The Ministry of Finance has officially issued Decision No. 3761/QĐ-BTC dated November 6, 2025, regarding the implementation plan for Decision No. 2014/QĐ-TTg, which approves the project to upgrade Vietnam’s stock market. A key aspect of this decision pertains to the foreign ownership ratio, commonly referred to as the “foreign room.”

Specifically, the Ministry of Finance has tasked the Foreign Investment Agency with leading the effort, in collaboration with the Legal Department, the State Securities Commission (SSC), and other relevant units. Their mission is to review the list of conditional business sectors, study and propose the expansion or removal of foreign ownership restrictions in areas not related to national security. This initiative aims to enhance the investment environment and increase the attractiveness of Vietnam’s capital market, ultimately suggesting necessary amendments to relevant legal documents. Regular reviews will also be conducted to improve foreign investors’ access to sectors currently subject to ownership limitations.

For years, the issue of foreign room in public companies has been a significant barrier to Vietnam’s stock market upgrade, particularly according to MSCI standards. Inconsistencies related to foreign ownership have hindered foreign investors’ access, impacting market liquidity and size.

In practice, the maximum foreign ownership ratio in Vietnam varies by industry, ranging from 50% to 100%. Previously, companies had the autonomy to set their foreign ownership limits as long as they remained below the regulatory maximum. This led to some companies setting very low foreign room limits, often between 5-10%, for reasons such as preventing takeovers, reserving space for potential strategic investors, or safeguarding the interests of controlling shareholder groups.

However, this situation has been mitigated. The government issued Decree 245 on September 11, 2025, amending and supplementing certain articles of Decree No. 155/2020/NĐ-CP, which details the implementation of the Securities Law. The previous regulation allowing public companies to self-determine their maximum foreign ownership ratio has been abolished, facilitating better market access for foreign investors.

Under the new regulations, only public companies that previously announced their foreign ownership ratios may retain or modify them. These companies must disclose this ratio on their corporate websites and stock exchanges, completing the notification process within 12 months. The Vietnam Securities Depository (VSDC) will update and publish the maximum and current foreign ownership ratios for each public company on its website.

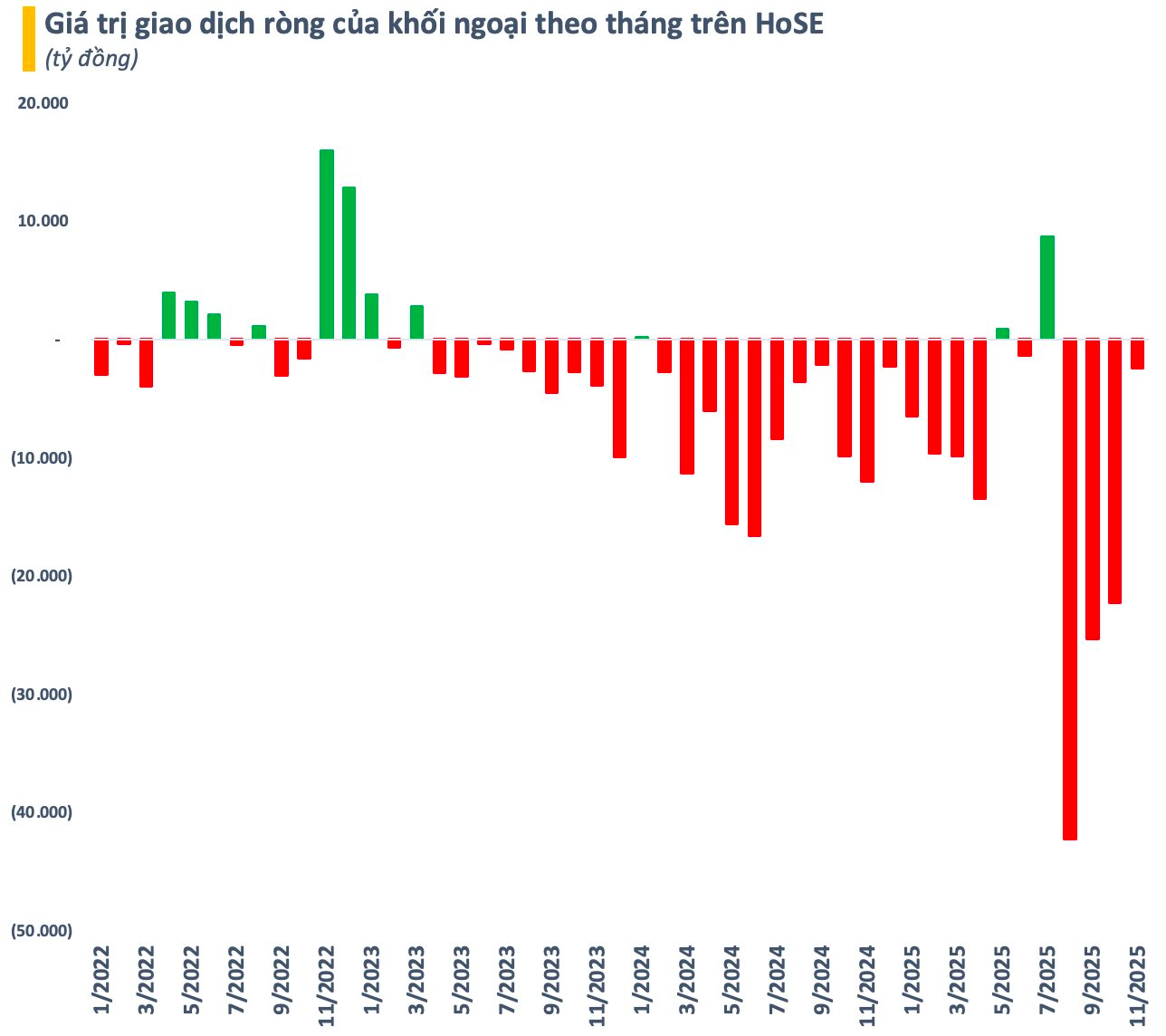

It is evident that regulatory authorities are taking decisive measures to pave the way for foreign investors to access Vietnam’s stock market. These actions come amid persistent net selling by foreign investors, despite FTSE Russell’s announcement of Vietnam’s upgrade roadmap.

Since the beginning of 2025, foreign investors have net sold over 123 trillion VND on the HoSE. Selling pressure intensified notably from August as the VN-Index reached historic highs. Historically, foreign investors’ net buying periods have been brief, typically lasting only a few months before reversing. This trend is expected to shift once Vietnam officially joins FTSE Russell’s Secondary Emerging Market.

A recent FTSE Russell report revealed Vietnam’s weight in various indices post-upgrade. Specifically, Vietnam will hold a 0.04% weight in the FTSE Global All Cap, 0.02% in the FTSE All-World, 0.34% in the FTSE Emerging All Cap, and 0.22% in the FTSE Emerging Index. FTSE has established tracking indices to simulate the impact before the official reclassification.

Vanguard Set to Launch Investment Accounts Following Vietnam Stock Market Upgrade

Vanguard, one of the world’s largest asset management firms, currently overseeing nearly $13 trillion USD, has announced plans to expand its investment operations into Vietnam following the market’s recent upgrade.

No Reason to Be Pessimistic: Current Price Levels Are More Than Reasonable, Says Mr. La Giang Trung

According to experts, if we assume the market cannot worsen beyond the “tariff” bottom seen in April, the current price range is exceptionally reasonable for any investor.