In recent years, no brand exemplifies the meteoric rise of China’s automotive industry better than BYD. Its ascent past Tesla to become the world’s leading electric vehicle (EV) manufacturer is a stunning commercial victory. BYD’s vehicles now grace streets from Bangkok to São Paulo, with UK sales surging 880% year-over-year, making it the largest market outside China.

Yet, when examining the broader global impact, a critical question remains unanswered: Why hasn’t this sales success translated into brand prestige and soft power for China, as Ford, Mercedes, or Ferrari have done for their nations?

Legacy

Historically, the ability to manufacture and export automobiles was more than business—it was a statement of national identity. The Ford Model T symbolized American efficiency, Mercedes-Benz precision German engineering, and Ferrari Italian passion and artistry.

Brands weren’t just products; they were cultural narratives that consumers aspired to own. Successful automotive brands sold dreams and stories, not just transportation.

More recently, Japanese and South Korean automakers built soft power by evolving from initial skepticism to global benchmarks for reliability and luxury, reshaping perceptions of their nations’ manufacturing capabilities.

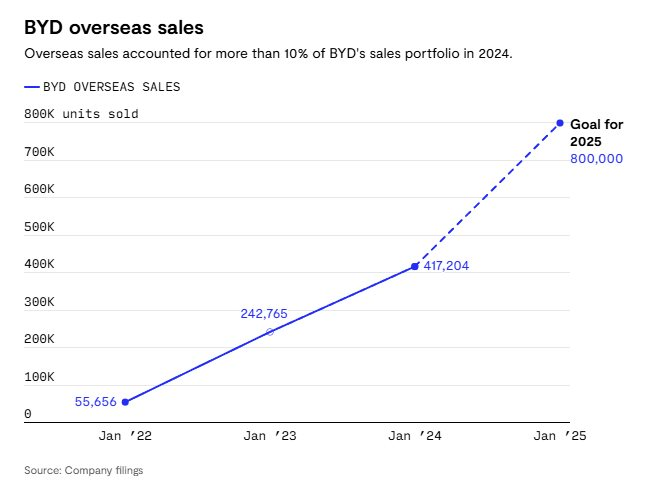

BYD’s Overseas Sales (in thousands)

BYD boasts the numbers to join these giants: massive revenue, Blade battery technology, and a presence from Asia to Europe. Yet, consumers buy BYD primarily for its compelling value and practicality, not cultural cachet or aspiration, unlike Tesla, despite Elon Musk’s brand erosion.

BYD’s failure to build prestige commensurate with its sales stems from three zeitgeist and geopolitical barriers.

First, automotive manufacturing is no longer a rare feat. In Henry Ford’s era, mass production signaled membership in an elite club of industrialized nations. Today, even EV production is commonplace.

The shift from internal combustion to electric lacks the technological mystique of a decade ago. Battery chemistry innovations, while impressive, fail to ignite imagination like groundbreaking design.

Second, BYD’s absence from prestigious global markets. History shows the US market is the ultimate proving ground for auto brands. Japanese and South Korean automakers gained global legitimacy by conquering America’s demanding consumers.

BYD’s exclusion by a 100% US tariff costs not just sales but the ultimate validation, where success signals global-class status.

Third, the burden of national perception. Unlike historical competitors, BYD carries its country’s negative stereotypes. Slow app updates and recalls of over 100,000 vehicles further erode trust.

Though China is a sophisticated manufacturing hub, “Made in China” still connotes affordability over excellence. Edelman’s 2024 Trust Barometer shows global trust in Chinese brands at 30%, down from 33% a decade ago, versus 62% for German or 64% for Canadian brands.

Other Chinese tech giants illustrate this phenomenon. Huawei dominates telecom, Lenovo leads PCs post-IBM acquisition, Alibaba and Tencent are tech titans, and TikTok captivates a generation.

Yet, except for TikTok among youth, none achieve aspirational status. They’re ubiquitous but lack global “cool” or desirability.

To transform sales into soft power, BYD must offer more than affordability. It needs a brand people desire for its superiority, not just accessibility. This demands decades of consistent innovation and unwavering quality.

The journey from commercial success to cultural influence is a marathon. Until BYD shifts from practical choice to aspirational icon, its record numbers will remain business achievements, not global perception shapers.

Sources: RoT, Fortune, BI

Can the Tet Season Boost Vietnam’s Automotive Market?

As the Vietnamese automotive market enters Q4 2025, the peak shopping season is in full swing with a slew of new models either launched or on the horizon, including the Lynk & Co 08, Mitsubishi Destinator, and Jaecoo J7 AWD. However, many experts predict that the year-end car market in 2025 may not be as vibrant as it was in 2024.

Toyota Bets Big on Vietnam’s Hybrid Vehicle Market

Toyota Motor is set to commence hybrid vehicle production in Vietnam as early as 2027, marking a significant milestone in the Japanese automaker’s expansion strategy within the promising Southeast Asian market.

Brazil’s President Receives BYD’s 14 Millionth Vehicle Milestone

The BYD Song Pro, a remarkable new energy vehicle, was bestowed upon the President of Brazil as a prestigious honor. This milestone marks BYD’s 14 millionth new energy vehicle rolling off the production line globally, showcasing the company’s commitment to sustainable transportation and its growing impact on the world stage.