The Vietnamese stock market witnessed a vibrant trading session, with a notable uptrend gaining momentum towards the close, fueled by strong bottom-fishing demand, particularly in blue-chip stocks. By the end of the November 12th session, the VN-Index surged by over 38 points, closing at 1,631.86. Liquidity improved but remained subdued, with HoSE’s order-matching value reaching approximately VND 19.4 trillion.

Foreign trading activity remained a drag, with net selling extending to VND 464 billion for the day. Details are as follows:

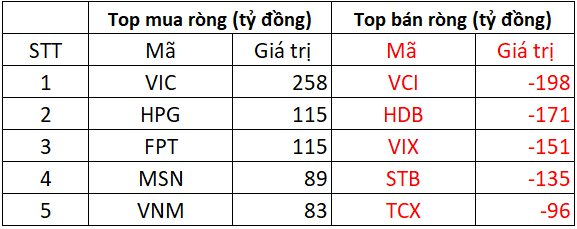

On HoSE, foreign investors net sold approximately VND 386 billion

On the buying side, VIC led the market with foreign investors accumulating VND 258 billion worth of shares. HPG and FPT followed closely, each seeing net buying of VND 115 billion. MSN and VNM were also in focus, with net purchases of VND 89 billion and VND 83 billion, respectively.

Conversely, financial stocks dominated the net selling list. VCI topped with VND 198 billion in net sales, followed by HDB, VIX, and STB, which saw net selling ranging from VND 135 billion to VND 171 billion. TCX also faced net selling of VND 96 billion from foreign investors.

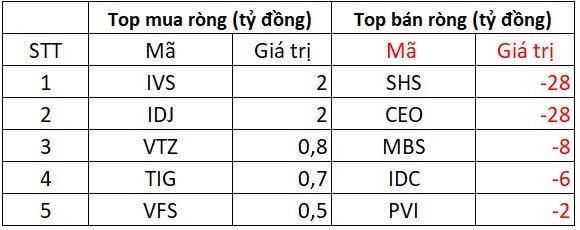

On HNX, foreign investors net sold around VND 78 billion

On the buying side, foreign investors mildly net bought VND 2 billion in IVS and IDJ. VTZ, TIG, and VFS saw negligible net buying.

Conversely, SHS and CEO faced significant net selling of VND 28 billion each. IDC, PVI, and MBS also saw modest net selling of a few billion dong each.

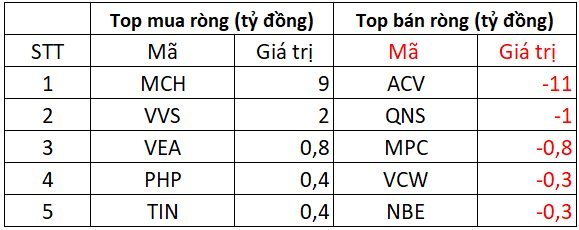

On UPCOM, foreign investors mildly net bought VND 20 million

On the buying side, foreign investors injected approximately VND 9 billion into MCH. VVS, VEA, PHP, and TIN saw net buying ranging from a few hundred million to VND 2 billion.

Conversely, ACV faced net selling of around VND 11 billion, while QNS saw VND 1 billion in net sales. MPC, VCW, and NBE also experienced minor net selling of a few hundred million dong each.

November 13th Stock Market: Will Blue-Chip Stocks Continue to Lead the Market?

Market trends have been significantly influenced by the volatility of major stocks, a pattern that is likely to persist into the November 13th session.

Vietstock Daily 14/11/2025: Is Market Polarization Returning?

The VN-Index experienced a minor adjustment, forming a small-bodied candlestick pattern with trading volume remaining below the 20-day average, reflecting investor hesitation. The Stochastic Oscillator has signaled a buy opportunity from the oversold territory. Should this buying momentum persist and exit the oversold region in upcoming sessions, the short-term outlook may turn more favorable.