Exporters’ Financial Performance Affected by Tariffs

Q3/2025 business results reveal that tariffs have begun impacting major exporters’ outcomes.

Sao Ta Food reported revenue of nearly VND 2,983 billion, up 5%, and post-tax profit of VND 112 billion, a 18% increase, thanks to a 5.02% sales rise and reduced costs from settling self-farmed shrimp in the second crop of 2025.

However, in the first nine months, aside from VND 6,850 billion in revenue (up 23%), the company incurred nearly VND 193 billion in countervailing duties, VND 98 billion in anti-dumping taxes, and VND 60 billion in anti-subsidy taxes—costs absent in the same period last year.

Despite this, strong financial income growth kept nine-month post-tax profit at VND 251.2 billion, up 6.7%.

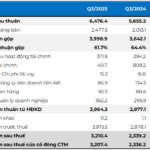

Vinh Hoan’s Q3 revenue reached over VND 3,470 billion, up 5.8%, with post-tax profit of VND 455 billion, up 34%; nine-month profit hit VND 1,206 billion, up 39%. However, much of this growth stemmed from financial income and reduced financial costs.

For US tra fish exports, Q3 revenue fell nearly 8% to VND 1,760 billion. After a 31% surge in July due to pre-tax order rush, August and September exports dropped 36% and 27% year-on-year, respectively.

Nam Kim Steel faced sharper pressure: Q3 revenue fell 27% to over VND 3,770 billion, with net profit down nearly 24% to VND 49.5 billion. Nine-month export revenue plunged over 55%, halving post-tax profit to VND 207 billion.

Thanh Cong Textile also struggled in Q3, with revenue down 18% to VND 902 billion and post-tax profit down 21% to VND 64 billion. Nine-month revenue fell 3% to VND 2,786 billion, but net profit rose 4% due to strong management.

Illustrative image.

Conversely, some firms leveraged the pre-tax “buffer” to boost sales or cut costs.

Vinatex saw Q3 profit surge over 56% to VND 359.3 billion on strong export growth. Quarterly revenue topped VND 5,000 billion for the first time. Nine-month post-tax profit hit VND 943.4 billion, up 132%.

May Song Hong achieved a record Q3 post-tax profit of nearly VND 201 billion, up 54% despite a 6% revenue drop. Nine-month revenue rose 8% to nearly VND 4,150 billion, with profit up 74% to VND 470 billion.

Nam Viet Seafood (ANV) reported Q3 revenue of VND 2,000 billion, up 49%, and post-tax profit of VND 283 billion, 10 times higher year-on-year. Nine-month revenue reached VND 4,832.6 billion, with profit up 36% and 17.6 times higher.

Q4/2025 Outlook

Entering Q4/2025, the outlook is expected to polarize further. Vinatex notes that tariff impacts are becoming evident, with US textile orders declining.

Unlike previous years, when orders extended into Q1, this year’s orders are mostly monthly; some firms lack orders for November.

Thanh Cong Textile remains optimistic, securing 76% of Q4 revenue targets. It expects Vietnam’s 20% countervailing duty to remain competitive against China and India, while expanding into EU, CPTPP, and RCEP markets to leverage FTAs.

The seafood sector faces greater challenges. Sao Ta Food may face significant impacts post-October 15, with the US Commerce Department’s final anti-dumping ruling due December 9. If the 35.29% preliminary duty is upheld, the company will forfeit VND 42 billion and potentially pay VND 300 billion more. However, its five-year expansion into Canada, Australia, South Korea, and Japan has reduced US reliance.

According to Bao Viet Securities, Vinh Hoan will face tougher US competition as tilapia gains market share and rivals enjoy lower or zero anti-dumping duties, intensifying the export race.

Hòa Bình Construction (HBC) Reports 138% Surge in Q3/2025 After-Tax Profit Compared to Previous Year

The standout highlight of this period is a remarkable 1,100% surge in financial revenue, reaching 229.5 billion VND, primarily driven by late payment interest recorded in accordance with a court ruling.

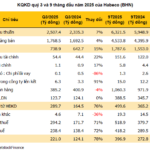

Northern Beer Industry Leader Revives Golden Era, Achieving Highest Profits in 5 Years

Following the post-COVID-19 slowdown, Hanoi Beer-Alcohol-Beverage Joint Stock Corporation (Habeco, HOSE: BHN) is regaining its growth momentum, with revenue, profit, and gross margins all returning to peak levels. Beyond its robust recovery in the beer segment, Habeco has also made a notable mark with nearly VND 5,000 billion in cash deposits.

Comprehensive Joint Statement: Vietnam-U.S. Agreement on Reciprocal, Fair, and Balanced Trade

The United States of America (USA) and the Socialist Republic of Vietnam (Vietnam) have reached a consensus on the Framework for a Reciprocal, Fair, and Balanced Trade Agreement. This agreement aims to strengthen bilateral economic ties, fostering enhanced market access for each country’s exports. Building upon the longstanding economic relationship between the two nations, the Reciprocal, Fair, and Balanced Trade Agreement will expand upon existing foundations, including the U.S.-Vietnam Bilateral Trade Agreement signed in 2000 and effective since 2001.