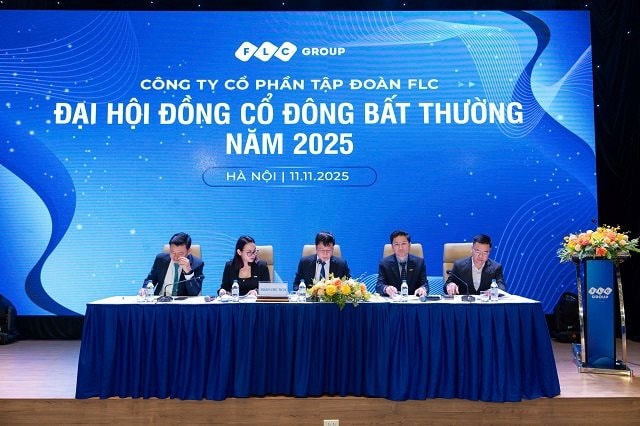

FLC’s Extraordinary Shareholders’ Meeting 2025, 2nd session, held on November 11, 2025. Photo: FLC

The 2nd Extraordinary Shareholders’ Meeting of FLC Group Corporation in 2025 took place on the morning of November 11, with a shareholder attendance rate of 35.682% at the opening.

Leadership Overhaul

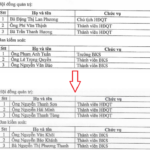

The meeting approved the resignation of Board of Directors members Mr. Le Ba Nguyen, Mr. Nguyen Chi Cong, and Mr. Do Manh Hung, following their submitted letters of resignation.

The Supervisory Board also saw changes, with Mr. Nguyen Xuan Hoa being relieved of his position as a member.

Three new Board of Directors members were elected: Mr. Trinh Van Nam, Ms. Do Thi Hai Yen, and Ms. Phung Thi Thu Thao. The new Supervisory Board member is Ms. Tran Thi Doan. None of these members hold FLC shares.

The new Board of Directors will consist of five members: Mr. Vu Anh Tuan (Chairman), Mr. Nguyen Thanh Tung, Mr. Trinh Van Nam, Ms. Do Thi Hai Yen, and Ms. Phung Thi Thu Thao. The new Supervisory Board will include Mr. Bui Pham Minh Diep, Ms. Tran Thi My Dung, and Ms. Tran Thi Doan.

Regarding the changes in the Board of Directors and Supervisory Board, Mr. Vu Anh Tuan, Chairman of the Board, stated that FLC’s Board of Directors had received resignation letters from several members of both boards. After review and direct discussions, the Board found that the reasons for resignation were personal and in compliance with legal regulations and the company’s charter. Upon receiving the resignations, the Board had no grounds to refuse and could only accept them, submitting them to the Shareholders’ Meeting for consideration.

To ensure the Board’s continuous and effective operation, FLC’s Board of Directors has actively sought, evaluated, and introduced qualified candidates with professional expertise and reputation, in accordance with legal requirements, for election by the Shareholders’ Meeting.

Additionally, FLC has developed a succession plan and a work handover process among members to ensure uninterrupted company operations.

Bamboo Airways Development Plan to Be Announced at the 2026 Annual Shareholders’ Meeting

Regarding the decision to reacquire Bamboo Airways, FLC’s leadership emphasized that the decision to accept ownership, management, and operational control of Bamboo Airways was made cautiously, comprehensively, and in compliance with regulations. This decision was also based on a proposal from Mr. Le Thai Sam, Chairman of Bamboo Airways.

FLC’s leadership acknowledges that reacquiring Bamboo Airways during the group’s comprehensive restructuring is challenging. However, the decision was made with principles in mind: not to disrupt the restructuring process, to align with FLC’s current financial and human resources, and to maintain strict control over the group.

FLC is currently working with aviation partners, aircraft leasing/purchasing companies, and financial institutions to explore cooperation, technical support, and investment solutions for Bamboo Airways. Resource mobilization will be conducted cautiously, step by step, based on current financial capabilities.

FLC plans to report Bamboo Airways’ 2025-2030 development plan to the Prime Minister and relevant state authorities. This plan will be announced at the 2026 Annual Shareholders’ Meeting.

FLC Shares Expected to Resume Trading on UPCOM in Q1/2026

Regarding the restoration of FLC’s stock trading, FLC representatives stated that they have worked with independent audit firms and provided financial records for preliminary assessment. The meeting authorized the Board of Directors to select an independent audit firm to conduct reviews, audits, and issue outstanding financial reports.

In 2025, FLC plans to release financial reports for 2021-2024, and in Q1/2026, it will publish the 2025 financial report. After completing the necessary documents, the group will submit them to the State Securities Commission and the Stock Exchange to restore stock trading. FLC shares are expected to resume trading on UPCOM in Q1/2026.

2026 Goals

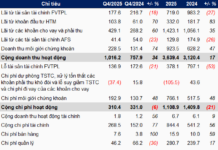

According to meeting documents, FLC’s real estate sales in the first nine months of 2025 reached nearly VND 1,800 billion, with cash flow from customers at VND 654 billion. Projected real estate sales for 2025-2026 are estimated at nearly VND 4,000 billion.

The Hausman Premium Residences project within the FLC Premier Parc urban area received its construction permit on March 14, 2025, and has been eligible for sale since June 3, 2025. The FLC Quang Binh Hotel & Villas project, with 433 rooms, is accelerating its progress and is expected to open in 2026.

Mr. Le Doan Linh, Deputy General Director in charge of project investment at FLC, stated that the group has a vast project portfolio with over 50 projects, ranging from tens to thousands of hectares. The total land area exceeds 10,000 hectares, with over 30 km of coastline across nationwide projects. Additionally, the group owns international golf courses, 5-star resorts and hotels, and urban areas catering to both luxury and low-income segments, including social housing.

For 2026, FLC’s goals include: first, seeking potential localities for real estate investment, such as Ho Chi Minh City, Hue, Da Nang, Nha Trang, Can Tho, and Lao Cai; second, expediting legal processes and construction to deliver homes and land titles to customers; third, accelerating construction at the Hausman Premium Residences, with topping-off expected in November and handover to residents by June next year; and fourth, implementing the government’s social housing initiative, exemplified by the FLC Tropical Ha Long project with 3 social housing buildings totaling 765 apartments.

FLC Accelerates Efforts to Lease and Purchase Aircraft

At the 2nd Extraordinary Shareholders’ Meeting on the morning of November 11, 2025, FLC Group announced the re-acquisition of ownership, management, and operational control of Bamboo Airways. The Group is actively collaborating with domestic and international partners experienced in aviation, aircraft leasing, and finance to explore cooperative solutions and secure investment capital.

FLC Shares Expected to Resume Trading in Q1 2026 Following Leadership Overhaul

The extraordinary 2025 Shareholders’ Meeting (2nd session) of FLC Group Joint Stock Company (UPCoM: FLC), held on the morning of November 11th, commenced with a remarkable shareholder attendance rate of 35.682%.

SCIC Offers 98% Stake in Viwaseen for Sale, Starting at Over 1.2 Trillion VND

The divestment of Vietnam Water and Environment Investment Corporation (Viwaseen, UPCoM: VIW) has been relaunched by SCIC at an average price of VND 21,620 per share, despite VIW’s current market price standing at only VND 16,000 per share. Previous offering attempts failed due to a lack of investor interest.