Rystad Energy forecasts that offshore oil from Brazil, Guyana, Suriname, and Argentina’s Vaca Muerta shale will serve as the primary non-OPEC cost-competitive supply source until 2030.

Demand is projected to peak in the 2030s at approximately 107 million barrels per day (bpd), sustaining above 100 million bpd into the 2040s before declining to around 75 million bpd by 2050.

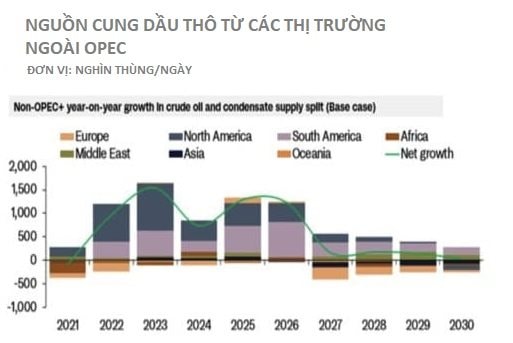

According to the Norwegian energy consultancy, non-OPEC+ supply will be pivotal in balancing the global market. Low-cost South American oil will offset slower U.S. shale growth. Non-OPEC+ producers are expected to contribute roughly 5.9 million bpd, nearly 60% of new capacity under development by 2030.

South America will lead this supply growth with 560,000 bpd of crude oil and condensate, while North America contributes approximately 480,000 bpd.

Radhika Bansal, Rystad Energy’s Vice President of Upstream Research, notes that South America’s deepwater projects are well-positioned to deliver globally competitive crude oil. Continued investment is critical as supply gaps are expected to widen post-2030s.

Brazil leads production growth, driven by ultra-deep pre-salt offshore reserves with low breakeven costs. Significant investments are underway, with several new FPSO units set to launch this year.

Brazil’s offshore output, primarily from pre-salt fields like Lula and Búzios, is a key economic driver. The country has set new production records and continues expansion through new rigs and deepwater exploration, despite regulatory and infrastructure challenges.

The Lula field, with 8.3 billion barrels of recoverable reserves, and Búzios, which hit a record 800,000 bpd in February 2025, are central to Brazil’s strategy. Additional rigs are being deployed to boost Búzios’ capacity.

Guyana’s production surged past 770,000 bpd by October 2025, led by ExxonMobil’s Stabroek Block projects. Output is expected to reach 900,000 bpd with the fourth facility’s full operation, targeting over 1 million bpd by 2027 via projects like Uaru and Whiptail.

Exxon estimates Guyana could produce nearly 1.3 million bpd by 2027, ranking it among the world’s highest per-capita oil producers.

Argentina’s Vaca Muerta shale output jumped 26% year-over-year to 447,000 bpd, now accounting for most of the country’s oil production, per Rystad.

Vaca Muerta, holding 16.2 billion barrels of recoverable reserves, has seen output growth fueled by investment lowering costs and boosting efficiency in key production zones.

However, drilling activity is slowing due to saturated capacity. Notably, natural gas now dominates Vaca Muerta’s focus, with dry gas output reaching 2.1 Bcfd in Q1 2025, up 16% year-over-year.

Rystad highlights Argentina’s ambitious LNG export strategy, positioning it as a potential global gas supply leader and reshaping energy geopolitics.