Margin: A Double-Edged Sword in Vietnam’s Stock Market

As of Q3-2025, the total margin loan debt among Vietnamese securities companies reached approximately VND 370 trillion, marking a 26% and 56% increase compared to Q2-2025 and the end of 2024, respectively, according to Bao Viet Securities (BVSC).

This figure represents a historic high in Vietnam’s stock market, spanning over 25 years of operation.

Vietnam’s Stock Market: A Market of Expectations. Photo: LE VU

|

Among securities companies, TCBS leads with margin loan debt and advance payment for stock sales reaching VND 41.713 trillion by the end of Q3-2025, up 23% from Q2-2025 and 64% from the end of 2024.

VPBank reported margin loan debt of VND 27 trillion by the end of Q3-2025, the highest in its operational history.

Similarly, VNDirect, outside the top 5 brokerage firms by market share, reported margin loan debt of VND 14.8 trillion by the end of Q3-2025, VND 3.5 trillion higher than the previous quarter.

Notably, the market-wide margin record comes as foreign investors have net sold over VND 110 trillion since the beginning of the year, highlighting the dominance of domestic investors, who account for over 90% of market trading value.

According to Le Duc Khanh, Director of Analysis at VPS Securities, this context stems from Vietnam’s stock market being in a long-term uptrend, supported by macroeconomic factors such as low interest rates, government efforts to boost public investment disbursement, and legal reforms in capital and real estate markets.

These factors create a favorable environment for both domestic and foreign capital to operate more efficiently. Additionally, when Vietnam is officially upgraded by FTSE Russell in 2026, international capital is expected to return strongly.

“Liquidity has remained high for several consecutive months, reflecting the dominant role of domestic capital and investor optimism amid a stable economy and consistent policies. The market’s current uptrend is also supported by listed companies’ profit growth and a healthy capital flow structure, distinct from previous cycles,” Khanh emphasized.

In reality, margin capital has significantly contributed to the growth of market indices in the recent quarter, with the VnIndex rising over 280 points (approximately 21%), alongside vibrant trading sessions and record liquidity exceeding USD 3 billion.

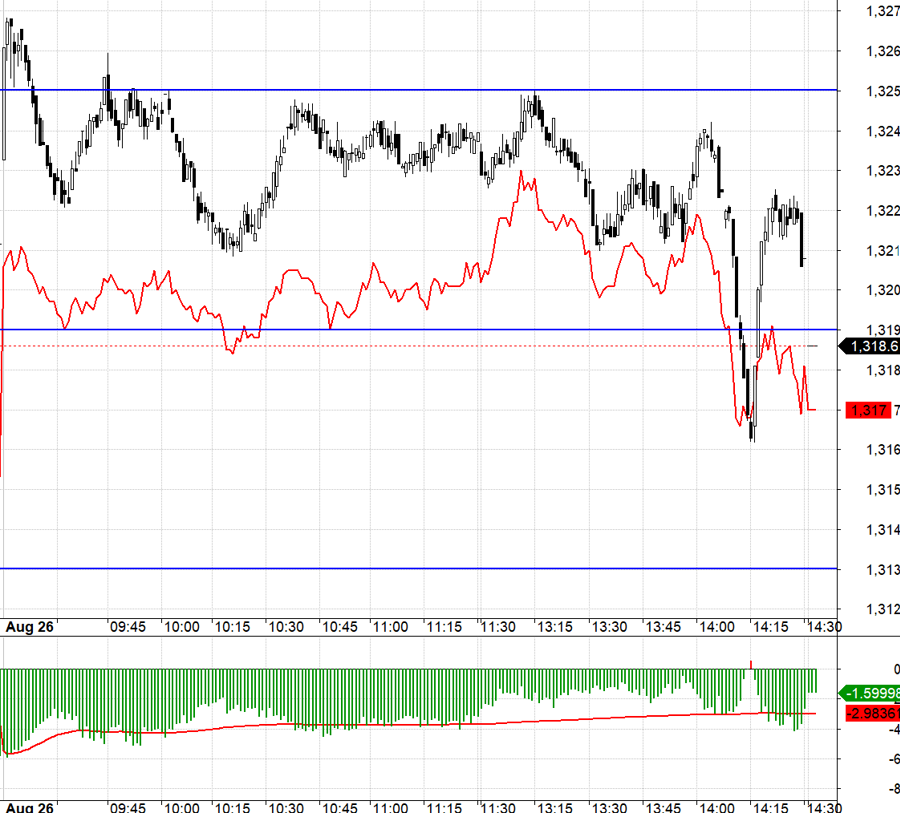

However, since mid-October 2025, negative news such as inspection conclusions on bond issuance activities of 5 banks, 37 joint-stock companies, and 25 limited liability companies, along with rising interbank interest rates and the USD/VND exchange rate, have increased short-term capital costs, leading to market volatility. This has sparked concerns about margin calls and forced selling, along with pressure from third-party lenders.

Signs of abrupt price drops accompanied by high trading volumes and consecutive floor-price sessions have appeared in stocks with high margin loan ratios. Notably, on October 20, 108 stocks on the HOSE and 148 market-wide reached their daily limit down, causing the VnIndex to drop 95 points at the close. Some investors’ accounts hit margin call thresholds, requiring additional collateral to maintain safe margin ratios.

By October 21, more investor accounts faced margin pressure, though forced liquidations were fewer or limited to specific stocks.

Relying Solely on Margin Is Unsustainable

After a prolonged euphoric phase driven by positive news, Vietnam’s stock market has entered a correction period, with the VnIndex declining for four consecutive weeks and falling below the psychological threshold of 1,600 points by November 7.

Combined with record-high margin debt levels at many securities companies, SGI Capital predicts the market needs fresh capital to sustain growth in the final months of the year.

Vietnam’s Stock Market Still Has Significant Growth Potential. Photo: LE VU |

Echoing this view, financial expert Dao Phuc Tuong believes Vietnam’s stock market faces growth challenges, evident in the prolonged correction after the VnIndex rose over 30% this year.

He attributes this to listed companies’ profit growth being driven by non-recurring income, making it unsustainable. Additionally, profit growth, especially in the banking sector, faces challenges in Q4-2025 compared to the high base of Q4-2024. Many sectors’ valuations are also near 10-year highs and upper limits of 3-year ranges.

“I don’t see any breakthrough catalysts ahead, especially with valuations already high, though not overpriced. Investors shouldn’t be surprised by sharp sell-offs,” Tuong said, noting that large margin debt poses additional risks.

Amid short-term and cyclical risks, Nguyen Ngoc Linh, CEO of DNSE Securities, believes Vietnam’s stock market development will be driven by securities companies, leveraging their data, technology, and customer access capabilities.

Furthermore, as regulators push policy reforms to meet international standards, intermediaries must create a friendly, safe, and transparent investment environment. Simplified investment processes, lower barriers, and greater transparency will drive stronger and more sustainable domestic capital growth.

“As investing becomes more accessible and transparent, people will view the stock market as a long-term savings channel. Robust domestic capital is key to Vietnam’s development progress,” Linh said, noting that new investors prioritize convenience, speed, and experience over traditional models.

SGI Capital experts highlight that while market upgrade prospects are positive, foreign capital inflows should not be overexpected. Macroeconomic stability and a favorable business environment, enabling sustainable corporate profit growth, are crucial for market trends.

“High-quality assets and attractive businesses are essential for Vietnam to draw long-term capital,” SGI Capital experts stressed.

Van Phong

– 07:00 09/11/2025

Deputy Minister of Finance Outlines Strategies for Robust Growth in Bond and Stock Markets by 2026

At the October 2025 Government Press Conference, Deputy Minister of Finance Nguyễn Đức Chi outlined strategic measures to bolster capital mobilization through initial public offerings (IPOs) and corporate bond issuances.

Market Pulse 06/11: Unsuccessful Rally, VN-Index Closes 12 Points Lower

After a challenging morning session, the afternoon market quickly showed signs of recovery. Despite briefly returning to the reference point, the VN-Index closed the session with a sharp 12-point decline, weighed down by decisive downward movements.