According to VietstockFinance data, the total revenue of nine auto distribution and manufacturing companies on the stock market exceeded VND 16 trillion, a 15% increase year-on-year. Net profit reached over VND 2.2 trillion, up 29%, largely due to a one-time gain from SVC’s real estate investment sale.

A closer look reveals that luxury car distributors like HAX and GMA underperformed, while the mass-market segment’s profit margins at CTF and SVC were equally unimpressive.

Luxury Cars Struggle to Recover

G-Automobile (HNX: GMA), the Mercedes distributor, reported a 42% drop in Q3 profit to nearly VND 5 billion, despite revenue surging past VND 1 trillion. Gross margin fell from 8.3% to 6.9%. CEO Nguyễn Thị Thanh Thủy attributed this to weak demand in the auto market, particularly for luxury vehicles. GMA’s consolidation of Ford distribution boosted revenue but also increased financial, sales, and management costs.

A similar situation unfolded at Hang Xanh Auto Services (Haxaco, HOSE: HAX). Chairman Đỗ Tiến Dũng noted that Q3 saw fierce competition as brands offered deep discounts, impacting both luxury and mass-market segments. HAX posted a net loss of over VND 28 billion, its second consecutive quarterly loss, compared to a VND 61 billion profit last year. Revenue dropped 25% to under VND 1.15 trillion, with gross margin plunging from 11.3% to 5.2%.

| HAX’s Consolidated Gross Margin Declines Sharply |

Mass-Market Segment Fares No Better

Even PTM (UPCoM: PTM), a HAX-owned MG distributor with over 51% stake, saw a downturn. PTM’s Q3 revenue fell 27% to VND 300 billion, with gross profit dropping nearly 60% to VND 35 billion as margins shrank from 20.5% to 11.6%. Net profit plummeted to VND 362 million from VND 51 billion last year. Both PTM and HAX representatives cited weak purchasing power and intense competition forcing dealers to offer aggressive discounts to maintain market share.

At City Auto (HOSE: CTF), Deputy CEO Trần Quang Trí stated that the auto market showed “no signs of recovery in the first nine months.” CTF’s Q3 net profit plunged 88% to VND 244 million. While gross margin improved to 11.3% due to Volkswagen consolidation, post-merger expenses outpaced profit growth, significantly reducing parent company earnings.

Dịch vụ Tổng hợp Sài Gòn (Savico, HOSE: SVC) reported higher revenue and profit, but auto sales gross margin fell from 3.3% to 2.2%. Profit growth was driven by service revenue and real estate divestment gains. Excluding these factors, SVC faced margin pressure from rising interest and operational costs as it expanded its showroom network.

| CTF’s Q3 Net Profit Plummets |

Commercial Vehicles Show Promise

In contrast to passenger cars, the commercial vehicle segment thrived due to robust public investment and infrastructure development.

Vietnam Machinery Development Investment (VVS, UPCoM) saw revenue soar 168% to over VND 2.2 trillion, with net profit doubling to VND 89 billion. Management credited the government’s launch and completion of 250 projects in August for boosting VVS’s customer demand.

TMT Auto (HOSE: TMT) reported its third consecutive profitable quarter post-restructuring. Revenue rose 10% to VND 386 billion from light truck sales under 10 tons. However, gross margin declined due to July discounts during weak demand. Net profit reached nearly VND 2 billion, reversing last year’s VND 92 billion loss.

Trường Long Technical and Auto Services (HOSE: HTL) saw profit fall 22% to VND 4.9 billion despite higher revenue, due to delayed Euro 5 certification increasing costs.

| VVS Benefits from Public Investment Wave |

Margins Rely on Customer Services

Vietnam’s auto market faces intense competition from new brands, especially Chinese ones, amid weak purchasing power due to economic challenges. Shrinking vehicle sales margins are forcing companies to shift focus to value-added services.

CTF Chairman Trần Ngọc Dân noted that new car sales margins are “razor-thin” due to price wars. The company is pivoting to after-sales services like car care, accessories, finance, and insurance. Q3 results highlight this shift, with service revenue rising 8% to nearly VND 108 billion, contributing VND 44 billion in gross profit—over one-third of total gross profit of VND 126 billion. Year-to-date, service revenue grew 6.5% to VND 130 billion.

At HAX, Chairman Đỗ Tiến Dũng predicts 2025 will remain challenging. For the MG brand, the focus is on strengthening dealership capabilities, especially in services and personnel, to prepare for future growth rather than rapid expansion.

SVC pursues a similar strategy. Chairman Ngô Đức Vũ highlights increasing competition from Chinese brands and VinFast, prompting showroom expansion and investment in high-margin after-sales services (20-40%). Used cars are a new focus, offering double the profit of new cars without direct competition. Vũ calls this SVC’s long-term strategy, leveraging stable profitability and longer lifecycles.

Q3 results show SVC’s service revenue exceeded VND 854 billion, up nearly 13%, with gross margin improving from 34% to nearly 38%. Service profit reached VND 323 billion, two-thirds of total gross profit, up from 57% last year. Year-to-date, services contributed VND 712 billion, over half of total gross profit.

Market Demand Remains Sluggish

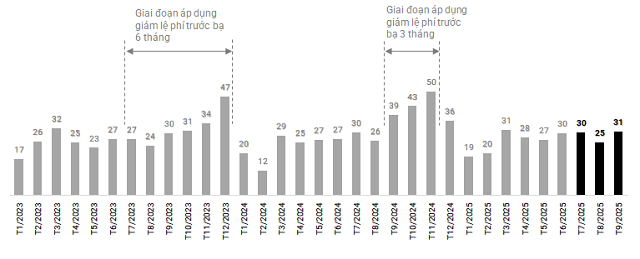

Data from the Vietnam Automobile Manufacturers’ Association (VAMA, excluding VinFast) and TC Group shows weak demand. In Q3/2025, total sales reached approximately 86,000 units, down 9% year-on-year and significantly below Q3/2022’s 99,400 units. This decline partly reflects 2024’s high base, when a 50% registration fee discount in September-November spurred sales.

Major automakers reported mixed results. Hyundai TC sold nearly 11,600 units, down 30%; Mitsubishi fell 31% to 9,200; Thaco Kia dropped 38% to 5,500. Toyota led with 18,800 units, up 3.8%.

Commercial vehicles outperformed, with Thaco Truck selling over 6,200 units, up 60%; Isuzu and Hino rose 23% and 217%, respectively, driven by strong freight demand.

|

VAMA and TC Group data show weak Q3 sales (Unit: Thousands)

Source: Author’s compilation

|

– 10:24 14/11/2025

Bank Stocks: Profit Quality and Inherent Risks Insufficient for Valuation Expansion

The Q3/2025 financial results of numerous banks reveal a promising outlook, driven by credit expansion and improved non-interest income, signaling that the toughest phase of the profit cycle may be behind us. However, the stock market has responded with caution, scrutinizing profit quality, net interest margin positioning, potential delays in bad debt formation, and lingering legal risks. As risk premiums rise amid macroeconomic uncertainties and capital flows, valuation multiples are compressing, tempering the short-term positive impact of profit growth.

Chinese Car Imports to Vietnam Surge Significantly

The Vietnamese automotive market has witnessed a notable shift in the first nine months of this year, marked by a significant surge in import trends. Particularly striking is the unexpected rise of Chinese-origin vehicles in the truck and specialized vehicle segments.