The energy sector stocks have unexpectedly surged in the stock market, recording a broad-based rally. As of the morning session on November 13th, several stocks such as PVB, OIL, BSR, PLX, GAS, and PVP turned green, climbing between 1% and nearly 4% in value.

Notably, the duo PVS and PVD saw significant gains. PVS soared over 5% in value, while PVD briefly hit its ceiling at 26,150 VND/share before slightly retreating to 25,950 VND/share, marking a 6.1% increase by the end of the morning session. This also represents the highest price level for the stock in over a year.

On a broader scale, the energy sector has been witnessing an upward trend since the latter half of October 2025. In just about three weeks, stocks like PVD and PVS have surged by 37% and 24% respectively, followed by GAS, OIL, and PLX, which have also risen by approximately 6%-10%.

Energy stocks rally on November 13th

This surge follows the government’s issuance of Resolution No. 66.6/2025/NQ-CP on October 28th, 2025, addressing challenges and bottlenecks in the delegation of approval authority for certain activities in the energy sector.

The resolution mandates the Vietnam National Oil and Gas Group (PVN) to exercise the duties and powers of the Ministry of Industry and Trade as stipulated in the 2022 Petroleum Law and Decree No. 45/2023/NĐ-CP, ensuring no impact on national defense and security. This includes approving the general development plan for oil and gas fields, approving adjustments to early exploitation plans, and approving adjustments to field development plans when total investment decreases or increases by less than 10%, among others.

Granting PVN additional authority in approving energy activities is seen as a crucial step, enhancing autonomy, reducing administrative procedures, and expediting the implementation of oil and gas projects.

In other developments, on the morning of November 8th, Petrovietnam held a ceremony to commemorate the 14th National Party Congress with the installation of the Central Processing Platform (CPP) jacket—a critical component of the Block B&48/95 and Block 52/97 gas field development project.

The Block B – O Mon gas-to-power project is a national key initiative with a total investment of nearly $12 billion, comprising three components: upstream (development of Block B&48/95 and Block 52/97 gas fields off the southwest coast of Vietnam); midstream (the 431 km Block B – O Mon gas pipeline); and downstream (the O Mon I–IV gas-fired power plants with a combined capacity of approximately 3,800 MW).

According to Petrovietnam, the Block B – O Mon project holds strategic significance for Vietnam’s energy security, economic development, and green transition. Upon completion, the project will contribute to reducing CO2 emissions, replacing FO oil-fired power with natural gas, creating jobs, and fostering industrial infrastructure development in the Southwest region.

Growth prospects to diverge in 2026

In its latest update, BSC Securities forecasts that energy companies will sustain growth in the final quarter of 2025.

However, BSC notes that the sector’s growth is primarily driven by cost reversals, asset sales, and foreign exchange gains, while profits from core operations have not met expectations.

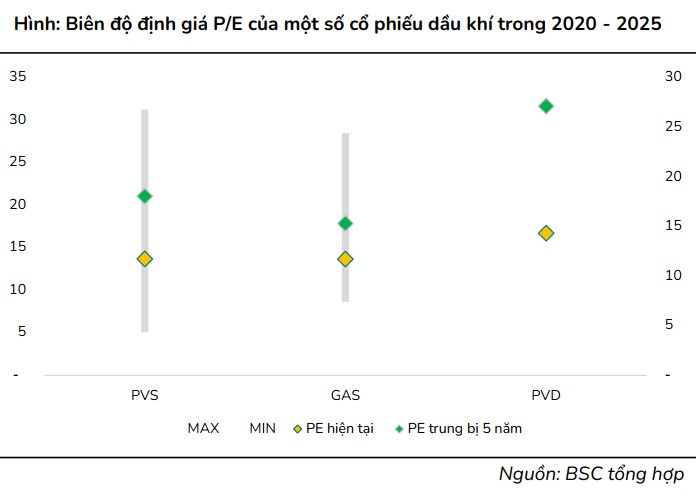

Looking ahead to 2026, BSC anticipates a divergence in performance among companies. Those with strong backlogs and favorable contract rates (PVS, PVD) are expected to maintain growth, whereas GAS may face challenges due to high profit benchmarks set in 2025 from cost reversals, with LNG supplies insufficient to offset the decline in natural gas. BSR could face headwinds from lower crude oil prices and narrowing crack spreads in 2026, though it will benefit from continued recovery in consumption volumes.

In the medium term, BSC analysts view energy stocks as attractive investments, given their deep discounts and undervaluation relative to historical levels. Notably, PVS’s market capitalization is lower than its net cash (after deducting debt), and PVD is trading at a 43% discount to its 5-year median PE ratio.

Meanwhile, SSI Securities projects in a recent report that global oil supply growth will slow to 2.1 million barrels per day in 2026, still outpacing demand growth of around 700,000 barrels per day, leading to continued oversupply.

Consequently, SSI Research expects oil prices to remain weak, with Brent averaging $63 per barrel in 2026 (-7.3% YoY). For gas, new LNG supplies from Canada, the U.S., and Qatar in 2026 are projected to cool LNG prices.

With oil prices staying low, SSI Research forecasts continued profit divergence among subgroups. The upstream segment (PVD, PVS) is expected to sustain growth due to robust workloads, directly benefiting from the Block B – O Mon project.

Specifically, PVD’s profit is projected to grow strongly at ~39.7% YoY in 2026, driven by high production capacity, rising rig rental rates, contributions from PVD XIII and IX, the end of depreciation for PVD I, and a low profit base in Q1/2025 (due to maintenance of PVD VI). PVS’s net profit is expected to increase by 9% YoY in 2026 from EPC contracts for Block B and Lac Da Vang, with total contract value estimated at ~$1.5 billion.

The downstream segment (PLX, OIL, BSR) is likely to face greater challenges, potentially recording flat or slightly lower profits. For GAS (midstream), the absence of significant cost reversals like in 2Q25 will likely result in a single-digit decline in net profit in 2026, despite a 7-9% increase in dry gas volume.

For the petroleum distribution segment (PLX, OIL), the new petroleum business decree is pending. Overall, the new decree enhances flexibility for distributors in adjusting retail prices based on actual costs, stabilizing profit margins.

Hanoi Captures Global Tech Giants’ Attention, Paving the Way for a Billion-Dollar Economic Boom

This is the booming economic sector that’s taking the world by storm, gaining traction across numerous countries globally.

Modernizing Railways: Why Vietnam Opts for Cost-Effective Technology Over the Most Expensive Solutions

The Minister of Construction emphasized that, in the current context, Vietnam is not seeking the most expensive technology but rather the most suitable one. This means prioritizing advanced, safe, and efficient technologies with transferable capabilities, enabling domestic enterprises to gradually take control and master these innovations.