Source: VietstockFinance

|

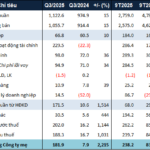

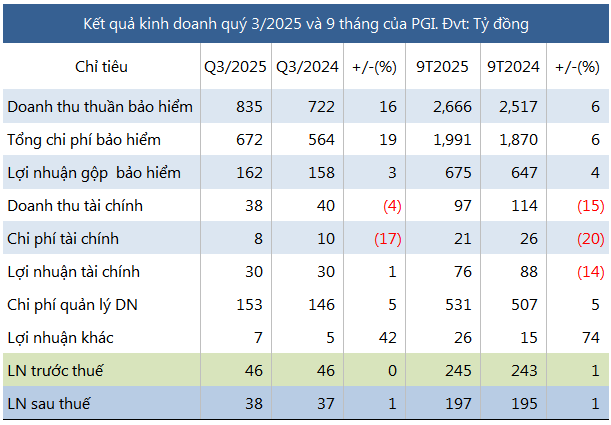

According to the Q3/2025 financial report, PGI’s insurance premium revenue surged by 21% year-over-year, reaching nearly VND 1.3 trillion. This growth propelled net insurance business revenue up by 16% to VND 835 billion. However, total expenses rose sharply by 19% to VND 672 billion, driven by increased claims and other costs, resulting in a modest 3% rise in gross insurance profit to VND 162 billion.

Financial activities contributed approximately VND 30 billion in profit, nearly matching the previous year’s figure, while corporate management expenses remained stable at over VND 150 billion. Consequently, net profit for Q3 stood at VND 38 billion, largely unchanged from the same period last year.

For the first nine months of the year, PGI recorded a net profit of VND 197 billion, a slight 1% increase year-over-year. While gross insurance profit grew by 4%, financial profit declined by 14%. Compared to the pre-tax profit target of VND 306 billion (a 5% increase from 2024), PGI has achieved 80% of its annual goal after nine months.

Total assets as of Q3’s end reached nearly VND 8.6 trillion, a 2% increase from the beginning of the year. This includes short-term deposits of over VND 4.1 trillion, which remained largely unchanged, and reinsurance assets (covering reinsurance premiums and claim reserves) decreased by 9% to more than VND 1.8 trillion.

Liabilities rose by 2% to nearly VND 6.7 trillion, with short-term operational reserves declining by 5% to over VND 4.4 trillion and short-term borrowings dropping by 8% to VND 567 billion.

– 1:00 PM, November 13, 2025

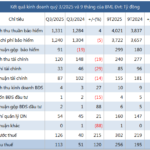

Q3 Profits Surge on Financial Revenue, Yet Hoa Binh Trails Behind After 9 Months

Despite a significant surge in profits during the third quarter, the nine-month business results of Hoa Binh Construction Group JSC (UPCoM: HBC) still reflect a decline in both revenue and profitability year-on-year.