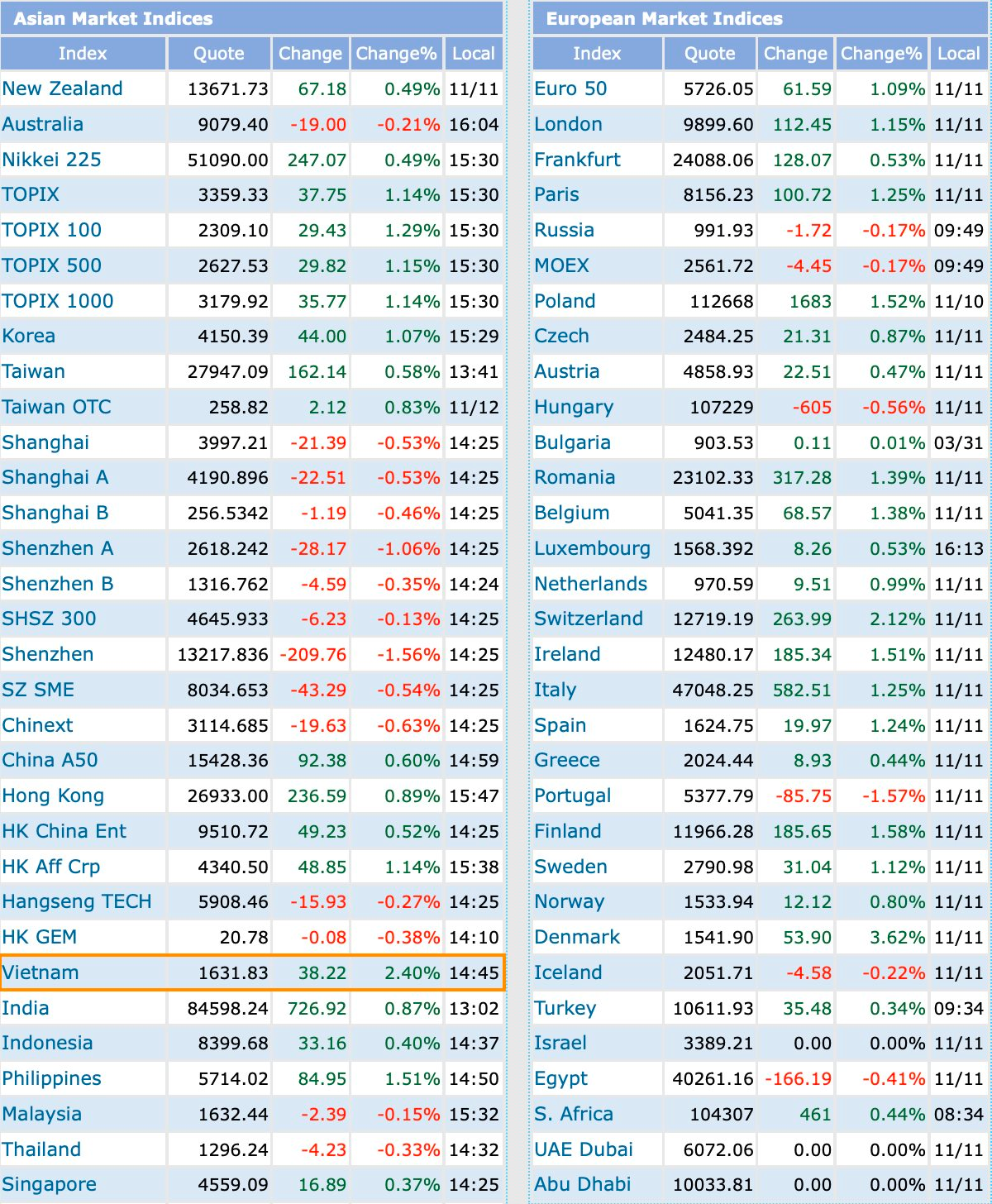

Vietnam’s stock market experienced a positive trading session, with widespread gains despite liquidity not yet reaching a peak. Numerous blue-chip stocks surged, with increases of over 3% being relatively common among large-cap stocks. The VN-Index closed up more than 38 points (+2.4%) at over 1,630 points, while the VN30 rose by nearly 51 points.

This 2.4% increase made Vietnam’s stock market one of the world’s top performers on November 12th. The second consecutive day of strong gains raises hopes of ending the prolonged correction that began in mid-October. Previously, the correction had seen the VN-Index lose up to 185 points (over 10%) from its peak, retreating to the 1,580-point range.

During the previous correction, many blue-chip stocks were deeply discounted by 20-30%. This stimulated bottom-fishing as market valuations and many stocks reached reasonable levels. It’s too early to predict a new wave, as liquidity remains subdued. However, the broadly positive session is an encouraging sign for investors.

Additionally, Vietnam’s stock market received a boost from global investment giant Vanguard, one of the world’s largest asset managers with nearly $13 trillion under management. Vanguard expressed interest in investing in Vietnam during a recent meeting with the State Securities Commission in Australia.

Vanguard outlined plans to initiate investment activities in Vietnam following the market’s upgrade, including opening trading and indirect capital accounts. The fund emphasized that navigating the new regulatory procedures will be a crucial test, providing global investors with firsthand experience of Vietnam’s investment environment.

In a recent analysis, Dragon Capital noted that after significant declines, the market has historically recovered to previous levels, albeit at varying speeds. Correspondingly, the DCDS fund, Vietnam’s oldest equity fund, has demonstrated impressive resilience and outperformance relative to the VN-Index.

Regarding investment prospects, Dragon Capital believes Vietnam’s market possesses strong fundamentals to sustain positive growth in 2025–2026. Corporate earnings continue to exceed expectations, with the 80 companies tracked by Dragon Capital projected to grow profits by 21.3% in 2025 and maintain 16.2% growth in 2026.

Furthermore, market valuations are attractive, with a projected 2025 P/E ratio of 12.5–13x and 11x for 2026, lower than many regional markets, while profit growth remains robust.

Vietnam’s upgrade from frontier to emerging market status will unlock significant re-rating potential, as large-scale international capital inflows could fuel a new growth cycle.

In a recent Facebook post, La Giang Trung, CEO of Passion Investment, observed that market corrections often trigger pessimism, accompanied by various explanations for the decline. However, current conditions do not warrant significant pessimism. As the world moves toward monetary policy easing, Vietnam is preparing its five-year plan with high expectations for economic growth and structural reforms.

“Betting against Vietnam’s stock market at this point is essentially betting against the economy’s ability to stay on course. Personally, I believe Vietnam will continue its successful economic development, as it has for over 30 years since the introduction of the Enterprise Law,” La Giang Trung stated.

Is MCH Poised to Become Vietnam’s Next Blue-Chip Stock Amid Surging Market Capitalization on HoSE?

Masan Consumer’s MCH stock is poised to become a leading representative of the essential consumer goods sector on the HoSE, with the potential to emerge as a new “national stock” favorite.