Golden Time, Golden Returns – The Financial Philosophy of Modern Investors

The story of Mr. P., a senior executive at a leading domestic real estate conglomerate, vividly illustrates this philosophy. With a diversified investment portfolio spanning stocks, bonds, and large-scale real estate projects, he meticulously manages his personal capital—closely monitoring cash flow, payment schedules, and reinvestment opportunities.

Savvy investors always leverage “golden time” to generate “golden returns.”

Within his financial portfolio, alongside long-term investments, lies short-term capital—funds awaiting payment deadlines or earmarked for upcoming deals. For him, this capital is purpose-driven and cannot be risked, yet it cannot remain idle in an account, depreciating over time.

“I want my capital to always be ready, so when an opportunity arises, I can act immediately—while ensuring it continues to generate returns during the waiting period,” he explains.

Thus, when ACB launched its Time Deposit Certificates (TDCs) with high yields and flexible withdrawal mechanisms, he promptly evaluated them as a tool for managing short-term capital. After consulting on the interest calculation based on holding period and flexible capital usage, he invested 98 billion VND in the first issuance.

“I can track interest rates and pre-maturity yield tables directly on the ACB ONE app, and withdraw funds when needed while still earning returns. Everything is swift, transparent, and efficient,” Mr. P. notes.

This experience, he believes, aligns with the financial management approach of entrepreneurs: prioritizing control and ensuring every penny, even in temporary repose, is utilized effectively to transform every moment into “golden time” for returns.

Optimal Yield Solution with Flexible Usage

Launched in late October 2025, ACB’s TDCs quickly garnered attention from investors and priority customers—those who value efficient cash flow management and seek both safety and control in financial decisions.

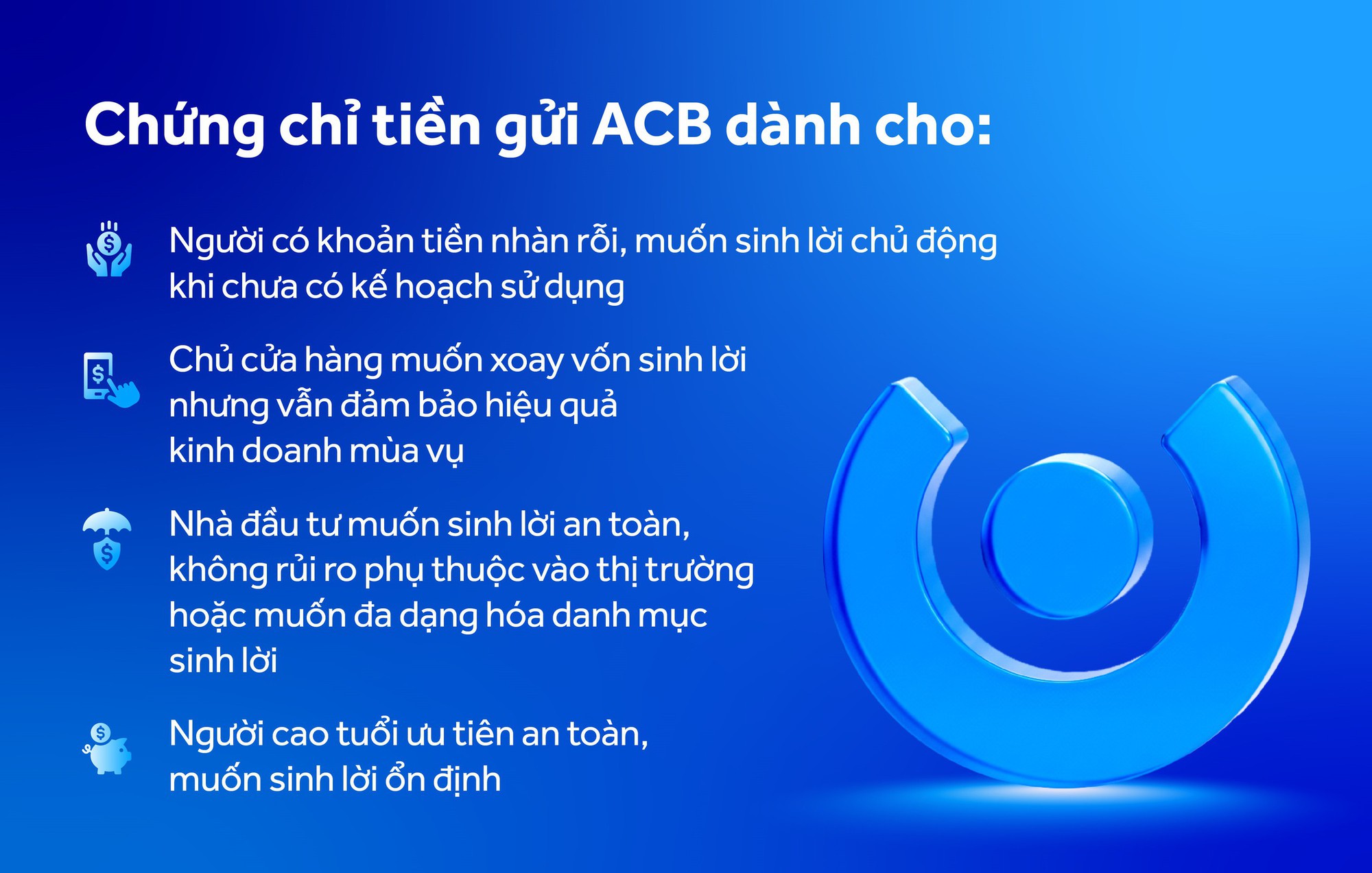

ACB TDCs cater to diverse financial needs.

According to Mr. Tu Tien Phat, CEO of ACB, the TDC launch is part of ACB’s strategy to diversify investment solutions for customers, particularly priority clients and individual investors demanding high returns and financial control.

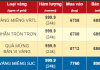

ACB TDCs boast four key advantages:

– Attractive yields – daily earnings with fixed interest up to 6%/year, calculated based on actual holding period.

– Flexible capital usage – customers can sell before maturity while still earning corresponding yields, without losing profit opportunities.

– Safety and transparency – clear digital contracts displaying term, face value, interest rates, and pre-maturity yield tables, all backed by ACB’s reputation and technology.

– 100% online execution via the ACB ONE app, saving time and enabling full investment portfolio control.

ACB TDCs offer optimal yields and flexible usage.

Beyond these advantages, ACB TDCs win customers through a knowledgeable financial advisory team adept at understanding needs and cash flow cycles, tailoring solutions to individual financial plans. This approach helped ACB successfully partner with Mr. P., who invested 98 billion VND in TDCs.

Sharing insights on serving this niche clientele, Ms. Huynh Thi Kim Chi, Deputy Director of ACB’s Retail Banking Division, states: “Effective advising requires deep product knowledge, understanding capital operations, and customer needs to design optimal profit-maximizing solutions. When solutions are ‘tailor-made’ for real needs, customers instantly recognize the value—the most persuasive approach.”

This customer-centric, experience-driven approach enables ACB’s advisors to build long-term trust, not just sell products. Combined with the product’s flexibility and modern digital platform, ACB TDCs swiftly attracted investor interest post-launch, becoming the go-to solution for “golden time – golden returns.”

Interested customers can learn more about ACB’s Time Deposit Certificates here, or contact the 24/7 Contact Center at (028) 38 247 247 or visit the nearest branch for consultation and support.