Vietnamese Rice Stall – Image: Thế Mạnh

|

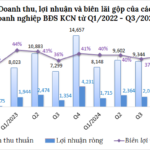

Vietnam’s rice industry faced a contradictory third quarter. According to VietstockFinance data, the total revenue of nine listed rice companies dropped by 23% year-on-year to over VND 8.3 trillion, while net profit surged by 93% to VND 66 billion. This profit improvement stemmed from cost management and a nearly 2 percentage point increase in gross margin to 9.6%, rather than sales expansion.

Notably, all nine surveyed companies were profitable in the quarter, unlike the previous year when some reported losses. However, performance varied: four companies increased profits, three decreased, and two turned losses into profits.

|

Southern Food Corporation (Vinafood II, VSF) stood out with a remarkable 5,500% net profit increase to over VND 13 billion, the highest since 2024, despite a 28% revenue decline to VND 3.8 trillion, a three-year low. This was driven by faster cost reduction than revenue decline, pushing gross margin above 10% (a seven-year high), along with a 41% cut in financial expenses and 21% in administrative costs.

| Vinafood II’s Quarterly Performance (2024-2025) |

This turnaround is significant given VSF’s history as a state-owned export leader that suffered a decade of losses (2013-2022) and post-equitization leadership scandals in 2018. Despite this quarter’s success, VSF still carries accumulated losses of nearly VND 2.783 trillion, making Q3’s results an initial recovery signal.

Small and medium-sized companies also showed positive shifts. Kien Giang Import-Export (Kigimex, KGM) and Kien Giang Trading (KTC) reported profit increases of 184% and 105% to VND 3 billion and VND 10 billion, respectively, though absolute values remain small and margins thin, typical for the rice industry.

Fragile Recovery

Trung An (TAR) and Ho Chi Minh City Food Corporation (Foodcosa, FCS) exemplify companies that successfully turned losses into profits.

Trung An ended five consecutive quarters of losses with a VND 2 billion profit, thanks to 30% revenue growth and significant financial expense cuts. However, its nine-month net loss narrowed to VND 21 billion from VND 31 billion last year, falling short of the VND 9 billion annual profit target.

| Trung An’s Quarterly Performance (2024-2025) |

Foodcosa (FCS) posted a modest VND 60 million profit, escaping quarterly losses through cost reduction, but still faces VND 200 billion in accumulated losses and severe working capital shortages, relying heavily on existing resources to sustain operations.

Industry Leader Struggles

In contrast, industry leader Vietnam Seed Corporation (Vinaseed, NSC) had its weakest quarter since 2020, with net profit falling 27% to VND 26.6 billion and gross margin dropping to 19%, the lowest in nearly two decades.

This was due to a 7% cost increase and 1% revenue decline. The company attributed this to the leap year shifting seasons and affecting sales. Despite this, Vinaseed remains the industry profit leader in absolute terms.

| Vinaseed’s Quarterly Performance (2020-2025) |

Other companies reporting profit declines include SSC (-34%), TCO (-28%), and MCF (-10%). However, TCO, a newcomer to the rice sector, showed promising nine-month results with 150% profit growth to nearly VND 41 billion, nearing its annual target.

Inventory Buildup Amid Weak Exports

Beyond financial results, asset management decisions, particularly inventory, reveal strategies amid market volatility. The industry shows a clear trend of inventory buildup.

|

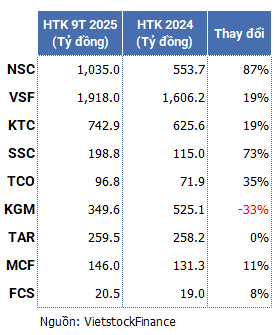

By September 2025, total inventory of the nine companies reached nearly VND 4.8 trillion, up 22% year-to-date. Vinaseed led with an 87% increase to over VND 1.035 trillion, but alarmingly, its finished goods inventory doubled, comprising 95%, risking outlet congestion and cash flow pressure. Vinafood II held the largest inventory value at VND 1.918 trillion (up 19%), with 40% finished goods and 39% raw materials. In contrast, Kigimex efficiently reduced inventory by 33% to under VND 350 billion, with only 16% finished goods, indicating better turnover.

This inventory buildup, amid declining export volume and value, is a risky strategy, especially with major markets like the Philippines and Indonesia halting imports. Without outlet recovery, inventory pressure will further strain cash flow and profits. The Vietnam Food Association urges companies to avoid price dumping, seek new markets, and enhance product value-added.

Overall, the impressive profit recovery of listed rice companies in Q3 came from internal factors like cost management and margin improvement. However, this faces significant challenges from international market instability, requiring flexible and sustainable strategies.

Long-term success depends on enhancing value-added, expanding export markets, and prudent working capital management to navigate these challenges.

|

According to Customs data, nine-month exports reached 6.8 million tons, down 2% year-on-year, with value at USD 3.5 billion, down 20%, and average export price falling 18.3% to USD 511/ton. The Philippines, Vietnam’s largest market (43.1% of export volume), caused a September shock by halting imports from October 1, leading to a 92.2% volume and 93.4% value drop in September exports, pushing it from first to sixth place. |

– 12:00 12/11/2025

The Đinh Trường Chinh Case: Unveiling the Fate of Four Prime Saigon Land Plots Worth 970 Billion VND

The Ho Chi Minh City People’s Court has determined that defendant Đinh Trường Chinh unlawfully profited 970 billion VND from illegal asset transfer transactions.

Tycoon Dinh Truong Chinh Sentenced to 13 Years in Prison for Vinafood II’s ‘Golden Land’ Acquisition Scandal

Unveiling a lucrative land deal gone awry, the Ho Chi Minh City People’s Court sentenced tycoon Dinh Truong Chinh to 13 years in prison. Chinh, who profited a staggering 970 billion VND from the sale of prime real estate owned by Southern Food Corporation (Vinafood II), was ordered to return the entire sum.

Appellate Hearing for Vinafood II: Prosecution Demands Joint Compensation of 68 Billion VND from Defendants

At the appellate trial, the representative of the People’s Procuracy proposed that the former leaders of Vinafood II be jointly liable for compensating 68 billion VND to rectify the consequences of the case.