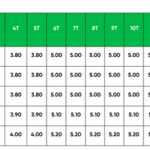

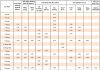

Loc Phat Bank Vietnam (LPBank) has recently adjusted its deposit interest rates across various terms, with the highest increase reaching approximately 0.3 percentage points compared to previous rates.

Specifically, customers depositing savings for terms ranging from 1 to 5 months will enjoy an additional 0.3 percentage points, while terms from 6 to 11 months will see an increase of 0.2 percentage points. Currently, the highest counter deposit interest rate at LPBank is 5.3%/year for terms of 18 months or more.

After the adjustment, the online savings interest rate for 1 month, with interest paid at maturity, is listed at 3.9%/year; for terms from 3 to 5 months, it is 4.2%/year.

Terms from 12 to 16 months offer a rate of 5.4%/year, with the highest rate of 5.5%/year applicable to terms from 18 to 60 months.

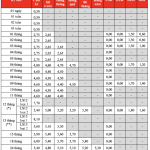

Another bank joining the interest rate hike is Kien Long Bank (KienlongBank), which had maintained its rates for several months. Customers depositing savings at KienlongBank for terms of 1 to 4 months will receive an additional 0.2 percentage points, and terms of 6 to 7 months will also see a 0.2 percentage point increase. Specifically, a 6-month term deposit at the counter offers a rate of 5.2%/year, while longer terms over 12 months start at 5.3%/year.

Since the beginning of November, several banks have increased their deposit interest rates, including Sacombank, VPBank, SHB, HDBank, GPBank, NCB, BVBank, Bac A Bank, and PVComBank…

Savings interest rates are on the rise |

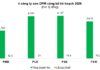

The widespread increase in interest rates is attributed to the anticipation of higher capital demand towards the end of the year. Many major banks have recorded loan growth significantly outpacing deposits in the first nine months of the year, including VPBank, ACB, SHB, and MB. This has compelled banks to intensify their efforts to attract deposits to ensure capital safety ratios and increase input capital for year-end lending.

The latest statistics from the State Bank of Vietnam, as of October 30, show that the credit balance across the system has increased by approximately 15% compared to the end of 2024 and is projected to reach 19%-20% by the end of 2025. However, deposit growth has only increased by more than 9%.

The Vietnam Banking Association notes that although the deposit interest rate floor remains low, there are signs of an upward trend since late October 2025 to prepare for the peak capital mobilization period at the end of the year. Competition among banks to attract capital is also intensifying.

Thai Phuong

– 10:31 12/11/2025

The Ultimate Guide to Agribank’s Interest Rates: Maximize Your Returns with the 24-Month Term Deposit Offer in September 2024

In September, Agribank offered a competitive 4.8% annual interest rate on personal deposits with a 24-month term. This market-leading rate showcases Agribank’s commitment to rewarding customers with attractive returns on their savings.

The Best HDBank Interest Rates for July 2024: Online Deposits for 18 Months Offer Competitive Returns

“HDBank offers a competitive interest rate framework for individual customers, with rates ranging from 0.5% to 8.1% per annum in early July. The maximum interest rate offered for regular deposits stands at an attractive 6.1% per annum.”