According to the Ho Chi Minh City Stock Exchange (HOSE), Dofico is set to auction its entire stake in D&F, a company specializing in meat processing, preservation, and distribution. The book value of this investment stands at VND 40.3 billion, representing a 29% stake in D&F’s charter capital of VND 139 billion. The starting price for the auction is VND 72.5 billion.

Eligible participants include domestic organizations, individuals, and qualified foreign investors. D&F is one of Dofico’s nine affiliated companies, alongside well-known entities like Tan Mai Timber Corporation (UPCoM: TMW) and Bien Hoa Construction and Building Materials Production (UPCoM: VLB).

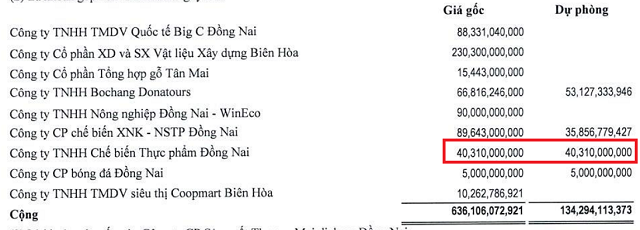

Dofico’s 2025 semi-annual financial report reveals an investment of over VND 40 billion in D&F, fully provisioned. As of mid-2025, Dofico has invested a total of VND 636 billion in affiliated companies, with the largest being a 49.2% stake in VLB (valued at VND 230 billion). VLB boasts a market capitalization exceeding VND 2.2 trillion, making it the most valuable asset in Dofico’s portfolio.

Dofico invested over VND 40 billion in D&F but fully provisioned it. Source: Dofico’s 2025 semi-annual financial report

|

Among its subsidiaries, Dofico holds stakes in listed companies such as Dong Nai Agricultural and Livestock (UPCoM: NSS), Phu Son Livestock (UPCoM: PSL), Industrial Rubber (UPCoM: IRC), Dong Nai Agricultural Supplies (UPCoM: DOC), and Dong Nai Tourism (UPCoM: DNT). Notably, Dofico has invested VND 347 billion in Buu Long Development Investment LLC and VND 115 billion in IRC.

The divestment from D&F aligns with Dofico’s ongoing portfolio restructuring efforts. In 2025, the company initiated valuation processes for potential divestments in DOC and Donafoods, where it holds 72.9% and 39.8% stakes, respectively. Similar actions were taken in late 2024 for PSL and NSS.

Established in 2005, Dofico operates as a parent company with a diversified portfolio spanning tobacco, livestock, rubber, and tourism. As of June 2025, its total assets exceeded VND 5.3 trillion, with equity surpassing VND 4 trillion. Dofico and its subsidiaries hold nearly VND 2.4 trillion in bank deposits, while short-term debt stands at approximately VND 783 billion.

In the first half of 2025, Dofico reported revenue of VND 986 billion, a 13% year-on-year decline, but net profit rose 37% to VND 76 billion, driven by earnings from affiliates and cost management.

– 10:43 13/11/2025

DIC Corp to Preemptively Repurchase VND 800 Billion in Bonds

DIC Corp is set to execute an early repurchase of a portion of its DIGH2326002 bond issuance, valued at 800 billion VND. The buyback will take place from November 20, 2025, to November 30, 2025.

Nearly 20,000 Investors Join VPS Securities’ IPO

As of 5:00 PM on November 6, 2025, an impressive 19,952 investors have registered to purchase shares in VPS’s IPO, with an offering price set at 60,000 VND per share.