The enforcement action stems from the company’s tax debt exceeding 90 days past the due date, totaling over 51.3 billion VND. The decision is effective for one year, from November 10, 2025, to November 9, 2026, and will be revoked upon full payment of the outstanding tax to the State Budget.

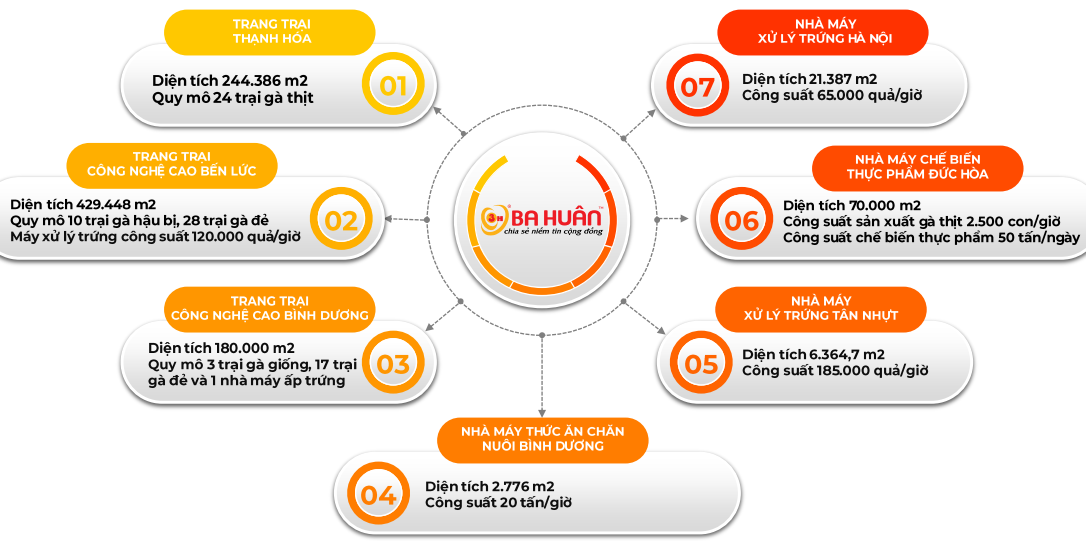

Ba Huân is a renowned and long-standing brand in the consumer market, primarily known for its “Ba Huân” chicken eggs. The company operates three factories: Duc Hoa Food Factory (formerly in Long An), Hanoi Egg Processing Factory, and Binh Chanh Egg Processing Factory, along with three farms in Binh Duong and the former Long An (Ben Luc and Thanh Hoa).

|

Ba Huân’s farm and factory system

Source: Ba Huân

|

|

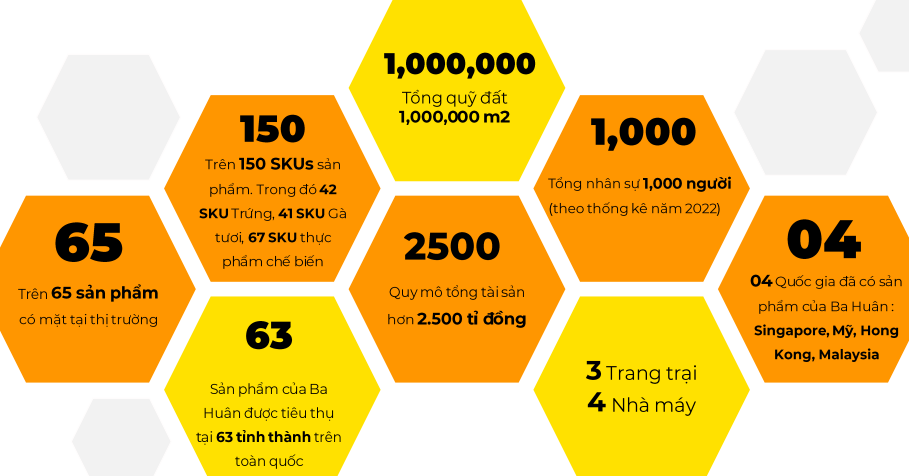

In 2022, Ba Huân reported total assets of over 2,500 billion VND

Source: Ba Huân

|

Founded in February 2006, Ba Huân is headquartered in Binh Tay Ward (former District 6), Ho Chi Minh City, specializing in animal husbandry. The company was established by Ms. Pham Thi Huan, who serves as both the Director and legal representative.

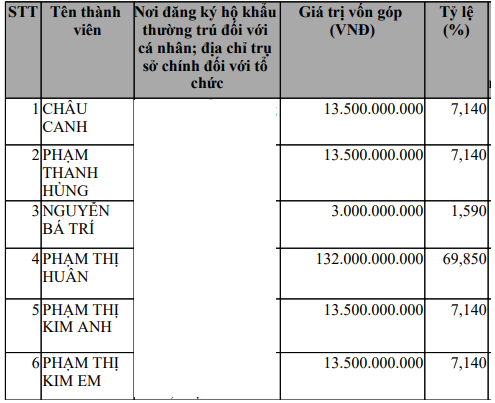

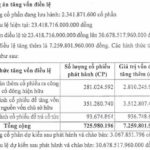

Ba Huân has undergone numerous changes in its charter capital. In 2016, the capital increased from 189 billion VND to 219 billion VND, with Ms. Huan holding the largest share at nearly 69.9%. By February 2018, the capital rose to over 222 billion VND and then to 280.6 billion VND shortly after. The shareholder list included foreign investor Hawke Investment S Pte. Ltd. from Singapore, holding approximately 33.8%.

Ba Huân Chicken Eggs

|

However, by October 2018, the capital was reduced to 222 billion VND, with Hawke Investment’s stake decreasing to 16.4%.

In 2019, Ba Huân increased its capital to 330 billion VND. By February 2021, it was reduced to 212 billion VND, then raised again to 330 billion VND in late March 2021 following the merger with Ba Huan Vinh Tan Investment JSC and Ba Huan Duc Hoa Investment JSC. It was later adjusted to 284 billion VND in November 2021. In March 2022, the capital was increased to 330 billion VND, before surging to 780 billion VND in late March 2022 after merging with Minh Hoang Real Estate Development JSC.

Ms. Pham Thi Huan, founder of Ba Huân, and Mr. Tran Viet Hung, CEO.

|

In August 2022, Ba Huân increased its capital to over 821 billion VND, then to over 909 billion VND in September, and 942 billion VND in November. The legal representatives were Ms. Huan as Chairwoman and Mr. Tran Viet Hung as CEO.

By 2023, Mr. Hung became the sole legal representative. Ba Huân’s charter capital exceeded 1 trillion VND, reaching over 1.1 trillion VND by August 2024.

In a media interview, Ms. Huan stated that the tax debt is no longer related to her family, as she transferred her shares in the company three years ago.

|

Early contributors to Ba Huân’s capital

Source: Business Registration Certificate

|

|

Mr. Tran Viet Hung is the brother of Mr. Tran Viet Ha, former Chairman of Dong Nai Traffic Works JSC (UPCoM: DGT) from April 19, 2023, to September 27, 2023. |

– 12:01 November 13, 2025

IDICO to Inject Additional $34.6 Million into Nhon Trach 1 Industrial Park Developer

IDICO Group (HNX: IDC) has announced a Board of Directors resolution approving the capital increase for IDICO Urban and Industrial Zone Development One-Member LLC (IDICO-URBIZ).