Saigonres Real Estate Joint Stock Company (Saigonres, Stock Code: SGR, HoSE) has recently submitted a report detailing the utilization of capital raised from its private placement of shares.

By the end of the issuance on May 7, 2025, Saigonres successfully sold nearly 9.9 million SGR shares at a price of VND 40,000 per share, raising a total of VND 394.85 billion.

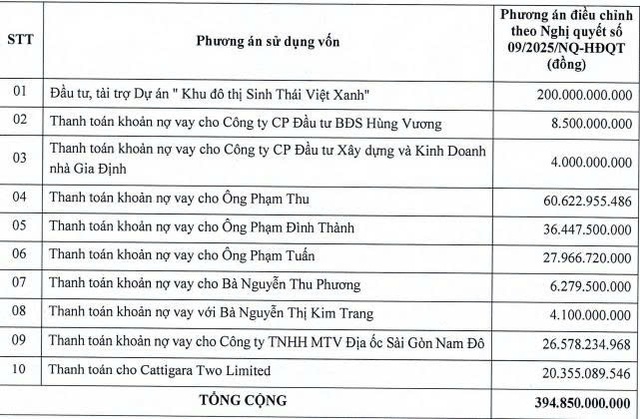

According to the plan, Saigonres intends to allocate the raised funds for the following purposes:

Source: SGR

As of November 7, 2025, Saigonres has disbursed VND 194.85 billion, with the remaining VND 200 billion earmarked for investment in the Viet Xanh Eco-Urban Area project yet to be utilized.

The Viet Xanh Eco-Urban Area project, spanning 49 hectares in Tan Vinh Commune, Luong Son District, Hoa Binh Province, is developed by Saigon Hoa Binh Real Estate Co., Ltd., a subsidiary of Saigonres. The total investment is projected at VND 1.1 trillion.

Regarding business performance, Saigonres’ consolidated financial report for Q3/2025 shows a net revenue of over VND 19.8 billion, a 65.7% decrease compared to the same period last year. After deducting the cost of goods sold, gross profit reached over VND 3.1 billion, down 93.1%.

During the period, the company generated VND 44.5 billion in financial revenue, a 7.5-fold increase year-over-year.

After accounting for taxes and fees, Saigonres reported a net profit of over VND 15.5 billion, a 63.1% decline compared to the same period last year.

In the first nine months of 2025, Saigonres achieved a net revenue of over VND 182 billion, up 54.4% compared to the same period in 2024; post-tax profit reached nearly VND 83.4 billion, 4.5 times higher year-over-year.

For 2025, Saigonres has set a business target of VND 1.025 trillion in revenue and VND 320 billion in post-tax profit.

By the end of Q3, the company has fulfilled 17.8% of its revenue target and 26.1% of its post-tax profit goal.

As of September 30, 2025, Saigonres’ total assets increased by 14.6% since the beginning of the year to over VND 2,581.7 billion, while total liabilities decreased by 11.4% to over VND 1,131.5 billion.

Landmark $200 Million Duc Giang Chemical Real Estate Project Approved After 5-Year Wait

Nestled in the heart of Viet Hung Ward, Hanoi, this expansive 47,470 m² development at 18, Alley 44, Duc Giang Street, offers a harmonious blend of modern living and convenience. Featuring 60 elegant townhouses, a high-rise residential complex with 880 apartments, a 1.1-hectare school, and a comprehensive array of commercial, sports, and recreational facilities, it’s designed to elevate your lifestyle.

“TBD Sustains 3 Consecutive Years of 20% Cash Dividend Payouts”

Dong Anh Electrical Equipment Corporation – JSC (UPCoM: TBD) announces the finalization of its shareholder list for the 2024 cash dividend distribution. Shareholders will receive a 20% dividend, equivalent to VND 2,000 per share. The ex-dividend date is set for November 21st, with payments expected to commence on December 24th.