|

Profits Plummet Across the Board

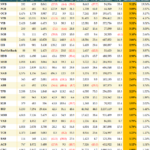

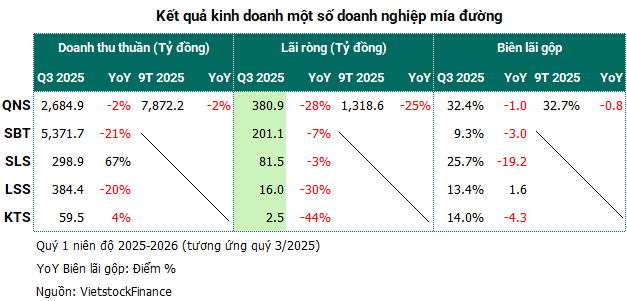

Quang Ngai Sugar (QNS), the industry leader, reported a 28% drop in net profit for Q3/2025 (equivalent to the first quarter of the new fiscal year), reaching 381 billion VND—the lowest in the past 10 quarters. Over the first nine months, QNS’s net profit barely reached 1.319 trillion VND, a 25% decline, achieving only 74% of the annual target.

| QNS Quarterly Business Results (2023-2025) |

The sugar segment remains the heaviest burden on the company’s profitability. In the first nine months, this segment generated only 2.635 trillion VND in revenue (down 18%), with gross profit plunging 44%, narrowing the gross margin from 32.3% to 22%. The company attributed this to weak demand and fierce competition from liquid sugar and smuggled sugar, driving prices down and hurting performance.

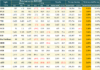

Son La Sugarcane and Sugar (SLS), known for its high production efficiency, also succumbed to the downturn. Sugar revenue plummeted 68%, and gross margin fell from a peak of 45% to 25.7%. However, a near doubling of financial revenue—thanks to a 47-fold surge in bank deposits to over 151 billion VND—helped cushion the blow, with net profit declining just 3% to 81.5 billion VND. This is the lowest in seven quarters but still meets 74% of the annual plan, reflecting the company’s conservative target-setting.

| SLS Quarterly Business Results (Past 2 Years) |

Thanh Thanh Cong – Bien Hoa JSC (TTC AgriS, SBT), the industry’s flagship, followed a similar trajectory. Quarterly revenue dropped 21% to 5.372 trillion VND, the lowest in three years, with gross margin shrinking to 9.3%. The sugar segment, accounting for over 90% of revenue, fell 24%, and its gross margin dropped sharply from 12.3% to 8.1%. Nonetheless, the company was partially rescued by a 53-fold increase in profit from associates, an 11% rise in financial revenue, and other profits replacing losses from the same period last year, resulting in a modest 7% decline in net profit to 201 billion VND—still the lowest in a year.

Smaller Players Also Struggling

Among smaller companies, Kon Tum Sugar (KTS) reported a 20% rise in quarterly revenue but saw net profit plunge 44% to 2.5 billion VND, achieving only 21% of the annual target. The primary cause was a 30% increase in production costs, driving gross margin down from 21.4% to 14.7%.

Lam Son Sugarcane and Sugar (Lasuco, LSS) was a rare bright spot, improving its gross margin by 1.6 percentage points to 13.4%, reflecting efforts to reduce production costs. However, results remained bleak, with net profit falling 30% to 16 billion VND, mainly due to a 20% drop in revenue and a 30% rise in financial costs. Consequently, the first quarter of the 2025-2026 fiscal year became Lasuco’s worst on record, achieving only 14% of the annual profit target.

Risk of a Broken Supply Chain

The widespread profit decline is not random but stems from systemic pressures weighing on the entire industry. According to Vietcombank Securities (VCBS), domestic sugar prices in Q3/2025 continued to fall, hovering around 17,500 VND/kg, due to ample supply, sluggish consumption, and high inventory levels. Meanwhile, smuggled sugar remains the industry’s biggest bottleneck, creating unfair competition and eroding domestic producers’ market share.

In response, Prime Minister Pham Minh Chinh directed the Ministry of Agriculture and Rural Development and the Ministry of Finance to urgently review production, inventory, and smuggled sugar issues under Document No. 7951/VPCP-NN. This move underscores the government’s efforts to support the industry during this crisis.

Nguyen Van Loc, Chairman of the Vietnam Sugarcane and Sugar Association, warned of a potential breakdown in the farmer-enterprise supply chain if low sugar prices persist. Without incentives for farmers to grow sugarcane, the industry risks losing its raw material base, threatening sustainable development.

What Lies Ahead for Vietnam’s Sugar Industry?

In summary, the 2025-2026 fiscal year began with unprecedented challenges for the sugar industry, amid converging pressures: falling prices, record-high inventories, and intensifying competition from imported sugar. VCBS forecasts that global and domestic sugar prices may continue to decline slightly due to oversupply and weak demand.

The industry’s recovery will hinge on two factors: the effectiveness of government market management and anti-smuggling measures, and companies’ ability to restructure internally, optimize costs, and adapt to fierce competition.

Amid these challenges, the critical question remains: Will policy interventions and self-efforts be enough to restore the industry’s “sweetness,” or will this mark the beginning of a deeper adjustment cycle in the years ahead?

|

Inventory: The Industry’s Ticking Time Bomb Another alarming indicator for the sugar industry is inventory levels. Divergent trends among companies reveal a complex industry landscape. For QNS, inventory rose 30% since the start of the year to 1.714 trillion VND by the end of September, with finished products accounting for 77% (over 1.314 trillion VND)—nearly four times higher than at the beginning of the year. This inventory pressure is expected to persist, impacting cash flow and operating costs in the coming quarters. Conversely, many companies are striving to reduce inventory. Compared to the start of the fiscal year (July 2025), SBT’s inventory fell 13% to 3.153 trillion VND; SLS dropped sharply by 40% to over 308 billion VND; LSS decreased 15% to 1.436 trillion VND; and KTS fell 18% to 206 billion VND. Finished products make up a significant portion of inventory for most companies, ranging from 60% to over 90%, reflecting weak demand. |

– 08:07 11/11/2025

The Sweet Industry’s Sour Complaints

The influx of cheap smuggled sugar has driven down domestic sugar prices to levels below those in the region.