TPC announced that the repurchased treasury shares will be canceled in accordance with securities laws to reduce the number of outstanding shares, thereby increasing the dividend ratio for shareholders in the coming years.

The funding for the share repurchase will be sourced from the surplus capital as per the audited financial statements, amounting to 77.2 billion VND, with a maximum purchase price of 13,500 VND per share.

On each trading day, the minimum order volume is 171,000 shares (3% of the registered trading volume with the State Securities Commission), and the maximum is 570,000 shares (10% of the registered trading volume). The order volume excludes canceled orders, and this rule is waived when the remaining purchase volume is less than 171,000 shares (3% of the registered trading volume).

The repurchase is expected to be completed within a maximum of 30 days from the announcement of the treasury share purchase transaction, following approval from the State Securities Commission.

Upon completion of the repurchase, TPC‘s charter capital will be adjusted downward from over 225 billion VND to more than 168 billion VND.

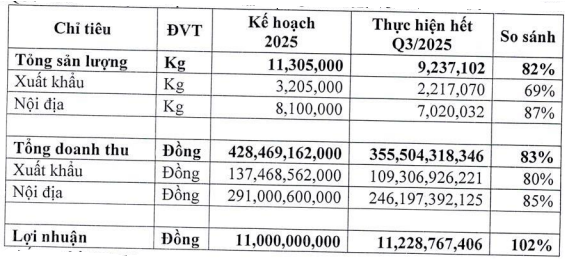

In addition to the early repurchase plan, TPC‘s management also presented to the Annual General Meeting the achievement of exceeding the 2025 profit target after 9 months. Specifically, in the first 9 months, TPC recorded a net profit of over 11.2 billion VND, a 65% increase year-on-year and surpassing the annual plan by 2%.

|

Implementation of TPC‘s 2025 annual plan after 9 months

Source: TPC

|

– 09:07 10/11/2025

Vinasun Board Member Seeks to Offload 1 Million VNS Shares

Taurus Consulting, a company associated with a Vinasun Board of Directors member, has registered to sell 1 million VNS shares to restructure its investment portfolio.

The World of Mobile Reduces Its Chartered Capital

Mobile World Investment Corporation has announced plans to repurchase up to 10 million shares to reduce its charter capital. The repurchase price will range from a minimum of VND 10,000 per share to a maximum of VND 200,000 per share, based on market prices at the time of transaction. Consequently, the estimated maximum expenditure for this initiative is VND 2 trillion.