Technical Signals of VN-Index

During the morning trading session on November 13, 2025, the VN-Index experienced a slight recovery, marked by a small-bodied candlestick. The Stochastic Oscillator also provided a buy signal, indicating potential upward momentum.

The 100-day SMA held firm during the recent correction and is expected to continue acting as a support level in the near term.

Technical Signals of HNX-Index

In the morning session on November 13, 2025, the HNX-Index continued its upward trend, breaking above the Middle Band of the Bollinger Bands. The MACD indicator has issued a buy signal, and if the Stochastic Oscillator follows suit in upcoming sessions, the outlook will become even more positive.

DGC – Duc Giang Chemicals Group JSC

During the morning session on November 13, 2025, DGC shares surged, accompanied by a Rising Window candlestick pattern. Trading volume spiked significantly, surpassing the 20-session average, reflecting heightened investor activity.

Currently, the stock price has risen above the 100-day and 200-day SMAs, while the MACD indicator continues to climb above the zero line, further supporting the short-term recovery. Additionally, DGC has broken through the neckline (96,600-97,700 range) of an Inverse Head and Shoulders pattern. If positive technical signals persist and the uptrend continues, the potential price target is 107,600-111,000 (equivalent to the August 2025 high).

HAH – Hai An Transport and Services JSC

In the morning session on November 13, 2025, HAH shares extended their gains for the second consecutive session, forming a Big White Candle pattern. Trading volume increased, surpassing the 20-session average, indicating investor optimism.

The MACD indicator remains bullish after issuing a buy signal, and the price is closely tracking the Upper Band of the Bollinger Bands, suggesting a positive short-term outlook. HAH is currently retesting the May 2025 high (65,000-68,300 range). A breakout above this level would reinforce the long-term uptrend.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, signals and conclusions are for reference only and may change by the close of the afternoon session.

Technical Analysis Department, Vietstock Advisory

– 12:04 November 13, 2025

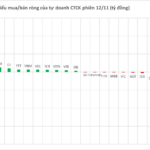

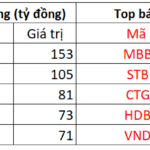

11/11 Session: Foreign Investors Reduce Net Selling, Counter-Trend with Hundreds of Billions Invested in Two Blue-Chip Stocks

Foreign investors’ block transactions remained a negative factor, with a net sell-off of 76 billion VND. However, the selling pressure has significantly eased compared to previous sessions.