Ha Giang Mechanical and Mineral JSC (stock code: HGM)

has announced that November 25th will be the final registration date for the second cash dividend payment of 2025, with a rate of 85% (equivalent to VND 8,500 per share). The payment is scheduled for December 18, 2025.

With 12.6 million outstanding shares, HGM is expected to disburse over VND 107 billion for this dividend.

Previously, Ha Giang Minerals paid an interim dividend for the first installment of 2025 at a rate of 45%. Including this payment, the total cash dividend for 2025 will reach 130% (VND 13,000 per share).

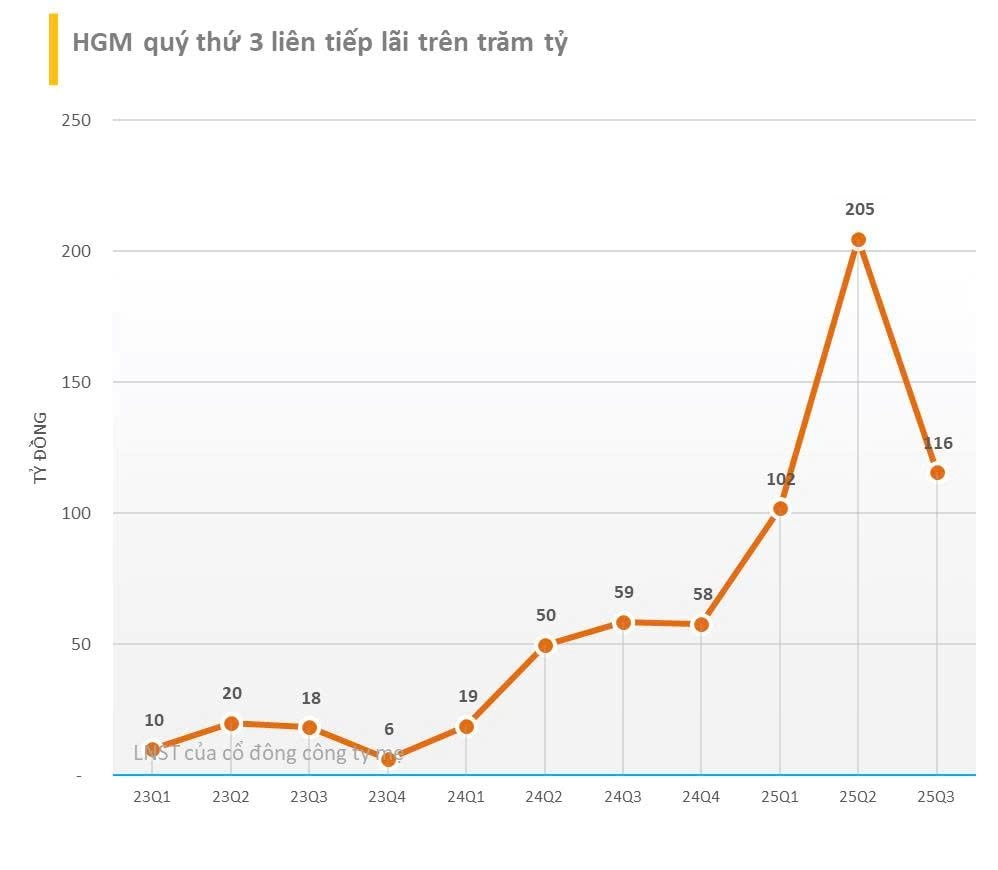

The mineral enterprise is generously distributing dividends following a significant surge in revenue and profit during the first nine months of 2025. Accumulated net revenue for the period reached VND 606 billion, a 144% increase compared to the same period last year (VND 248 billion). After-tax profit stood at VND 422 billion, up 231% from VND 127 billion in the same period of 2024.

Thus, after nine months, the company has surpassed 50% of its revenue target and doubled its pre-tax profit.

In the revenue structure, the primary income source comes from exported Antimony metal, totaling VND 597 billion, a 156% increase year-on-year. Domestic Antimony sales contributed VND 9.1 billion, down 39% from the previous year.

Antimony is a critical mineral highly sought after by Canada, the U.S., the European Union, the United Kingdom, and other nations globally. This strategic metal is used in military applications such as ammunition and missiles, as well as in lead-acid storage batteries for automobiles and brake linings due to its heat resistance.

This vital resource is also extensively applied in high-tech industries, serving as a key component in semiconductors, circuit boards, electrical switches, fluorescent lighting, high-quality transparent glass, and lithium-ion batteries. Common products like smartphones, high-resolution TVs, modern kitchen appliances, and even digital circuit-equipped vehicles all rely on Antimony.

As of the end of Q3 2025, HGM’s total assets reached over VND 675 billion, nearly 160% higher than the beginning of the year. Cash, cash equivalents, and deposits accounted for over 80% of total assets, valued at nearly VND 560 billion. The company has no financial debt, with equity capital exceeding VND 532 billion. Accumulated profit as of September 30th stood at VND 346 billion.

On the stock market, HGM shares are trading around VND 255,000 per share.

HGM Announces Additional Cash Dividend of VND 8,500 per Share

Hà Giang Mechanical and Mineral JSC (HNX: HGM) has announced the record date for its second cash dividend payment of 2025, offering an impressive 85% payout ratio (equivalent to VND 8,500 per share). The ex-dividend date is set for November 24th, with the payment expected to be distributed from December 18th.

Breaking News: Company Set to Allocate Nearly $230 Million to the Ministry of Industry and Trade

The Ministry of Industry and Trade currently stands as the largest shareholder of the Vietnam Engine and Agricultural Machinery Corporation (VEAM), holding nearly 1.18 billion shares, which equates to an 88.5% stake in VEAM’s chartered capital. From the upcoming dividend distribution, the Ministry is set to receive approximately VND 5.5 trillion.

Bình Sơn Refinery Doubles Down: Capital Surges Past 50 Trillion VND Post-Share Offering

Following the conclusion of the issuance on October 30, 2025, Binh Son Refinery successfully completed the distribution of over 1.9 million dividend and bonus shares to its shareholders. This strategic move has effectively increased the company’s chartered capital to nearly 50,073 billion VND.