3,500 Exclusive Gifts for Individual Customers

From now until December 31, 2025, when customers register and officially experience either the Family Banking or S-Living packages, SHB will offer an additional 3,500 exclusive Urbox E-vouchers for shopping and spending experiences, with a total value of up to 1 billion VND, alongside other service benefits.

These are meticulously tailored financial solutions, serving as a powerful ally for every Vietnamese family in their journey toward smart spending management, effective savings, and profitable investments. As a result, material values are nurtured alongside spiritual ones, strengthening family bonds and collectively building a prosperous and fulfilling future.

Thousands of attractive offers await individual customers nationwide

|

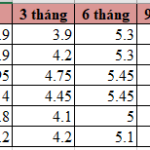

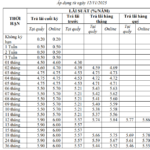

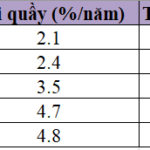

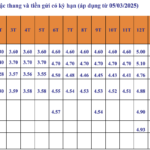

In addition to these appreciation programs, SHB has adjusted its savings interest rate policy to be more competitive, offering clear benefits to customers during a period of market volatility.

At our branch counters, customers can experience a diverse range of savings products with flexible terms and interest rates of up to 6.8%/year, which is incredibly attractive. For those who prefer convenience, our online transaction channel is the perfect choice. With just a tap, you can deposit money quickly and securely while enjoying an additional interest rate of up to 1.1%/year compared to the listed rates.

Savings channels remain a safe and effective option in the current context

|

These interest rate offers not only help customers increase profits but also demonstrate SHB‘s consistent strategy of promoting smart finance, encouraging digital transaction habits, and providing convenient, secure experiences for users in their personal financial management journey.

A representative from SHB stated that through these meaningful programs, SHB aims to create sustainable values with customers, where the spirit of smart living and modern financial management is strongly disseminated, realizing the philosophy of “Happy Banking” that SHB pursues.

“Celebrating 32 years is not just a milestone to reflect on our journey but, more importantly, an opportunity to express our deepest gratitude to all our customers, who have accompanied, trusted, and contributed to SHB‘s success today. Each offer during this time is a promise to continue delivering superior financial solutions, accompanying the community in future development stages,” the SHB representative emphasized.

Accompanying and Appreciating Corporate Customers Program

From November 13, 2025, to March 13, 2026, SHB is launching a special promotion for corporate customers named “Accompanying Development – Appreciating Progress,” featuring numerous special offers.

Specifically, new corporate customers meeting the program’s conditions will receive fee waivers or reductions when opening new premium account numbers or payment accounts. Simultaneously, SHB provides corporate credit cards and approves online overdraft limits, helping customers alleviate concerns about working capital.

SHB consistently accompanies businesses with useful financial solutions

|

Notably, SHB is offering over 2,000 service fee discount vouchers worth up to 10 million VND each to eligible corporate customers, allowing businesses to comfortably experience financial products at branches or on the bank’s digital platforms.

Throughout its development journey, SHB has established its reputation and position as a leading joint-stock commercial bank, a trusted partner for individual customers, corporate clients, large state and private economic groups, and international organizations.

As SHB enters its 32nd year, it will continue to accompany shareholders, employees, customers, communities, and society with modern, convenient financial solutions and services, supplying abundant capital to the economy and steadily advancing into the nation’s era of wealth and prosperity.

In its robust and comprehensive transformation strategy, SHB aims to become the TOP 1 bank in efficiency; the most beloved Digital Bank; the best Retail Bank, and a leading provider of capital, financial products, and services to strategic private and state-owned corporate customers with supply chains, value chains, ecosystems, and green development. By 2035, SHB envisions becoming a modern Retail Bank, a Green Bank, and a Digital Bank among the region’s top performers.

|

SHB – The Happy Bank For over three decades, Saigon-Hanoi Commercial Joint Stock Bank (SHB) has steadfastly pursued its mission of “sowing happiness” by giving and spreading positive values to employees, shareholders, customers, and the community. For SHB, happiness is both the driving force and the ultimate goal of all activities, where every individual is valued and together creates sustainable value. In celebration of its 32nd anniversary, SHB is launching the “Sowing Happiness” community campaign, encouraging everyone to contribute to stories of love and sharing for special individuals and communities across the country. Every small action and every act of kindness will help spread compassion, multiplying happiness through sharing. With its mission as the Happy Bank, SHB will continue its journey of connecting and nurturing trust, accompanying customers and the community toward a happier society in the nation’s era of wealth and prosperity. |

– 16:49 12/11/2025

Bank Hikes Savings Interest Rates to Maximum Limit on November 12th

Interest rates for 3- to 5-month deposits at this bank have risen to 4.75% per annum. This is the maximum interest rate allowed under the State Bank’s regulations for deposits with terms of less than 6 months.

Happy Enterprises: The Foundation of Sustainable Growth

In an era where “happiness” has emerged as the new metric for sustainable development, we find ourselves redefining progress. This shift underscores the importance of well-being as a cornerstone of societal growth, challenging traditional measures of success and inviting a more holistic approach to prosperity.

SHB Bank Interest Rates Surge in November 2025: A Significant Hike After Months of Stability

In November 2025, SHB significantly boosted online deposit interest rates across various terms, with the highest increase reaching up to 0.6% per annum.