The real estate market has shown positive recovery signs in the first nine months of 2025. According to the Ministry of Construction, the total number of transactions nationwide exceeded 430,000, a slight 1% increase compared to the same period in 2024. The absorption rate of new supply reached 68%, double that of last year and the highest in the past three years.

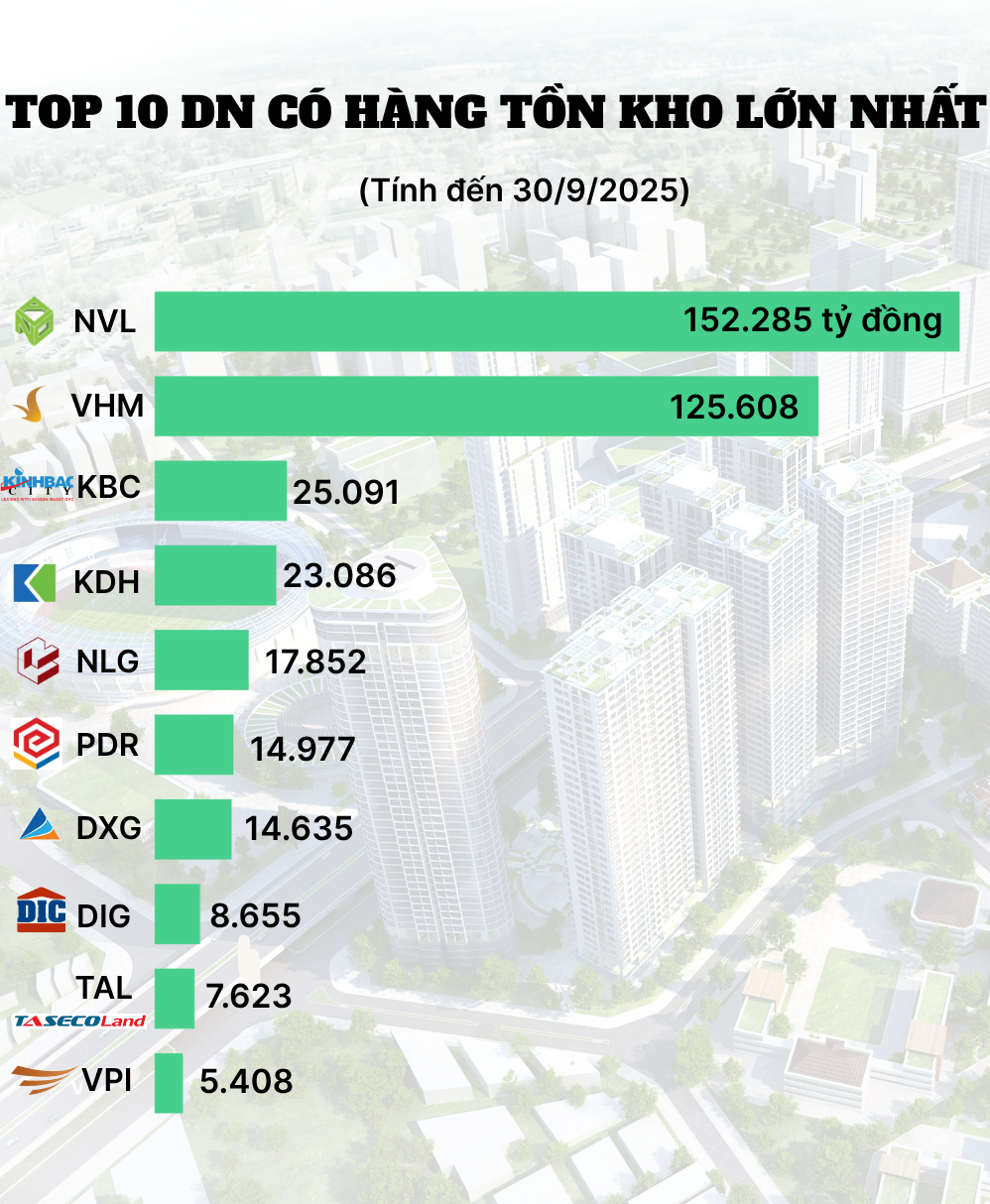

However, behind this optimistic picture lies a notable paradox: businesses’ inventory levels have surged, particularly in Q3/2025. Financial reports from 10 listed companies reveal that inventory value surpassed VND 395 trillion, up 32% from the beginning of the year. This increase hints at a “hold-and-wait” strategy among industry giants but also signals potential financial risks if liquidity issues persist.

Leading the inventory chart is Novaland (NVL), with a record-high VND 152 trillion as of September 30, 2025, up 4% year-to-date and accounting for 63% of total assets. Over 95% of this stems from ongoing projects like Aqua City (Dong Nai), NovaWorld Phan Thiet (Binh Thuan), and NovaWorld Ho Tram (Ba Ria – Vung Tau), where land, consulting, design, and construction costs have exceeded VND 145 trillion.

In second place is Vinhomes (VHM), Vingroup’s powerhouse, with inventory soaring to VND 125 trillion, a 130% jump since the year’s start. Most of this is attributed to the mega project Vinhomes Green Paradise in Can Gio (Ho Chi Minh City).

However, the bulk of Vinhomes’ inventory—over VND 122.5 trillion—comprises properties under construction for sale. This aligns with the company’s unrecorded sales revenue of VND 223.937 trillion by September’s end, up 93% from Q3 2024, reflecting robust asset liquidity. In this context, properties under construction will serve as a strategic reserve for future sales.

Among mid-sized firms, Kinh Bac (KBC) saw inventory swell 80% to VND 25 trillion, primarily from Trang Cat Urban Area (Hai Phong) and Loc Giang Industrial Park (Long An)—key projects in its infrastructure expansion strategy.

Similarly, Khang Dien (KDH) rose 4% to VND 23 trillion, focused on residential areas like Khang Phuc – Tan Tao (VND 8.272 trillion). Phat Dat (PDR) and Dat Xanh (DXG) followed suit, increasing 6% (VND 15 trillion) and 9% (VND 14.6 trillion), respectively.

In contrast, Nam Long (NLG) was among the few to see a slight 1% decline to VND 17.852 trillion, thanks to progress at Izumi (Dong Nai) and Waterpoint (Long An). Likewise, DIC Corp (DIG) reported a 6% drop to VND 8.655 trillion.

Current inventory levels could become a “latent resource,” enabling companies to surge ahead with sudden revenue boosts from sales and handovers. Conversely, for financially strained firms, prolonged high inventory will exacerbate costs, lock up cash flow, and impair debt repayment capabilities.

According to Dr. Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokerage Association (VARS), the primary causes of rising inventory include delayed legal procedures and soaring land and capital costs. Additionally, some companies with vast land reserves are slow to develop or hoard properties, creating a supply-demand mismatch.

To foster a balanced and sustainable market, Dr. Dinh recommends diversifying capital sources, promoting real estate investment funds and bonds, and reducing reliance on bank credit and customer deposits. Accelerating major infrastructure projects like highways, metros, and ring roads will expand urban spaces, making homeownership more affordable.

He also urges swift completion of key laws—Land Law, Housing Law, and Real Estate Business Law—with detailed guidelines for uniform local implementation. Simultaneously, social housing development, a national real estate database, and state-managed transaction centers should be prioritized to enhance transparency.

Why You Should Never Borrow More Than 50% of Your Home’s Value

Real estate brokers caution: Borrowers should limit loans to a maximum of 50% of the property’s value, avoid over-reliance on debt, and prioritize projects from reputable developers with proven financial and legal credibility, especially for future-built homes, to mitigate risks effectively.

Capital Flow Shifts: Northern Investors’ Quest for Profitable Territories

In the context of the Northern market entering a phase of diminishing profit margins, investment capital is now significantly shifting towards the South, an area recognized for its substantial growth potential and long-term profitability. Savvy investors are increasingly focusing on regions with ample room for yield expansion.

Long Xuyên: The Untapped Niche Market for Savvy Investors

As prime real estate markets in major cities and coastal tourist hubs like Nha Trang, Quy Nhon, and Da Lat approach saturation, with soaring prices and shrinking profit margins, savvy investors are increasingly pivoting toward niche markets that offer genuine value and more sustainable growth potential.

How Much Should You Borrow from the Bank to Buy a House?

According to experts, leveraging financial tools to purchase a home is becoming increasingly popular. However, buyers should carefully consider their loan-to-value ratio to ensure financial security.