KIS Grabs Attention Amid Domestic IPO Deals

In early November 2025, the South Korean securities firm KIS is quietly seeking approval from its parent company’s shareholders for a capital increase plan to raise 789 billion VND, boosting its charter capital to over 4,500 billion VND.

The goal is to allocate approximately 596 billion VND to margin lending and 193 billion VND to proprietary trading.

KIS’s move comes as domestic securities firms are launching three IPOs totaling nearly 35 trillion VND, alongside numerous private placements.

This highlights the need for foreign securities firms to ensure competitiveness as market development increasingly relies on margin lending capabilities.

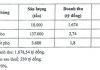

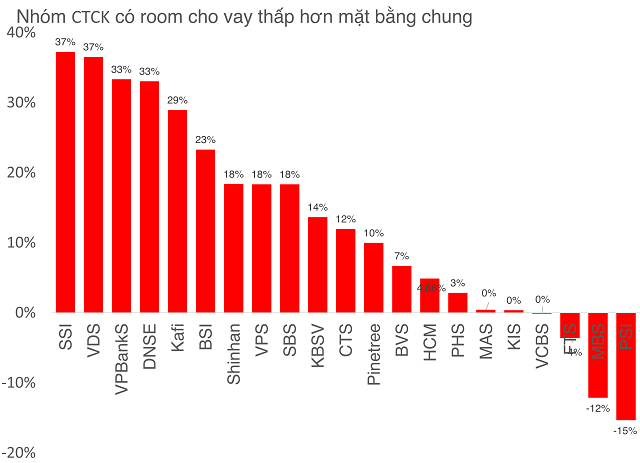

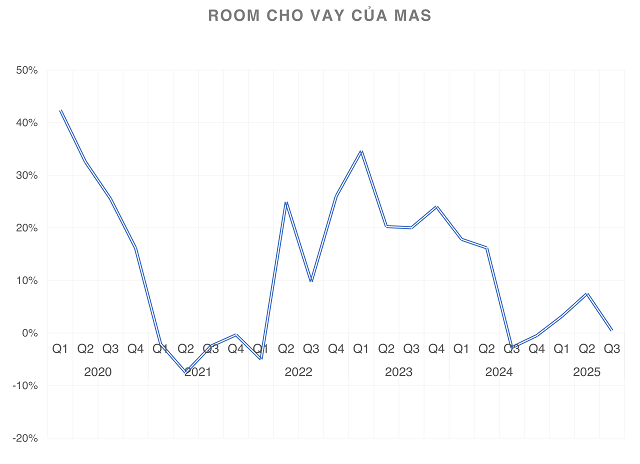

Like KIS, other foreign securities firms face similar margin constraints. MAS, also from South Korea, has repeatedly hit its lending limit and cannot expand further.

MAS’s lending capacity (capped at twice equity) shows consistent signs of depletion.

|

Other firms like Shinhan, KBSV, and Pinetree also have lower lending capacity than the market average.

Taiwan’s PHS Securities, despite a 2,000 billion VND capital increase in late 2024, still has limited lending room.

Thus, foreign firms like KIS and PHS must enhance financial capacity soon.

The market also anticipates IPOs from FDI enterprises. With shortened timelines, the State Securities Commission plans to list FDI firms soon.

Securities Stocks Correct as Funds Diverge

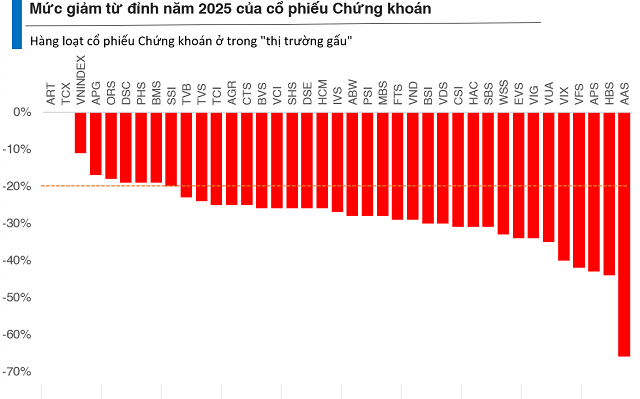

Despite the FTSE Russell upgrade benefiting the sector, securities stocks like SSI, HCM, VCI, and MBS have fallen over 20% post-announcement.

The bearish trend has negatively impacted investor sentiment, with debates over fund diversion to IPOs affecting overall market performance.

Bùi Văn Huy, Vice Chairman and Investment Research Director at FIDT, notes the impact of new IPOs like TCBS, VPS, and VPBankS on the capital market.

TCBS saw 2.5 times oversubscription at a P/B of 3.3x, higher than the sector average of 2.2x. Decree 245/2025/NĐ-CP has expedited IPO and listing processes.

“From a liquidity perspective, simultaneous IPOs amid sluggish trading can disperse funds. Investors shifting to IPOs may reduce liquidity in listed stocks, which has dropped 50% from Q3 2025 peaks,” Huy said.

However, he views this as temporary. Most IPO capital comes from new or IPO-focused investors, not entirely from listed stocks. Quality listings will attract funds back, expanding market depth and long-term liquidity.

Investors should monitor fund diversion without panic. Current liquidity tightness may be transitional, with capital restructuring before returning. Stable market conditions and recovery signals will restore liquidity.

– 10:00 12/11/2025

MWG Aims to Transform Indonesian Electronics Chain into Southeast Asia’s New Retail Icon

In the 2026–2030 strategic cycle, EraBlue aims to achieve sustainable growth, expand its regional footprint, and go public before 2030, solidifying its position as Southeast Asia’s emerging retail icon.

Market Pulse 12/11: Green Wave Sweeps In, VN-Index Recaptures 1,630 Mark

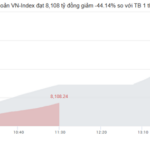

At the close of trading, the VN-Index surged by 38.25 points (+2.4%), reaching 1,631.86 points, while the HNX-Index climbed 3.71 points (+1.42%) to 264.79 points. Market breadth was overwhelmingly positive, with 361 advancing stocks versus 323 declining ones. Similarly, the VN30 basket saw a near-complete dominance of green, with 29 gainers and only 1 loser.