I. MARKET DYNAMICS OF WARRANT CERTIFICATES

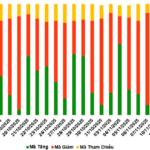

By the close of the trading session on November 12, 2025, the market recorded 236 advancing codes, 43 declining codes, and 22 reference codes.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

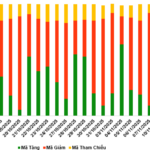

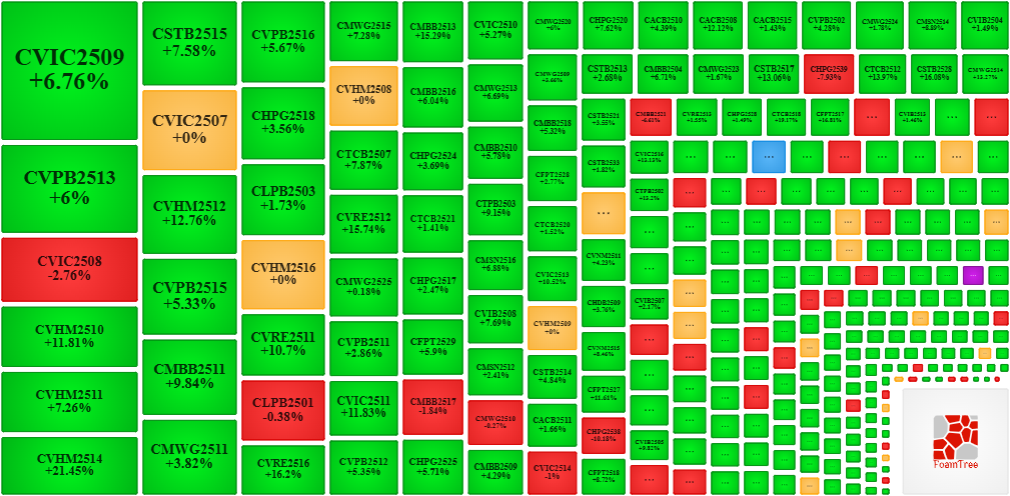

During the November 12, 2025 trading session, buyers dominated the market, driving most warrant certificates to rise. Notably, the top gainers included CVIC2509, CVPB2513, CVHM2510, and CSTB2515.

Source: VietstockFinance

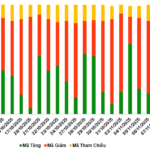

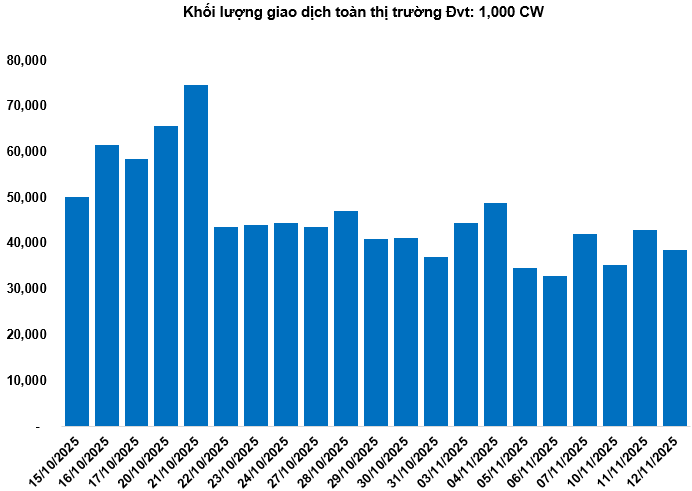

Total market volume on November 12 reached 38.46 million CW, down 10.51%; trading value hit 64.94 billion VND, a 22.69% decrease compared to November 11. CMBB2518 led the market in both volume and value, with 4.6 million CW traded, equivalent to 8.66 billion VND.

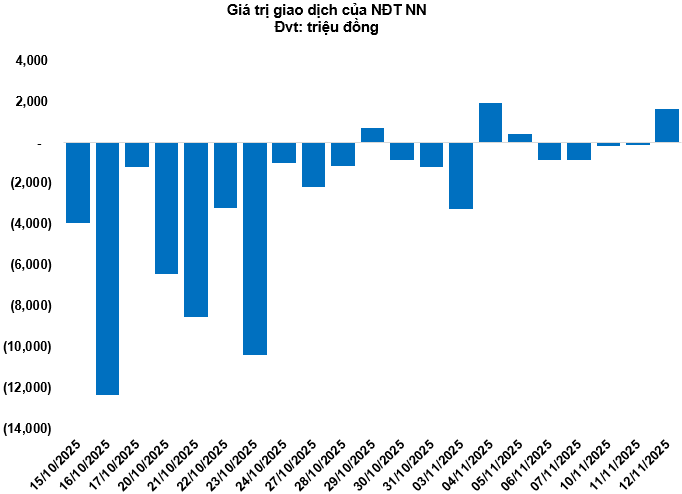

Foreign investors returned to net buying on November 12, with a total net purchase of 1.62 billion VND. CSHB2507 and CVIC2510 were the most net-bought codes.

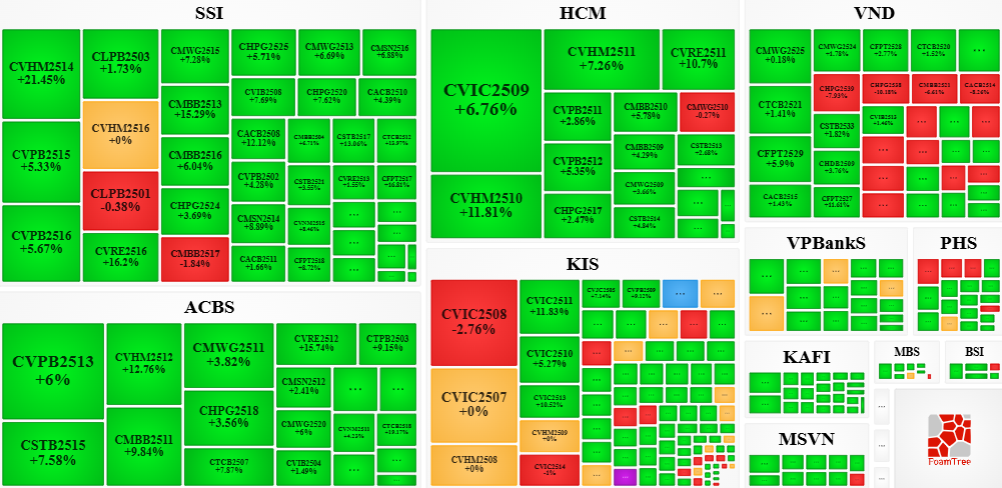

Securities firms SSI, KIS, VND, and ACBS are currently the leading issuers of warrant certificates in the market.

Source: VietstockFinance

II. MARKET STATISTICS

Source: VietstockFinance

Source: VietstockFinance

III. WARRANT CERTIFICATE VALUATION

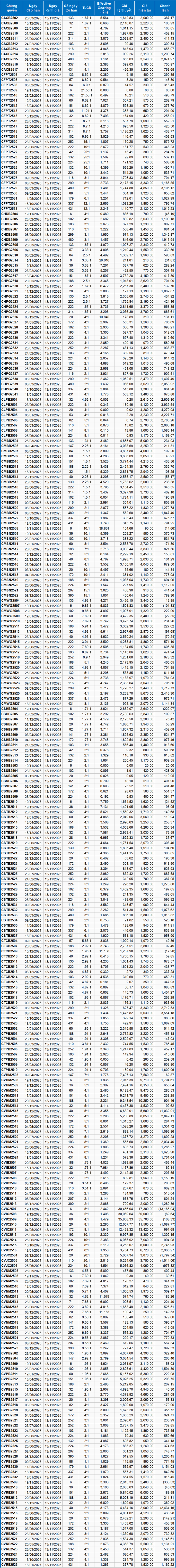

Based on the valuation method applicable from November 13, 2025, the fair prices of warrant certificates currently trading are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model have been adjusted to align with the Vietnamese market. Specifically, the risk-free treasury bill rate (Government Treasury Bill) is replaced by the average deposit rate of major banks, with term adjustments suitable for each warrant type.

According to the above valuation, CVIC2507 and CVRE2515 are currently the most attractively priced warrant certificates.

Warrant certificates with higher effective gearing will experience greater volatility in response to underlying securities. Currently, CMSN2508 and CHPG2514 have the highest effective gearing ratios in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:58 November 12, 2025

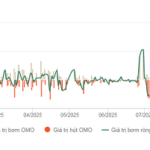

Central Bank Maintains Net Injection in Open Market Operations

During the week of November 3–10, the State Bank of Vietnam (SBV) continued its fourth consecutive week of net injection into the open market operations (OMO), with a total value exceeding 39 trillion VND, significantly higher than the 854 billion VND recorded in the previous week.

Stock Market Update November 7: Awaiting Signals to Invest in Oil & Gas Stocks

Despite the lackluster market conditions, savvy investors can strategically allocate funds into stocks within the oil and gas sector, as well as public investment domains, particularly those trading near their support levels.