Loc Phat Joint Stock Commercial Bank of Vietnam (LPBank) has recently adjusted its deposit interest rates across various terms. Specifically, the rates for 1–5 month terms have increased by 0.3 percentage points per annum; the 6–11 month terms have risen by 0.2 percentage points per annum; and longer terms from 18–60 months have seen a slight increase of 0.1 percentage points per annum. Notably, the 12–16 month terms remain unchanged.

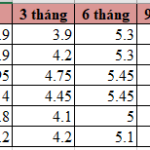

Following these adjustments, LPBank’s online savings rates with interest paid at maturity are as follows: 1-month term at 3.9%/year; 2-month term at 4%/year; 3–5 month terms at 4.2%/year. The 6–11 month terms are now at 5.3%/year; the 12–16 month terms stand at 5.4%/year; and the highest rate of 5.5%/year is offered for terms ranging from 18–60 months.

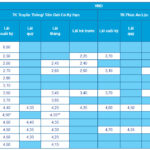

On November 11th, Kien Long Commercial Joint Stock Bank (KienlongBank) also revised its deposit interest rates after nearly 8 months of maintaining them. According to the latest update, deposit rates for 1–4 month terms have increased by 0.2 percentage points per annum; similarly, the 6–7 month terms have also seen a 0.2 percentage point increase per annum.

Notably, KienlongBank has reduced the interest rate for 8–9 month terms by 0.1 percentage points per annum, while other terms remain unchanged.

In KienlongBank’s latest online savings rate chart with interest paid at maturity for individual customers, 1–5 month terms are listed at 3.9%/year. The 6–7 month terms are currently at 5.3–5.4%/year; meanwhile, the 8–9 month terms have dropped to 5.1%/year. Online savings rates for 10–11 month terms are set at 5.3%/year, with the highest rate of 5.5%/year observed for the 12-month term. For longer terms ranging from 13–36 months, the interest rate remains stable at 5.45%/year.

Source: Kienlongbank

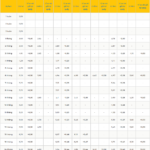

LPBank and Kienlongbank are the latest banks to increase savings interest rates in November. Previously, several banks such as Sacombank, VPBank, SHB, HDBank, GPBank, NCB, BVBank, Bac A Bank, BaoVietBank, and PVComBank had also raised their savings rates in October and early November.

According to industry experts, the widespread increase in interest rates indicates that the competition for capital mobilization has intensified in the fourth quarter of 2025, particularly among joint-stock commercial banks. This surge aims to meet the heightened capital demand at year-end and narrow the gap between deposit and lending growth.

In reality, many major banks, including VPBank, ACB, SHB, and MB, recorded significantly higher lending growth compared to deposit growth in the first nine months of the year. This disparity has compelled banks to enhance deposit attraction efforts to ensure compliance with capital safety ratios.

Vietnam-Germany Steel Joins Vinaconex for the 6.2 Trillion VND Việt Đức Legend City Project

The extraordinary shareholders’ meeting of Viet-German Steel Pipe Joint Stock Company (VG PIPE, HNX: VGS) on November 7th approved a strategic investment partnership with Vietnam Construction and Import-Export Corporation (Vinaconex, HOSE: VCG) to develop the Viet-German Legend City urban area project (LGC project).