As the third quarter and the first nine months of 2025 drew to a close, while many natural rubber companies surpassed their profit targets, the outlook for the tire and tube group was less promising.

|

Natural Rubber Sector Surges on Improved Selling Prices

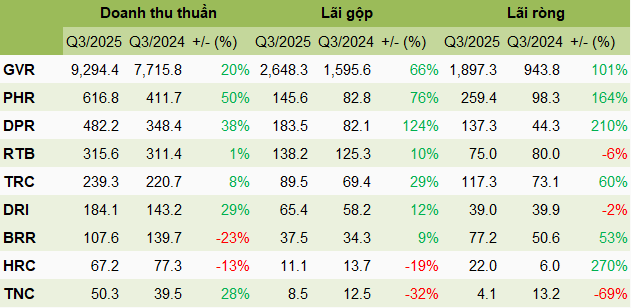

According to VietstockFinance data, the natural rubber sector demonstrated a robust performance in Q3/2025, with the majority of companies reporting growth in both revenue and profit compared to the same period last year. In addition to volume and price drivers, other income streams also contributed to these results.

In Q3, Vietnam Rubber Industry Group (HOSE: GVR), the largest listed rubber company, generated over VND 9,294 billion in net revenue and VND 1,897 billion in net profit, up 20% and double the same period last year, respectively. According to GVR, the main reason was higher rubber latex prices.

By the end of Q3, GVR managed 115 subsidiaries and associates. Among the listed companies under the Group are Phuoc Hoa Rubber (Phuruco, HOSE: PHR), Dong Phu Rubber (Doruco, HOSE: DPR), Tan Bien Rubber (Tabiruco, UPCoM: RTB), Ba Ria Rubber (Baruco, UPCoM: BRR), and Hoa Binh Rubber (Horuco, HOSE: HRC), all of which hold significant positions in the natural rubber industry.

HRC, DPR, and PHR showed the most impressive net profit growth in the industry and within the GVR group. However, each company has a unique story.

HRC reported a net profit of VND 22 billion, 3.7 times higher than the same period last year, thanks to its financial segment turning from a loss of over VND 3 billion to a profit of over VND 17 billion, contributed by dividends from Vietnam-Laos Rubber and Ba Ria – Kampong, alongside no financial provisions.

In terms of core operations, net revenue decreased by 13% to VND 67 billion. The company attributed this to a decline in sales volume, despite improved selling prices.

On the other hand, DPR reported a net profit of over VND 137 billion, 3.1 times higher than the same period last year, accompanied by growth in core operations. According to the company, Q3 sales volume reached nearly 5.8 thousand tons, up 26%, and the average selling price was nearly VND 48.5 million per ton, up 5%, driving both revenue and profit margins. Additionally, a 61% increase in financial profit also contributed positively.

Meanwhile, PHR reported a Q3 net profit of over VND 259 billion, 2.6 times higher, thanks to stable and higher selling prices compared to the same period. The company also recorded compensation and support related to land allocation for projects, including the Ho Chi Minh City – Thu Dau Mot – Chon Thanh Expressway (nearly VND 7 billion) and VSIP III Industrial Park (over VND 120 billion).

TRC reported a net profit of over VND 117 billion, up 60%. The average selling price of rubber latex increased for both the parent company and its subsidiary Tay Ninh Siem Reap (Cambodia). The selling price of rubber tree liquidation also increased, alongside reduced loan interest expenses at the subsidiary and lower losses from associates.

As for BRR, Q3 revenue decreased by 23% to nearly VND 108 billion, due to a 25% decline in sales volume to over 2.2 thousand tons. However, with an 18% increase in selling prices to VND 47.4 million per ton and higher dividend income, the company ended Q3 with a 53% growth in net profit, reaching VND 77 billion.

The natural rubber industry in Q3 also saw several cases of declining net profits, ranging from insignificant decreases like Dak Lak Rubber Investment (UPCoM: DRI), down 2% to VND 39 billion, and RTB, down 6% to VND 75 billion, to a sharp 69% drop for Thong Nhat Rubber (HOSE: TNC), to VND 4.1 billion.

According to TNC, the main reason was the decline in Cavendish banana prices, which negatively impacted the banana business segment, coupled with no rubber tree liquidation as in the same period last year.

|

Most natural rubber companies grew in Q3/2025

Unit: Billion VND

Source: VietstockFinance

|

Tire and Tube Group Marked by Exchange Rates and Cost Management

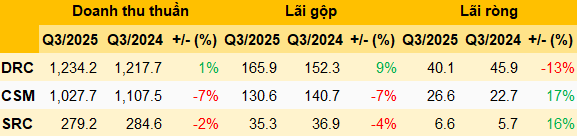

In the tire and tube group, three companies reported total Q3 revenue of over VND 2,541 billion, down 3% year-on-year, and total net profit of over VND 73 billion, down slightly by 1%.

Revenue for Southern Rubber Industry (Casumina, HOSE: CSM) decreased by 7% to nearly VND 1,028 billion, while gross margin remained stable at 12.7% due to a corresponding decrease in cost of goods sold. However, this Vinachem subsidiary still reported a net profit of nearly VND 27 billion, up 17%, thanks to more favorable exchange rate movements and improved cost management efficiency.

Similarly, Sao Vang Rubber (HOSE: SRC) saw declines in both revenue and gross profit but reported a 16% increase in net profit to nearly VND 7 billion.

In contrast, another Vinachem member, Danang Rubber (HOSE: DRC), was the only company to report a 13% decline in net profit to just over VND 40 billion, despite a slight 1% increase in revenue. According to the company, higher exchange rates boosted financial performance, but this was not enough to offset increased sales policies and other negative factors. Notably, DRC‘s Q3 selling expenses reached VND 88 billion, up 66%.

|

Q3/2025 Business Results for the Tire and Tube Group

Unit: Billion VND

Source: VietstockFinance

|

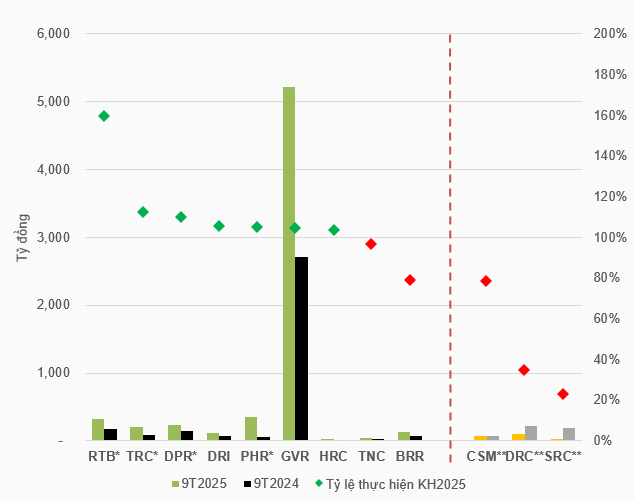

Natural Rubber Outperforms, Tire and Tube Lags

For the first nine months of 2025, most natural rubber companies have already exceeded their full-year profit targets. Leading the way is RTB, surpassing its target by 60%, followed by TRC at 13% and DPR at 10%. Other companies, including DRI, PHR, GVR, and HRC, have also slightly exceeded their targets a quarter early. Meanwhile, TNC and BRR are close to meeting their goals, with completion rates of 97% and 79%, respectively.

In the tire and tube group, CSM has achieved 79% of its target. However, DRC and SRC have only reached 35% and 23% of their goals, respectively.

In an August interview, Mr. Le Hoang Khanh Nhut, CEO of DRC, predicted that the company would likely miss its 2025 targets. The market has faced numerous challenges since the beginning of the year, such as rising raw material costs and difficulties in the key U.S. export market due to tariffs. DRC’s leadership also emphasized that the company did not raise prices to offset higher input costs, leading to reduced efficiency.

|

Contrasting 2025 Target Achievement Between Natural Rubber and Tire and Tube Groups

*Parent company’s post-tax profit target; Pre-tax profit target

Source: VietstockFinance

|

– 09:00 12/11/2025

HDBank Poised to Surpass 2025 Business Plan Targets

At the Q3/2025 Investor Conference held on November 10, 2025, the leadership of Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank, HOSE: HDB) expressed unwavering confidence in their ability to accelerate growth in Q4, aiming to surpass the full-year 2025 profit targets.

MB CEO Pham Nhu Anh: Many FDI Enterprises Opt to Borrow in Vietnam Instead of Their Home Countries Due to Lower Interest Rates

The CEO of MB highlighted that this serves as a prime example of how interest rates in Vietnam have reached historically low levels. In the short term, rates may edge up slightly, but the increase will be minimal. Even with a rise of 0.5-1%, borrowing costs remain remarkably affordable compared to previous periods and global standards.