VIT Announces Issuance of Up to 18.8 Million Shares for Stock Swap with VIH and TLT

According to the company, the merger aims to innovate and streamline the organizational structure of the tile group under Viglacera Corporation (VGC). Consolidating tile and construction material production units under a single listed entity will yield several benefits. Firstly, it will optimize administrative costs. Secondly, it will increase market capitalization and stock liquidity. Thirdly, it will standardize risk management, IFRS, and ERP compliance. Lastly, it will enhance the ability to raise medium and long-term capital.

The consolidation aims to simplify the ownership structure within the Viglacera ecosystem, improving the efficiency of control and monitoring activities.

Additionally, the tile segment will be synergized, integrating sales channels, R&D, centralized procurement, optimizing factory capacity, sharing brands, and logistics systems.

Currently, VIT does not own shares in TLT or VIH. Therefore, the company plans to issue up to 18.8 million additional shares at a swap ratio to exchange for all outstanding shares held by TLT and VIH shareholders, equivalent to approximately 37.6% of VIT‘s charter capital. The post-merger charter capital is expected to increase to a maximum of over 688 billion VND.

The swap ratio for VIT shares with TLT shares is 1:1.4 (1 TLT share for 1.4 VIT shares).

The swap ratio for VIT shares with VIH shares is 1:1.61 (1 VIH share for 1.61 VIT shares).

Thus, the expected number of shares to be issued to TLT shareholders is nearly 9.8 million, and to VIH shareholders, it is 9 million.

After the successful stock swap, TLT and VIH shares will be delisted from the UPCoM and deregistered at the Vietnam Securities Depository.

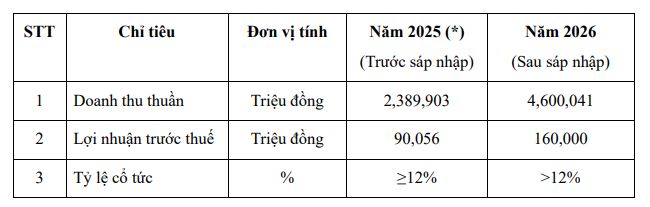

Post-Merger Business Plan

Upon completion of the swap and merger procedures, VIT will inherit all assets, rights, and legal benefits, as well as assume responsibility for outstanding debts, labor contracts, and other liabilities of TLT and VIH (including but not limited to business rights, property rights, receivables, payables, and obligations under contracts with third parties) based on the book values of TLT and VIH.

The company expects the merger to be implemented in Q4/2025 – Q1/2026. From January 1, 2026, VIT will take over the product distribution of VIH, TLT, and Viglacera Aerated Concrete JSC, transferring all personnel from Viglacera Tile Trading JSC to VIT. The company will inherit all brands and product lines of VIH, TLT, and Viglacera Aerated Concrete.

Post-merger, VIT targets net revenue of 4.6 trillion VND, pre-tax profit of 160 billion VND, and a minimum dividend rate of 12%.

|

VIT‘s Post-Merger Business Plan

Source: VIT

|

These developments are part of Viglacera’s strategy to restructure its business segments. Viglacera’s leadership stated that the focus is on restructuring the material segment to enhance profit margins. The company will invest deeply in tiles, glass, and sanitaryware to increase efficiency. Additionally, it will develop new materials, including post-processing glass (self-cleaning glass, anti-reflective glass, electricity-generating glass for walls, etc.).

Following the restructuring of construction materials like tiles, glass, and sanitaryware, on November 10, Viglacera’s Board of Directors approved the restructuring plan for the roof tile segment. Accordingly, Viglacera Ha Long JSC will develop a strategy aimed at optimizing operational efficiency and sustainable development. Viglacera will divest from Yen Hung Construction Ceramics JSC and Cau Duong Firebrick JSC.

Dong Anh 382 JSC, Huu Hung Construction Ceramics JSC, Tu Liem JSC, and Tu Son Tile JSC will continue operations, streamline management structures, and implement restructuring and business conversion at the appropriate time.

– 08:23 13/11/2025

Viglacera Sets Date to Distribute Nearly VND 1 Trillion in 2024 Dividends

On December 5, 2025, Viglacera will distribute a substantial dividend of 986.37 billion VND to its shareholders, reflecting the company’s strong performance in 2024.