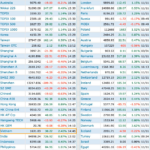

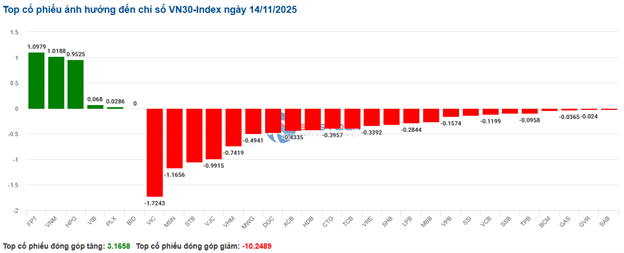

Among the top 10 stocks influencing the VN-Index, VIC had the most negative impact, reducing the index by 1.47 points. Closely following were CTG and VHM, which further decreased the index by over 1 point. Conversely, TCX, FPT, VPB, and VNM were the top contributors, adding a combined total of 1.83 points to the index.

| Top 10 Stocks Impacting VN-Index on the Morning of November 14, 2025 (Measured in Points) |

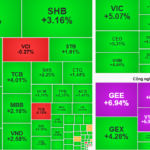

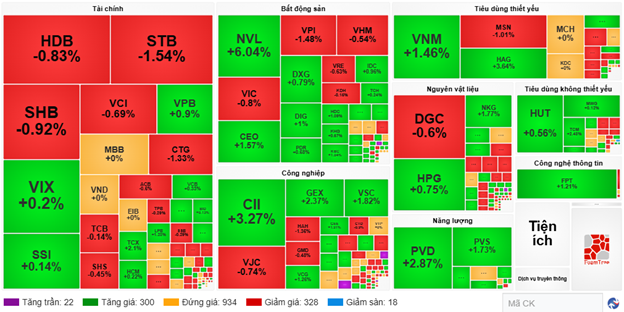

Market polarization continued to dominate, with all sectors fluctuating within narrow ranges. In the green, the information technology sector led the market with a 1.09% increase, primarily driven by the positive performance of FPT, up 1.21%, and VEC, up 1.69%.

The industrial sector also saw several stocks attracting positive demand, including ACV (+1.09%), GEE (+1.91%), GEX (+2.37%), VCG (+1.26%), CC1 (+1.61%), and CII (+3.27%). However, notable declines were observed in VJC (-0.74%), BMP (-1.04%), THD (-1.27%), PHP (-1.44%), HAH (-1.36%), and SJG (-14.41%).

On the flip side, the real estate sector underperformed with a 0.58% decline, influenced by adjustments in stocks like VIC (-0.8%), KSF (-1.33%), BCM (-1.62%), VPI (-1.48%), TAL (-2.22%), and VCR (-5.8%). Nevertheless, buying interest persisted in select stocks such as NVL (+6.04%), CEO (+1.57%), DIG (+1%), KBC (+1.04%), HDC (+1.09%), and SCR (+2.7%), preventing the sector from falling further in the morning session.

Source: VietstockFinance

|

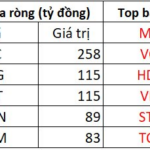

Foreign investors continued to net sell, with a total value of 562.78 billion VND across all three exchanges. Selling pressure was concentrated in VCI and STB, with values of 126.46 billion VND and 121.27 billion VND, respectively. Meanwhile, VNM led the net buying list with a value of 189.68 billion VND, significantly outpacing other stocks.

| Top 10 Stocks with Strongest Foreign Net Buying and Selling on the Morning of November 14, 2025 |

10:30 AM: Red Dominates Financial Sector, VN-Index Continues to Struggle

Investor hesitation led to continued volatility in key market indices around the reference point. As of 10:30 AM, the VN-Index fell by 5.26 points, trading around 1,625.12 points. The HNX-Index saw a slight increase, trading around 266 points.

Stocks in the VN30 basket exhibited mixed movements, with selling pressure slightly outweighing buying interest. Notably, VIC, MSN, STB, and VJC collectively deducted 1.72 points, 1.17 points, 1.05 points, and 0.99 points from the index, respectively. In contrast, FPT, VNM, and HPG were among the few stocks maintaining gains, contributing over 3 points to the VN30-Index.

Source: VietstockFinance

|

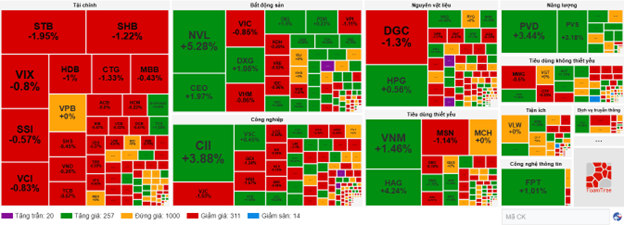

Sector-wide performance showed a balanced mix of green and red, though the financial and real estate sectors continued to underperform, declining by 0.4% and 0.66%, respectively.

Within the banking sector, notable declines were observed in STB (-1.95%), SHB (-1.22%), HDB (-1%), and CTG (-1.43%). Additionally, securities stocks like VIX (-0.6%), SSI (-0.43%), VCI (-0.69%), and VND (-0.26%) also experienced mild losses.

The real estate sector remained constrained by Vingroup stocks, with VIC down 0.9%, VHM down 0.96%, and VRE down 0.63%. Conversely, other stocks showed more optimistic gains, including NVL (+5.28%), CEO (+1.97%), DIG (+1.25%), and DXG (+1.05%).

Compared to the opening, sellers gradually gained the upper hand. The number of declining stocks reached 311, while 257 stocks advanced.

Source: VietstockFinance

|

Opening: Financial and Real Estate Sectors Show Early Divergence

At the start of the November 14 session, as of 9:30 AM, the VN-Index dropped by over 6 points to 1,624 points. Similarly, the HNX-Index saw a slight decline of nearly 1 point, trading around 265 points.

The financial sector opened in the red, with leading stocks like SHB (-1.22%), SSI (-0.57%), and STB (-0.51%) experiencing early declines.

The real estate sector continued to show contrasting trends among VinGroup stocks, with VHM down 1.71%, VIC down 0.8%, and VRE down 0.78%. Meanwhile, other stocks received strong buying support, such as NVL hitting its upper limit, DXG up 2.89%, CEO up 3.94%, and DIG up 3%.

Large-cap stocks like VIC, VHM, and VCB weighed heavily on the market, collectively reducing the index by over 3.3 points. Conversely, NVL, TCX, and HPG led the upward trend, though their combined impact was less than 0.5 points.

– 12:00 PM, November 14, 2025

$13 Trillion Shark Signals Account Opening, Vietnamese Stocks Surge to Global Lead

Vietnam’s stock market has surged for two consecutive sessions, sparking optimism that the prolonged correction since mid-October may finally be coming to an end.

November 13th Stock Market: Will Blue-Chip Stocks Continue to Lead the Market?

Market trends have been significantly influenced by the volatility of major stocks, a pattern that is likely to persist into the November 13th session.