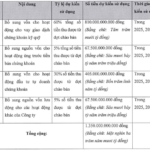

Specifically, the approved offering price is VND 60,000 per share, which corresponds to the minimum level in the initial plan. Regarding the allocation ratio, valid purchase orders with prices higher than the offering price will be allocated 100%, while orders at the offering price will be allocated 83.73%.

On the same day, VPS also shared notable details about the recently completed IPO on its Facebook platform. The company revealed that the IPO attracted 19,952 investors, with a total registered volume of over 220.4 million shares (exceeding the 202.31 million shares offered). Individual investors accounted for 98.11% of the total registered value.

IPO results announced by VPS – Source: VPS Facebook

|

The offering period, opened by VPS, ran from October 16 to November 6. According to the plan, investors will settle the remaining payment for the shares from November 10 to 5 PM on November 14.

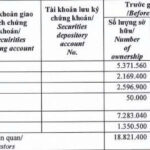

This is one of three capital increase plans approved by the company, including the issuance of 710 million bonus shares (completed on October 10), an IPO of up to 202.31 million shares, and a private placement of 161.85 million shares.

As a result, the number of shares will increase from over 570 million to more than 1.64 billion, corresponding to a rise in chartered capital from VND 5.7 trillion to over VND 16.4 trillion, nearly tripling the initial amount.

According to the plan, VPS will submit its listing application to the Ho Chi Minh City Stock Exchange (HOSE) upon IPO registration, register and deposit shares with the Vietnam Securities Depository (VSDC), and finalize the listing process on HOSE after the IPO concludes. Note that if the offering is completed but listing conditions are not met, the company commits to registering for trading on UPCoM.

At the “VPS The Next Chapter” event on October 12, VPS announced its expected stock code as VCK.

Previously, two other high-profile IPOs in the securities sector concluded. Technocom Securities (TCBS) offered 231.15 million shares from August 19 to September 8 at VND 46,800 per share, achieving a 40.188% allocation rate. VPBank Securities (VPBankS) offered shares from October 10 to 31 at VND 33,900 per share, with a 96.036% allocation rate.

– 11:03 10/11/2025

Foreign Investors’ Sudden Net Selling Surge in a Bank Stock During the First Week of November

Foreign investors resumed strong net buying on Wednesday, but selling pressure gradually intensified towards the end of the week.