Recently, Sa Giang Import-Export Joint Stock Company (Stock Code: SGC, HNX) announced the resolution of its Extraordinary General Meeting of Shareholders (EGM) held on November 3, 2025.

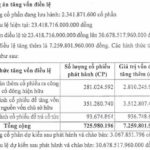

Accordingly, SGC’s shareholders approved a plan to issue additional shares to existing shareholders to increase the company’s chartered capital. The Board of Directors was also authorized to decide on all matters related to the offering.

Specifically, SGC plans to issue over 7.1 million shares to existing shareholders at a 1:1 ratio, meaning each shareholder holding one share can purchase an additional new share. The shares will not be subject to transfer restrictions.

Illustrative image

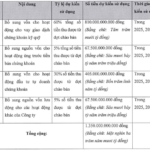

The offering is expected to take place in Q4/2025 or in 2026, following approval from the State Securities Commission (SSC) with the issuance of a Certificate of Public Offering of Additional Shares.

If successful, SGC’s outstanding shares will increase from over 7.1 million to nearly 14.3 million, raising its chartered capital from approximately VND 71.5 billion to nearly VND 143 billion.

With an offering price of VND 65,000 per share, SGC anticipates raising nearly VND 464.6 billion. The proceeds will be used to invest in Hoan Ngoc Agricultural and Food Products Joint Stock Company for the Hoan Ngoc Agricultural and Food Processing Plant project.

Notably, SGC’s Board of Directors previously approved the acquisition of a controlling stake in Hoan Ngoc Agricultural and Food Products, with a total transaction value of VND 119 billion.

Hoan Ngoc Agricultural and Food Products was established in April 2025 with a chartered capital of over VND 145.8 billion, specializing in the production of ready-to-eat meals and processed foods.

Sa Giang Import-Export Joint Stock Company (SGC) is a subsidiary of Vinh Hoan Joint Stock Company (Stock Code: VHC, HoSE), with a 76.72% ownership and voting rights as of September 30, 2025.

In terms of business performance, SGC recorded a net revenue of over VND 531.6 billion in the first nine months of 2025, an increase of nearly VND 11 billion compared to the same period in 2024. After-tax profit reached nearly VND 94.5 billion, up 14%.

As of September 30, 2025, SGC’s total assets increased by 24.4% year-to-date to over VND 560.2 billion, while total liabilities rose by 18.3% to over VND 123.4 billion.

HSV Launches Exclusive Offering at Over Double Market Price, Raising $150 Billion for Water Transportation Investment

HSV Vietnam Group Joint Stock Company (UPCoM: HSV) is set to issue 15 million shares at a price of 10,000 VND per share. This move aims to channel capital into the domestic inland waterway transportation sector, a new focus area within the company’s strategic shift beginning in 2025. HSV, traditionally a wholesale distributor of industrial waste and chemicals, is now diversifying its operations to embrace this emerging field.

Unveiling the Top 4 Shareholders of Xuan Thien Securities Post-IPO

Spring Securities has successfully completed the sale of 135 million shares to 66 shareholders, increasing its capital to VND 1.485 trillion. Following this offering, the company now boasts four major shareholders.