The dramatic late-session reversal on November 10th hinted at potential margin calls, as the market’s upward momentum abruptly stalled.

Top performers like HPG, TCB, and SSI saw their gains significantly trimmed. SSI, for instance, surged nearly 6% intraday but closed with a modest 2% advance.

In the final 10 minutes, intense selling pressure erased the day’s earlier gains, highlighting market fragility.

Vingroup-linked stocks (VHM -5.5%, VRE -4.9%, VIC -0.4%) alongside FPT (-4.75%), GAS (-2.7%), and major banks led the decline, collectively shaving nearly 6 points from the benchmark index.

Banking stocks bled red, with MBB, HDB, CTG, EIB, MSB, and VIB under pressure. State-owned banks like VCB, BID, and CTG also retreated.

Real estate shares faced broad selling, including CEO, NVL, DXG, CII, VRE, DIG, PDR, KDH, and KBC. GEX hit its lower limit at VND 40,900. Selling spread across sectors like securities, construction, materials, and energy, with over 200 HoSE stocks declining.

The VN-Index closed down 18.56 points (-1.16%) at 1,580.54. The HNX-Index fell 1.93 points (-0.74%) to 258.18, while the UPCoM-Index gained 0.7 points (+0.6%) to 117.45.

Trading volume remained subdued, with HoSE turnover at just VND 21.169 trillion—a four-month low.

SGI Capital notes the “cheap money” era since May 2023 is nearing its end. Tightening liquidity and rising interest rates loom, posing challenges for equity markets.

Short-term stock performance remains highly sensitive to rate trends. Record margin lending and new account openings reflect prolonged low rates and economic optimism, but these tailwinds may soon reverse.

Retail Banking Sector Leads Credit Growth Surge in First Nine Months of 2025

Credit growth is projected to reach a robust 20% this year, signaling a positive outlook for the entire banking sector. However, Q3 financial reports reveal a more nuanced narrative: it’s not just about the pace of growth, but the shifting dynamics of credit flows and emerging challenges that will shape the future trajectory of individual banks in the coming period.

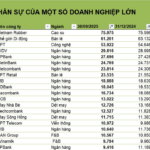

The 2025 Q3 Layoff Wave: 14 Banks Cut Nearly 7,300 Jobs, While Two FPT Subsidiaries Ramp Up Hiring Despite Parent Group’s Reduction

Among companies disclosing workforce figures, FPT Retail (FRT) leads with the highest personnel growth, adding 1,983 employees. FPT Telecom (FOX) follows closely in second place, with an increase of 986 employees.

Stock Market Liquidity Continues to Hit New Lows

Throughout today’s trading session (November 6th), the VN-Index predominantly fluctuated in negative territory. Despite briefly recovering to the reference level towards the close, the benchmark index struggled to maintain momentum. During the afternoon session, as T+ stocks became available for trading, sellers remained cautious, refraining from aggressive selling. This hesitation reflects the subdued sentiment surrounding short-term trading opportunities, which currently offer limited profit potential.

Stock Market Update November 6: VN-Index Expected to Fluctuate with Mixed Trends

VCBS Securities forecasts significant volatility in the VN-Index during the November 6th session, driven by cautious investor sentiment.