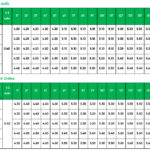

Since early November, numerous banks have continued to raise deposit interest rates. Notably, VPBank increased rates by 0.3% per annum compared to the previous month. Specifically, counter savings deposits for terms of 1-5 months are at 4.2% per annum for amounts under 10 billion VND, rising to 4.3-4.4% per annum for deposits of 10 billion VND or more. Longer-term deposits over 12 months range from 5.3-5.6% per annum, while online deposits enjoy an additional 0.1-0.2%, reaching a maximum of 5.8% per annum.

Similarly, BVBank launched a “10 Golden Days of Interest Rates” program, offering up to 6.8% per annum for 12-month online deposits. From November 3-13, customers receive an additional 1.2 percentage points, with rates of 4.75% for 1-month terms, 6.5% for 6-month terms, and 6.8% for 12-month terms. BVBank also introduced online deposit certificates with flexible terms of 6-15 months, offering a maximum rate of 6.3% per annum for 15-month terms.

Several other commercial banks, including Bac A Bank, SHB, HDBank, NCB, MB, and VCBNeo, have also adjusted their interest rates upward in November.

Previously, in October alone, six banks raised their interest rates, with LPBank leading at 6.1% per annum for 12-month terms. This trend reflects the growing demand for capital mobilization as banks prepare for year-end lending, a period when credit typically peaks due to seasonal cycles.

Speaking to Tien Phong on the sidelines of the Economic Insights 2025 Forum, Mr. Pham Nhu Anh, CEO of MB, attributed the recent interest rate hikes to pressure from exchange rates. Over the past three months, exchange rate pressures have been significant, with rates rising sharply.

Mr. Pham Nhu Anh, CEO of MB.

However, Mr. Anh noted that even with slight increases, current interest rates remain lower than historical levels. This situation is not critical and does not significantly impact the economy.

The MB CEO agreed that in the long term, Vietnam has the conditions to reduce interest rates. However, in the short term, capital flows may not reverse immediately. Over the past two months, rates have begun to rise slightly. By October, the exchange rate had increased by 3.5%, exhausting its margin, and compared to the same period last year, it has risen by 6%. Consequently, interest rates must adjust upward.

“In the short term, interest rates will rise slightly but not significantly. Even an increase of 0.5-1% remains low compared to previous periods and global rates. Vietnam’s current rates are lower than those in China and the U.S. If conditions improve early next year, rates may decrease slightly. If the U.S. Federal Reserve (Fed) lowers rates below 3% and policies stabilize, foreign capital could return to Vietnam. This could occur between 2026 and 2027,” Mr. Anh stated.

At the forum, Mr. Nguyen Tu Anh, former Director of the Department of Comprehensive Economics at the Central Economic Commission (now the Central Policy and Strategy Commission), observed that reductions in interest rates by major central banks will create favorable conditions for Vietnam to manage exchange rates and interest rates.

He noted that if the Fed continues to lower rates, the gap between domestic and international rates will narrow. “In 2022, we consistently maintained a financial account surplus, with inflows exceeding outflows. However, in 2024, while we have a current account surplus, there is a financial account deficit. If we attract USD inflows, the State Bank of Vietnam will find it easier to inject VND into the market, easing exchange rate pressures and creating conditions to lower interest rates,” Mr. Tu Anh explained.

Interest Rates on Deposits Edge Up Amid Year-End Capital Demand

Interest rates are expected to fluctuate minimally within a narrow range during the final two months of the year. More significantly, lending rates will remain stable at low levels, providing optimal conditions for businesses to sustain their production and operational recovery.

November 2025 Savings Interest Rates: Slight Uptick, Yet Remain at Low Levels

Interest rates for regular VND savings deposits at bank counters as of early November 2025 remain relatively stable, with slight increases observed in some short-term tenures. Analysts predict a modest upward trend in deposit rates for the final months of the year, though overall rates are expected to stay at a low level.