Becamex IJC (Infrastructure Development Investment Joint Stock Company, Stock Code: IJC, HoSE) has announced the results of its public share offering.

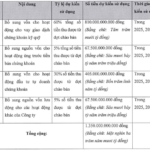

By the end of the issuance period on November 7, 2025, Becamex IJC successfully distributed over 251.8 million shares to 9,240 shareholders. The rights issue ratio was 3:2, meaning shareholders holding 3 shares were entitled to purchase 2 additional new shares. The expected share delivery date is in Q4/2025.

Illustrative image

With an offering price of VND 10,000 per share, Becamex IJC raised a total of over VND 2,518.3 billion from the aforementioned share offering. After deducting expenses, the company’s net proceeds amounted to more than VND 2,516.9 billion.

Following the successful offering, Becamex IJC’s chartered capital increased from nearly VND 3,777.5 billion to VND 6,295.8 billion.

In related share trading news, on October 22, 2025, Becamex Group (Industrial Investment and Development Corporation, Stock Code: BCM, HoSE) successfully acquired over 125.3 million shares in the aforementioned offering of 251.8 million shares by Becamex IJC.

At the same offering price of VND 10,000 per share, Becamex Group is estimated to have invested nearly VND 1,253.2 billion to acquire the aforementioned shares.

Following the successful transaction, Becamex Group increased its ownership in IJC from nearly 188 million shares to approximately 313.3 million shares, equivalent to a 49.76% stake in Becamex IJC.

Regarding business performance, according to the consolidated financial report for Q3/2025, Becamex IJC recorded net revenue of nearly VND 671.6 billion, 3.5 times higher than the same period last year. After deducting taxes and fees, the company reported a net profit of nearly VND 254.4 billion, 2.9 times higher than the same period.

For the first nine months of 2025, the company achieved net revenue of over VND 996.6 billion, a 39.5% increase compared to the first nine months of 2024; post-tax profit reached VND 397.3 billion, up 99.3%.

For 2025, Becamex IJC set a business target with an expected post-tax profit of VND 429 billion, a 21% increase compared to the profit achieved in 2024.

Thus, by the end of the first three quarters, the company has completed 92.6% of its planned post-tax profit target.

Is the Largest Stock Offering in History on the Horizon?

Vingroup, one of Vietnam’s leading conglomerates, is seeking shareholder approval for a groundbreaking issuance of 3.85 billion shares—the largest in the country’s stock market history. If successful, this move will double the company’s chartered capital to over 77 trillion VND, marking a significant milestone in its growth trajectory.