Today’s market (11/11) saw a positive boost, driven by the upward momentum of stocks poised for inclusion in the FTSE Global All Cap Index. Notable performers included VHM, VRE, VIX, SSI, MSN, and VNM.

Stocks rallied as major shares collectively surged in value.

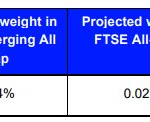

FTSE Russell recently announced its plan to reclassify Vietnam’s market from Frontier to Secondary Emerging status, effective September 2026. The report highlighted a list of potential candidates for the FTSE Global All Cap Index, including HPG, VCB, VIC, VHM, MSN, SAB, VNM, DXG, DIG, DGC, FRT, KDH, KDC, KBC, DPM, PDR, STB, SHB, SSI, HUT, VCI, VJC, GEX, EIB, PLX, VRE, VIX, and VND.

The final list will be unveiled ahead of the FTSE GEIS semi-annual review in September 2026. The inclusion of Vietnamese stocks is expected to occur in multiple phases.

The VN30 index, comprising large-cap stocks, saw a dominant green trend with 20 out of 30 stocks rising. Key sectors such as banking, real estate, and securities demonstrated strong consensus.

Despite the market’s recovery, liquidity declined. HoSE trading volume totaled just over VND 19.5 trillion, with only two stocks—SHB and SSI—crossing the VND 1 trillion mark. This modest rebound suggests uncertainty in upcoming sessions.

Analysts emphasize that a confirmed trend reversal requires the VN-Index to surpass 1,656 points. Conversely, further corrections may push the index back to the 1,530–1,550 support zone, mirroring late July accumulation levels and the 2022 peak.

At the close, the VN-Index gained 13.07 points (0.83%) to 1,593.61. The HNX-Index rose 2.9 points (1.12%) to 261.08, while the UPCoM-Index added 0.4 points (0.34%) to 117.85.

Foreign investors significantly reduced net selling to VND 77 billion. Buying and selling activities were relatively balanced. VIC, HPG, VNM, SHB, and MSN saw the strongest foreign inflows, while MBB, STB, CTG, and HDB faced net outflows.

Why Masan Consumer’s Stock Defied the Odds, Surging to a Record High and Nearly $8.5 Billion Market Cap Despite Q3 Earnings Decline?

The dip in Q3 sales isn’t a sign of weakness but a strategic “investment cost” essential for restructuring our distribution system.