On November 8th, during the regular government press conference, Deputy Minister of Finance Nguyen Duc Chi outlined strategies to bolster capital mobilization through initial public offerings (IPOs) and corporate bonds, aiming to establish these channels as pillars of the national capital market.

Deputy Minister of Finance Nguyen Duc Chi

Deputy Minister Nguyen Duc Chi emphasized that the capital market development strategy, approved by the Prime Minister, sets a clear goal: to implement solutions that position the capital and stock markets as primary long-term funding sources for the economy by 2030.

Over the past period, the Ministry of Finance has implemented various synchronized measures to foster the growth of the capital and stock markets. Notably, the stock market has recently been upgraded from frontier to emerging status.

The Ministry of Finance, in collaboration with relevant agencies, has assessed the 2025 bond market and proposed solutions. According to the Deputy Minister, the stock market’s recent progress provides a solid foundation for companies seeking capital through IPOs.

Additionally, the Ministry of Finance has reported to the Government and the Prime Minister, leading to the issuance of Decree No. 245/2025/NĐ-CP, which amends Decree No. 155/2020/NĐ-CP. This amendment significantly facilitates IPOs linked to stock market listings for businesses.

Ministry leaders highlighted that administrative procedures have been streamlined. Previously, post-IPO financial report reviews took 3-6 months, but new regulations reduce this timeframe to approximately 30 days.

“This regulation greatly facilitates companies conducting IPOs on the stock market, coupled with listings. It provides strong motivation for businesses to pursue this path. Successfully executing this will attract more investors to participate in IPOs,” stated Mr. Chi.

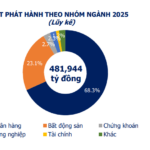

Furthermore, in 2025, the government plans to issue approximately VND 500 trillion in government bonds. The corporate bond market, both public and private, after a period of recovery, is expected to issue around VND 500 trillion. “Thus, the 2025 bond market is projected to reach approximately VND 1,000 trillion, encompassing both corporate and government bonds,” clarified the Ministry of Finance leader.

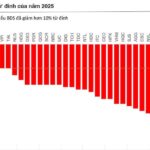

However, the Ministry of Finance acknowledges that the market’s current scale does not fully match its potential or the capital mobilization needs of both the government and businesses for 2026 and beyond, including the next five-year period.

The Ministry of Finance has devised fundamental solutions to expand this market, enabling both the government and businesses to raise capital through bond issuances.

The Ministry of Finance will focus on improving procedures, clarifying regulations for issuers, ensuring bond quality, and defining investor eligibility criteria for different bond types. Based on this, they will establish inspection and supervision processes to ensure a safe and transparent market development.

2025 Bond Market Outlook: Sustained Stability and Positive Growth

On the afternoon of November 6th in Quang Ninh, the Hanoi Stock Exchange (HNX) collaborated with the Financial Institutions Department and the State Treasury to host a conference summarizing the 2025 bond market activities.