Market sentiment improved on November 11th, driving a rebound in the stock market. The VN-Index closed the session up 13.07 points (0.83%) at 1,593 points. Trading volume remained low, with transaction values on HOSE exceeding VND 19.7 trillion.

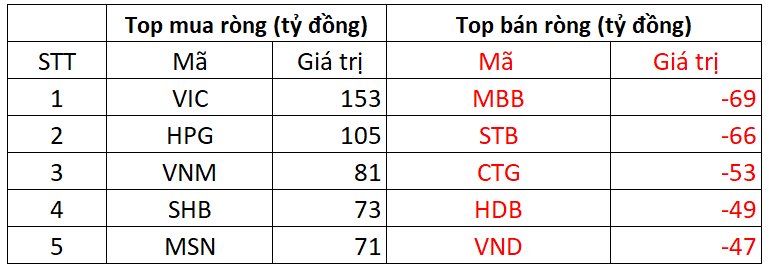

Foreign trading activity was a downside, with net selling of VND 76 billion, though the selling pressure significantly decreased compared to previous sessions.

On HOSE, foreign investors net sold VND 75 billion

On the buying side, VIC was the most heavily purchased stock by foreign investors on HOSE, with a value of over VND 153 billion. HPG followed closely, with VND 105 billion in purchases. Additionally, VNM and SHB were bought for VND 81 billion and VND 73 billion, respectively.

Conversely, MBB was the most heavily sold stock by foreign investors, with VND 69 billion. STB and CTG followed, with sell-offs of VND 66 billion and VND 53 billion, respectively.

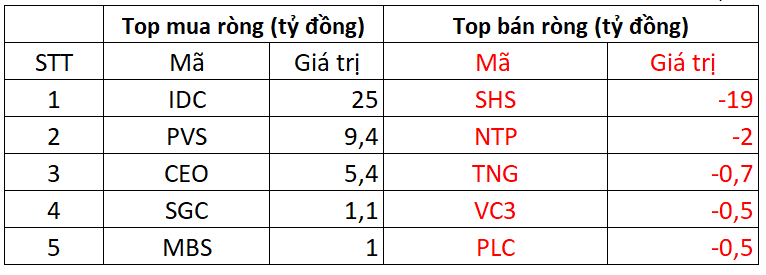

On HNX, foreign investors net bought VND 17 billion

On the buying side, IDC saw the strongest net buying, with a value of VND 25 billion. PVS was next, with VND 9 billion in net purchases. Foreign investors also allocated a few billion dong to net buy CEO, SGC, and MBS.

On the selling side, SHS faced the strongest selling pressure from foreign investors, with nearly VND 19 billion; NTP followed with VND 2 billion, and TNG, VC3, and PLC saw sell-offs of a few billion dong each.

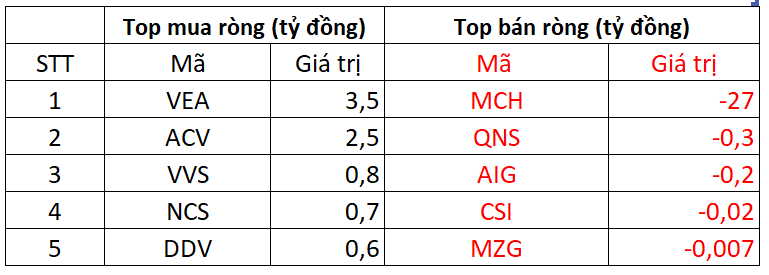

On UPCOM, foreign investors net sold VND 18 billion

On the buying side, VEA was purchased by foreign investors for VND 4 billion. ACV and VVS also saw net buying of a few billion dong each.

Conversely, MCH was net sold by foreign investors for VND 27 billion. Foreign investors also net sold QNS, AIG, and others.

Market Pulse 12/11: Green Wave Sweeps In, VN-Index Recaptures 1,630 Mark

At the close of trading, the VN-Index surged by 38.25 points (+2.4%), reaching 1,631.86 points, while the HNX-Index climbed 3.71 points (+1.42%) to 264.79 points. Market breadth was overwhelmingly positive, with 361 advancing stocks versus 323 declining ones. Similarly, the VN30 basket saw a near-complete dominance of green, with 29 gainers and only 1 loser.

Vietstock Daily November 13, 2025: Recovery Momentum Continues

The VN-Index has surged, decisively breaking above its 100-day SMA. The Stochastic Oscillator is poised to generate a buy signal from oversold territory. Should this signal materialize in upcoming sessions, accompanied by trading volume surpassing the 20-day average, the index’s recovery prospects would be significantly strengthened.