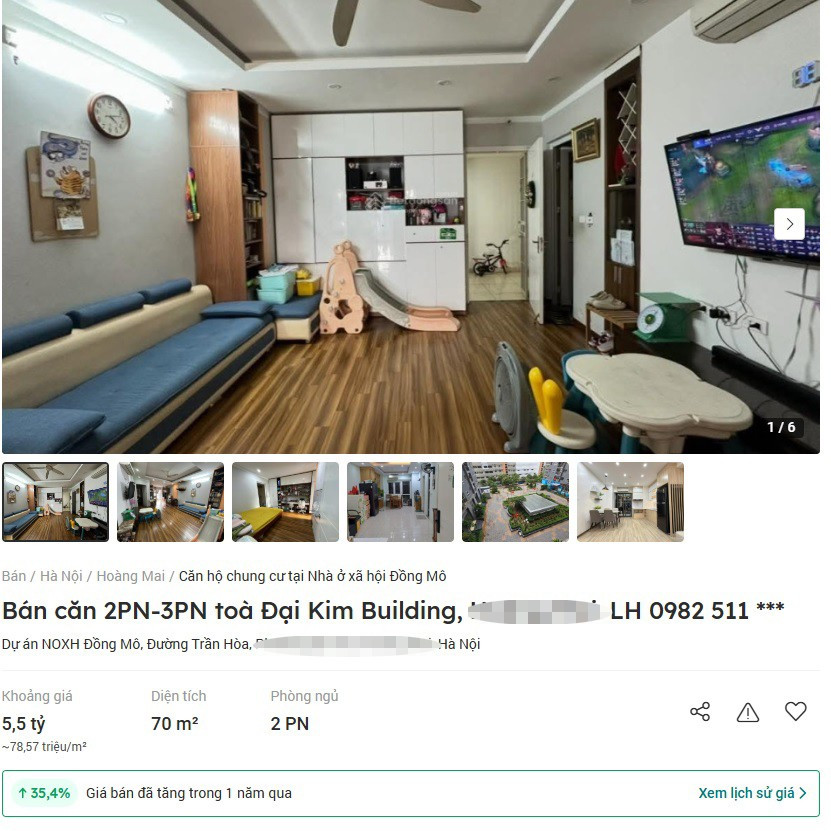

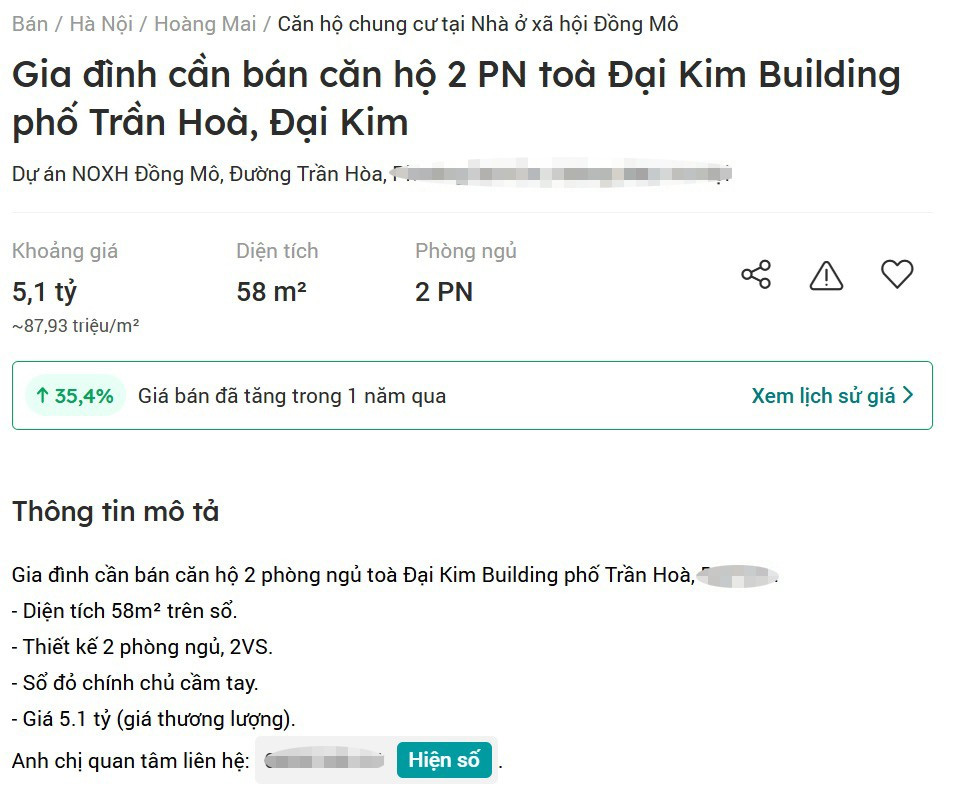

A social housing unit at Dai Kim Building in Dinh Cong Ward (Hanoi) listed at nearly 90 million VND per square meter. Screenshot.

A survey revealed that several units at Dong Mo Dai Kim social housing (commercially known as Dai Kim Building) in Dinh Cong Ward are listed above 5 billion VND, ranging from 70-80 million VND per square meter. Some units even approach 90 million VND per square meter.

Initially priced at nearly 15 million VND per square meter, residents have lived here for over 7 years. Current prices are over five times the launch price.

Similarly, the HH apartment complex in Linh Dam urban area (Hoang Liet Ward), launched in 2015 at 13.5-15.5 million VND per square meter, has seen significant price increases after 10 years.

HH Linh Dam units now list between 40-45 million VND per square meter. Prime location units with renovated interiors reach 50 million VND per square meter. In Hoang Liet Ward, Rice City Linh Dam apartments also surged to 4.9–5.3 billion VND per unit.

Other projects like @Homes (Hoang Mai Ward) set new price benchmarks at 4.7–5.2 billion VND per unit, while IEC Thanh Tri (60-70 sqm) ranges from 3-4 billion VND.

Possibly Just Expected Prices

Ms. Pham Thi Mien, Vice Director of VARS IRE, Vietnam Real Estate Brokerage Association (VARS), attributes the rise in older social housing prices to the supply-demand gap in the housing market.

The surge in older social housing prices stems from the housing market’s supply-demand imbalance.

According to Ms. Mien, both social housing and general housing prices have risen due to limited supply, while real demand remains high.

She notes that many listed prices, especially 60-88 million VND per square meter, may be speculative and don’t reflect actual transaction values. However, speculation and underground transfers negatively impact the market.

“Some individuals manipulate supply scarcity for profit, distorting property values and making affordable housing harder to access for genuine buyers,” Ms. Mien emphasized.

VARS IRE warns that without comprehensive policies to boost social and affordable housing, coupled with strict price controls, the “housing dream” will remain elusive for most young people.

Luxury Living in Hanoi: Apartment Prices Hit the 100 Million VND/m² Mark

In Q3/2025, Hanoi apartment prices remain high, with luxury and high-end projects driving the average primary market price to over 100 million VND/m². Despite increased new supply, the market still lacks affordable options, leaving many genuine buyers struggling to keep up in the race to purchase a home.