SMC Turmoil: Chairman Resigns, New Shareholder Group Acquires Over 20% Stake

Over the past five days, three board members—Mr. Nguyễn Vũ Kinh Luân, Mr. Vũ Anh Nguyên, and Mr. Fujitsuka Masahiko—have submitted their resignations. Both Mr. Luân and Mr. Nguyên confirmed that their decisions stem from the board’s collective strategy to streamline and restructure the management framework. Additionally, Mr. Nguyễn Quang Trung, a member of the Supervisory Board, has also resigned.

This move aligns with the personnel streamlining resolution previously announced by the SMC Board of Directors. According to the plan, the board will be reduced from seven members to five, while the Supervisory Board will maintain four members.

This wave of personnel changes follows the turbulence from the extraordinary shareholders’ meeting held in late September 2025, where a new shareholder group holding over 20% of the shares officially emerged. At that time, Ms. Nguyễn Thị Ngọc Loan resigned as Chairwoman of the Board, ceding her position to Mr. Phạm Hoàng Anh, who represents the new shareholder group.

During the extraordinary meeting, Chairman Phạm Hoàng Anh stated that the company’s top priority is addressing outstanding debt and completing restructuring efforts within the year. Subsequently, SMC will overhaul its governance and management systems, renegotiate terms with suppliers and customers to enhance business efficiency, and finally, proceed with a capital increase.

– 16:13 11/11/2025

BCM Plans to Raise VND 2,000 Billion Through Bond Issuance in Q4

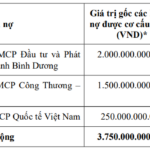

Following a successful issuance of VND 2.5 trillion in bonds in August, Becamex Group is set to launch an additional VND 2.0 trillion in private bonds in the final quarter of this year. This strategic move aims to restructure existing debt and fuel further expansion of its industrial park investments.

Becamex Group Plans to Issue VND 2 Trillion in Corporate Bonds

Becamex Group plans to issue VND 2,000 billion in bonds to restructure its debt and fund various investment programs and projects throughout 2025.

Assessing the Impact of Storms, Rain, and Floods on Borrowers’ Loan Status

The State Bank of Vietnam has mandated that credit institutions and branches in affected areas urgently review and assess the status of borrowers to implement support measures for overcoming the aftermath of Typhoon No. 10, ensuring that financial resources reach the intended recipients effectively.