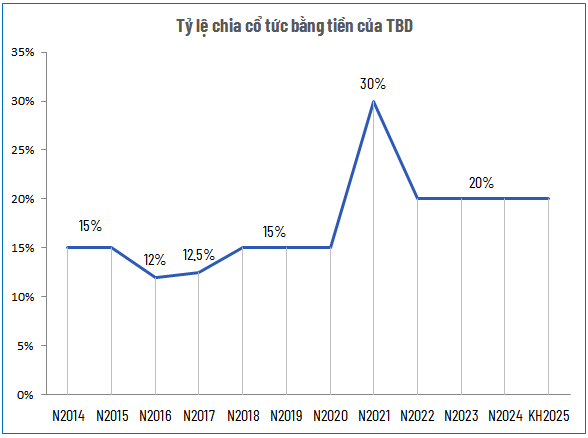

With over 32.4 million shares outstanding, TBD plans to allocate approximately VND 65 billion for dividend payments. This marks the third consecutive year the company has maintained a 20% payout ratio and the 11th consecutive year of cash dividends.

Source: VietstockFinance

|

Previously, TBD distributed its highest dividend at 30% in 2021. Since 2022, the company adjusted the ratio to 20% and has maintained it, despite record net profits in 2024.

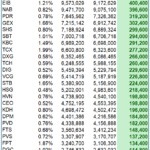

| TBD’s Financial Performance Over the Years |

In 2025, TBD aims for revenue of VND 2,362 billion and post-tax profit of VND 158 billion, representing a 14% and 11% increase, respectively, compared to the previous year. The dividend payout ratio is expected to remain at 20%.

In Q3/2025, TBD reported net revenue of over VND 506 billion, a 43% increase year-over-year. However, due to rising costs of goods sold, interest expenses, and operating costs, net profit rose only 11% to over VND 28 billion. For the first nine months, net revenue reached nearly VND 1.6 trillion (up 56%), with net profit surging 91% to VND 119 billion, achieving 75% of the annual target.

Source: VietstockFinance

|

As of September 30, 2025, the largest shareholder of TBD is Gelex Electricity JSC, holding 46.9% of the capital, expected to receive approximately VND 30 billion in dividends. Another major shareholder, Vietnam Electricity Group (EVN), owns 46.5% and will receive a similar amount.

– 13:58 13/11/2025

Thai Billionaire Set to Pocket Over $45 Million from Vietnam’s “Golden Goose” Venture

With nearly 1.3 billion outstanding shares, Sabeco is set to allocate approximately VND 2,570 billion for this dividend payout.

Petrosetco Surges Following PVN’s Announcement to Auction Entire Stake at Starting Price of 36,500 VND/Share

Petrovietnam is set to auction its entire 23.21% stake in Petrosetco (HOSE: PET), a leading integrated oil and gas services company, with a starting price of VND 36,500 per share. This move, valuing the entire lot at nearly VND 910 billion, immediately sent PET shares surging to their upper limit on the morning of November 10th, despite the market price still trailing 12% below Petrovietnam’s offering price.

HDBank Poised to Surpass 2025 Business Plan Targets

At the Q3/2025 Investor Conference held on November 10, 2025, the leadership of Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank, HOSE: HDB) expressed unwavering confidence in their ability to accelerate growth in Q4, aiming to surpass the full-year 2025 profit targets.