Mr. Doan Van Hieu Em, a board member of Mobile World Investment Corporation (MWG), recently shared insightful remarks about EraBlue’s strategic pivot for 2026–2030. EraBlue is a leading electronics retail chain in Indonesia.

“After three years of efficient operations with nearly 180 stores, revenue surpassing 2 trillion Rp, and consistent profitability since Q3/2024, EraBlue has solidified its sustainable business model and strong market position in Indonesia.

Inheriting the DNA of both MWG and Erajaya, combined with agility, innovation, efficiency, integrity, and a global mindset, EraBlue is poised to enter a new growth phase.

Now is the time for EraBlue to define its own VISION, MISSION, and CORE VALUES, guiding its 2026–2030 strategy toward sustainable growth, regional expansion, and an IPO before 2030—cementing its status as Southeast Asia’s new retail icon,” stated Mr. Doan Van Hieu Em.

EraBlue aims to operate 500 stores by 2027. Agriseco’s recent report confirms this goal as achievable, given the chain’s current expansion pace and efficiency.

Indonesia’s fragmented electronics market, with over 50% controlled by traditional stores, presents a significant competitive advantage for EraBlue. Agriseco highlights ample room for MWG to expand EraBlue in this high-potential market.

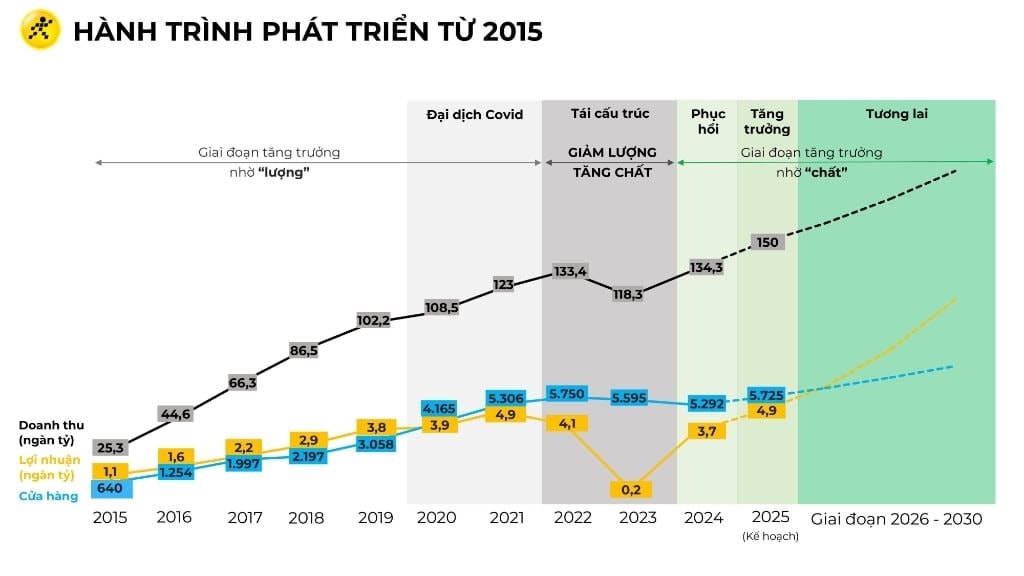

EraBlue is a cornerstone of Nguyen Duc Tai’s vision to build a Southeast Asian retail empire, alongside The Gioi Di Dong/Dien May Xanh (MW), Bach Hoa Xanh (BHX), and a new e-commerce focus. After two years of restructuring, MWG is entering a quality-driven growth phase.

By 2030, MWG aims to double its 2025 profits, maintaining a 15% annual growth rate. The MW chain is ready to challenge market saturation and unlock new opportunities, driving MW’s 2030 growth trajectory and regional expansion.

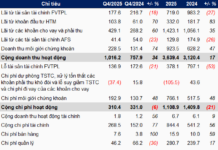

In Q1–Q3 2025, MWG reported record-high net revenue of 113.607 trillion VND, up 14% YoY, and net profit of nearly 5 trillion VND, a 73% increase, surpassing full-year targets.

Market Plunge Sparks Buying Spree: The Gioi Di Dong, Khai Hoan Land Chairman Lead Stock Acquisition Wave

Amidst the sharp decline in the stock market, a wave of listed companies and their internal shareholders have been actively accumulating shares, signaling a strong vote of confidence in their long-term prospects.

VPS Securities IPO: Nearly 20,000 Investors Registered, with Individuals Accounting for Over 98% of Value

On November 8th, the Board of Directors of VPS Securities Corporation (VPS) passed a resolution approving the offering price and allocation ratio for its highly anticipated IPO.