According to data from Phu Quy Jewelry Corporation, silver prices surged today, with 999 silver (1 tael) listed at VND 2,043,000 (buy) and VND 2,106,000 (sell). In just one day, domestic silver prices rose by 3.5%, nearing a one-month high.

Meanwhile, 999 silver bars (1 kg) are priced at VND 54,479,864 (buy) and VND 56,159,860 (sell), updated at 08:58 on November 13.

Globally, silver prices soared to $53.4 USD/ounce.

Silver prices climbed approximately 3.5% to over $53 USD/ounce, the highest in nearly three weeks, fueled by growing expectations that the Federal Reserve will continue cutting interest rates this year. Optimism about the U.S. government ending its shutdown, allowing the release of new economic data, further bolsters these predictions.

U.S. House members are returning to Washington, D.C. today to vote on ending the 43-day government shutdown. Speaker Mike Johnson expressed confidence that the bill, a hard-fought compromise passed by the Senate and backed by President Donald Trump, will swiftly gain approval.

Markets now price in a 65% chance of a 0.25 basis point Fed rate cut in December, up from 62% the previous day. Meanwhile, supply pressures are expected to persist, with demand potentially rising as India’s wedding season begins and U.S. tariffs on the white metal remain in place.

Key external markets today saw the U.S. dollar index edge higher. Crude oil prices dropped sharply, trading around $58.86 per barrel. The 10-year U.S. Treasury yield currently stands at approximately 4.1%.

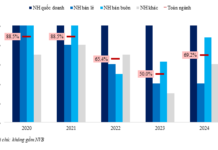

Customer Deposits Decline Across Multiple Banks

By the end of September 2025, total customer deposits across 27 listed banks reached over 12.26 quadrillion VND, reflecting a modest increase of nearly 207 trillion VND compared to June 2025. This marks the slowest quarterly growth rate observed in the past six quarters.