On November 12th, Masan Consumer Corporation (Masan Consumer, UpCOM: MCH) approved a shareholder written consent plan for a 22.5% stock dividend. This means shareholders holding 1,000 shares will receive an additional 225 new shares.

With over 1 billion shares outstanding, MCH plans to issue 237.8 million bonus shares, increasing its chartered capital to 12,945 billion VND post-issuance.

The capital for this issuance will be sourced from undistributed profits exceeding 3,835 billion VND.

Previously, on November 5th, the Ho Chi Minh City Stock Exchange (HoSE) officially accepted Masan Consumer’s initial listing application. The company registered 1.067 billion shares for listing, equivalent to a chartered capital of 10,676 billion VND. Vietcap Securities Corporation is the listing advisor.

According to regulations, the reference price on the first trading day on HoSE will be based on the average price of the last 30 sessions on UPCoM.

Masan Consumer’s leadership anticipates the stock will be included in the VN30 index during the July 2026 review period.

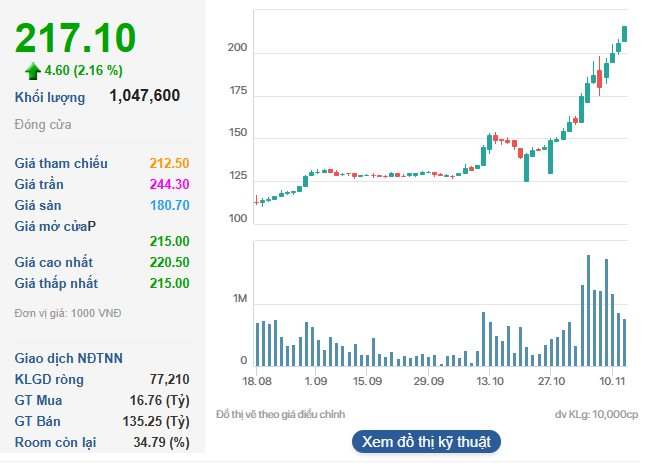

On the stock market, MCH shares closed at 217,100 VND on November 13th, a 54% increase compared to October 21st.

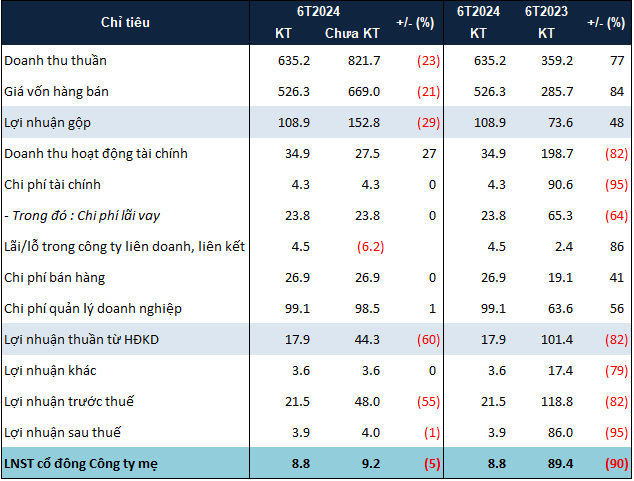

In Q3 2025, MCH reported net revenue of 7,516 billion VND, a slight 6% decrease year-over-year. Net profit after tax also declined by 19% to 1,698 billion VND.

For the first nine months of the year, Masan Consumer achieved net revenue of 21,281 billion VND, a 3% decrease compared to the same period last year. Consequently, net profit after tax fell to 4,660 billion VND, a 16% decline year-over-year.

Unveiling Vietnam’s FMCG “National Stock”: Decoding the Phenomenon

With nearly 30 years of dedication to Vietnamese consumers, Masan Consumer (UPCoM: MCH) has seamlessly integrated into the daily lives of millions of households. This deep-rooted connection has earned MCH the title of a “national stock,” where its commitment to serving consumers is matched by the unwavering trust of investors.

Dofico to Auction Off Entire Stake in Dong Nai Food Processing

Dong Nai Food Industry Corporation (Dofico) is set to auction off its entire 29% stake in Dong Nai Food Processing Co., Ltd. (D&F), with a starting price of 72.5 billion VND. The auction is scheduled to take place on December 15th.

Foreign Investors Ease Sell-Off, Counter-Trend with Over 400 Billion VND Buy-In on Blue-Chip Stock in November 10th Session

Foreign investors net sold approximately VND 300 billion, a notable cooling-off compared to the previous sessions marked by massive sell-offs worth thousands of billions of dong.