Source: VietstockFinance

|

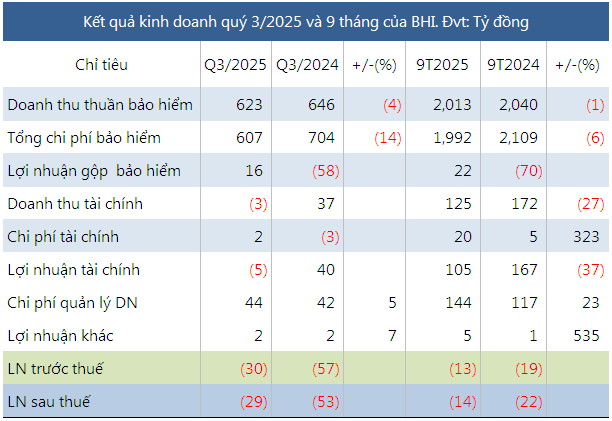

In Q3, BHI’s insurance operations reported a profit of VND 16 billion, a significant turnaround from the VND 58 billion loss recorded in the same period last year. This improvement stems from the company’s strategic decision to discontinue high-cost products, leading to a sharper decline in insurance business expenses compared to net revenue.

However, a slight financial loss of VND 5 billion and substantial management expenses of VND 44 billion—primarily attributed to employee costs—resulted in a continued net loss for the company. Despite this, the loss has narrowed compared to the VND 54 billion loss reported in the corresponding period.

| BHI’s Quarterly Business Performance |

For the first nine months of the year, BHI posted a net loss of VND 14 billion, primarily due to high management costs and a 37% decline in financial profits, driven by increased foreign exchange losses and losses from securities investments. To meet its annual post-tax profit target of over VND 13 billion, as presented to the Annual General Meeting, BHI must achieve a strong performance in the final quarter.

As of September 30, 2025, BHI’s total assets exceeded VND 4.5 trillion, an 8% decrease from the beginning of the year. Notably, term deposits fell by over VND 1.3 trillion (47%) to VND 1.5 trillion. Conversely, the company significantly increased its equity investments to nearly VND 170 billion (4.9 times higher than the start of the year) and non-term deposits to nearly VND 1.2 trillion (13.4 times higher).

Regarding liabilities, BHI’s short-term debt totaled over VND 3.4 trillion, an 8% decrease from the beginning of the year. Insurance contract payables decreased by 36% to VND 371 billion. Short-term provisions accounted for nearly 80% of total liabilities, reaching over VND 2.7 trillion, a slight 1% increase.

In late February 2024, South Korean non-life insurer DB Insurance acquired 75 million BHI shares for over VND 1.6 trillion, securing a 75% stake in the company. DB Insurance has maintained this ownership level to date.

Established in 1962 and headquartered in Seoul, DB Insurance (DBI) is a leading non-life insurance company in South Korea. It is part of the DB Group financial ecosystem and ranks as the second-largest non-life insurer in the country.

– 15:53 12/11/2025

Thai Billionaire Set to Pocket Over $45 Million from Vietnam’s “Golden Goose” Venture

With nearly 1.3 billion outstanding shares, Sabeco is set to allocate approximately VND 2,570 billion for this dividend payout.

Petrosetco Surges Following PVN’s Announcement to Auction Entire Stake at Starting Price of 36,500 VND/Share

Petrovietnam is set to auction its entire 23.21% stake in Petrosetco (HOSE: PET), a leading integrated oil and gas services company, with a starting price of VND 36,500 per share. This move, valuing the entire lot at nearly VND 910 billion, immediately sent PET shares surging to their upper limit on the morning of November 10th, despite the market price still trailing 12% below Petrovietnam’s offering price.

HDBank Poised to Surpass 2025 Business Plan Targets

At the Q3/2025 Investor Conference held on November 10, 2025, the leadership of Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank, HOSE: HDB) expressed unwavering confidence in their ability to accelerate growth in Q4, aiming to surpass the full-year 2025 profit targets.