|

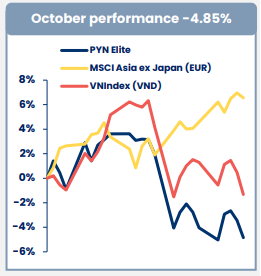

PYN Elite’s Performance vs. VN-Index

Source: PYN Elite Fund

|

According to the report released on November 10, PYN Elite announced that the VN-Index reached a historic high of 1,766 points on October 16. This surge was fueled by market optimism following a third-quarter GDP growth of 8.23%—the highest post-pandemic—and FTSE’s decision to upgrade Vietnam’s stock market to secondary emerging market status, effective September 2026.

However, after this rapid ascent, profit-taking pressures led to a sharp correction, with the index closing October down 1.33% month-on-month. During the same period, PYN Elite’s investment performance declined by 4.85%, primarily due to significant drops in banking and financial stocks. Notably, VIX and VCI were among the top underperformers, falling 22.4% and over 14%, respectively.

|

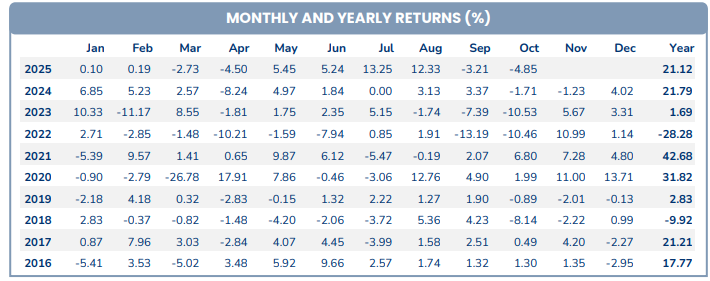

PYN Elite’s Investment Performance (2016-2025)

Source: PYN Elite Fund

|

Following two consecutive months of decline, PYN Elite’s year-to-date return narrowed from 27.29% after nine months to 21.12%.

Despite the stock market’s cooling, macroeconomic fundamentals remain robust. Third-quarter earnings reports from listed companies were generally positive, with aggregate net profits rising 30% year-on-year. Notably, on October 26, Vietnam and the United States jointly announced the Framework Agreement for a Just and Balanced Trade Partnership, paving the way for enhanced bilateral cooperation and tariff reductions, which could boost exports and investment.

On the policy front, the 10th session of the 15th National Assembly, which opened on October 20 and is scheduled to last 50 days, is one of the year’s most critical legislative events. The Assembly is expected to approve a $300 billion public investment plan for 2026-2030, along with 49 bills and 4 resolutions aimed at addressing legal bottlenecks in key sectors such as real estate and public investment.

Vietnam’s economy demonstrated strong momentum in October. Exports and imports grew 17.5% and 16.8% year-on-year, respectively, while industrial production expanded 10.8%, marking the second consecutive month of double-digit growth. The manufacturing PMI reached 54.5, its highest since July 2024.

Foreign investment inflows remained positive, with registered FDI up 15.6% and disbursed FDI rising 8.8% year-on-year. Retail sales growth slowed to 7.2%, impacted by widespread flooding and storms.

Inflation was well-contained at 3.25% year-on-year, while public investment disbursement and state budget revenue increased 27.8% and 30.8%, respectively, reaching 111% of the annual target.

– 14:28 11/11/2025

Vietstock Daily 12/11/2025: Market Pulls Back from Decline

The VN-Index has rebounded, yet trading volume remains below its 20-day average, indicating lingering investor caution following the recent sharp decline. The Stochastic Oscillator continues to weaken in oversold territory. Should buy signals reemerge in upcoming sessions, the recovery outlook may strengthen.

Market Pressures Mount: What Lies Ahead for Stocks Next Week?

Last week, the VN-Index fell below the 1,600-point mark amid mounting pressure from a strengthening USD/VND exchange rate and heavy net selling by foreign investors. Despite positive macroeconomic data and third-quarter corporate earnings, analysts predict that the stock market may shift toward a consolidation phase next week, testing the support range of 1,550–1,580 points in the short term.

Vietstock Weekly 10-14/11/2025: Seeking New Foundations?

The VN-Index extended its losing streak into the fourth consecutive week, underscoring a pronounced weakening trend in the market. Trading volumes remained below the 20-week average, indicating persistent caution among investors. The index is now retreating to test the Middle Band of the Bollinger Bands, as both the Stochastic Oscillator and MACD continue to weaken following earlier sell signals.

Technical Analysis Afternoon Session 10/11: August 2025’s Previous Bottom Fully Breached

The VN-Index has extended its short-term correction, decisively breaching the previous August 2025 low (equivalent to the 1,605–1,630 point range). Meanwhile, the HNX-Index is trending downward, now approaching the Lower Band of its Bollinger Bands.