At the beginning of Q3, hog prices were expected to remain high due to supply shortages caused by African swine fever. However, the reality proved otherwise, as prices plummeted nationwide. In September 2025, hog prices fell to just 50,000 – 59,000 VND/kg, significantly lower than the 66,000 – 69,000 VND/kg recorded in the same period last year.

This price drop signals a turbulent quarter for pig farming enterprises. Yet, not all companies have been severely impacted.

|

Q3 2025 Performance of Pig Farming Companies

|

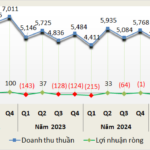

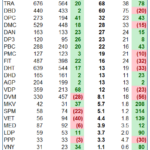

Despite falling hog prices, most major players in the industry still saw growth in Q3. HPG’s agriculture division, HPA, contributed over 2 trillion VND in revenue (up 11%) and 358 billion VND in post-tax profit (up 27%). This segment was HPG’s second-largest contributor, generating four times the revenue of its real estate division in Q3. However, it’s worth noting that HPG’s agricultural revenue also includes beef and eggs.

Next is HAG, with revenue of nearly 1.9 trillion VND (up 32%) and net profit of 416 billion VND (up 25%). However, HAG’s growth was primarily driven by increased gross profit from fruit sales, specifically bananas. In contrast, its pig farming segment remains bleak, with revenue of just 39.5 billion VND, down 83%.

Pig farming giant Dabaco (HOSE: DBC) also reported strong Q3 profits of 343 billion VND (up 10%) and revenue growth of 37%, exceeding 4.8 trillion VND. Dabaco attributed this growth to efficient operations across its production, farming, and processing chain. Ensuring biosecurity has also stabilized farming activities, leading to growth compared to the same period last year. Additionally, Q3 results included contributions from broiler breeding, vegetable oil, and trade services, significantly impacting overall performance.

| Dabaco maintains strong Q3 profits |

Masan Meatlife (UPCoM: MML) demonstrated the industry’s most impressive growth, with revenue up 23% and net profit nearly 38 times higher than the same period last year, reaching 78 billion VND. According to MML, Q3 revenue from fresh meat, processed meat, and farm segments all increased significantly. Coupled with cost control measures, this boosted gross profit and led to substantial earnings.

On the other hand, Vissan (UPCoM: VSN) saw a 39% decline, with profits reaching 20 billion VND due to reduced sales volume. Most notably, “vegetarian pig” BAF unexpectedly underperformed, with net profit plummeting 66% to 21 billion VND. Revenue also decreased by 14%, totaling over 1.1 trillion VND. However, BAF has entirely cut its agricultural trading segment, so all Q3 revenue came from pig farming. When considering this segment alone, revenue grew by 33%.

| After two strong quarters, BAF stalls in Q3 |

Explaining the decline, BAF stated that Q3 is typically a low point for the pig industry due to school closures. Additionally, disease outbreaks and flooding increased the number of pigs entering the market, driving prices down. Natural disasters also led to additional costs related to pigpens and increased operational expenses due to the launch of two new farms, TMC and Hoa Phat 4.

Hope for Q4?

During an investor meeting announcing Q3 estimates, Dabaco Chairman Nguyen Nhu So noted that African swine fever remains severe. In Q3, the disease forced farmers to sell pigs prematurely, “normally pigs are sold at 120kg, but now they’re sold at 60kg, increasing supply and lowering prices.”

However, Mr. So believes that pig supply is actually insufficient. Due to disease and flooding, farmers struggle to restock while ensuring biosecurity. Moreover, the new Livestock Law, effective from 2025, imposes strict environmental and distance regulations, making it difficult for small-scale farmers to continue operations. With supply shortages, pig prices are expected to rebound in Q4.

Yet, the reality seems to contradict Mr. So’s assessment, as pig prices continue to fall. As of November 10th, average national hog prices dropped to 48,600 VND/kg, nearing lows seen in early 2023. According to BAF representatives, small-scale farmers have continued restocking. However, complex diseases and recent storms like Bualoi, Matmo, and Kalmaegi have pushed more pigs into the market, further depressing prices.

Despite this, most forecasts predict that hog prices will recover in the coming period, especially during the year-end and Tet holidays when food demand peaks.

– 09:10 13/11/2025

Cement Industry Profits Surge in Q3, Anticipating Strong Year-End Growth

Third-quarter revenue for 17 listed cement companies rose 6%, with industry-wide profits surpassing 70 billion VND, a stark reversal from the 60 billion VND loss incurred in the same period last year. This marks the second consecutive profitable quarter. Fueled by increased public investment disbursement and a gradually recovering real estate market, the sector is poised for accelerated growth in the final months of the year.

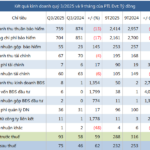

Q3 Pharmaceutical Sector: Sustaining Growth Momentum

The strategic restructuring of product portfolios, coupled with the advantages gained from the 2024 year-end policies, has significantly bolstered the performance of most pharmaceutical companies in Q3 2025.

Post Office Insurance Profits Decline in Nine Months

Post Office Insurance Corporation (HNX: PTI) reported a net profit of VND 232 billion in the first nine months of 2025, an 8% decline year-on-year. This decrease is attributed to reduced profitability in both its core insurance and financial services segments.