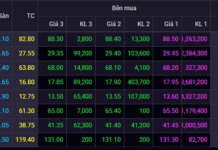

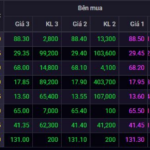

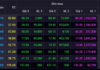

Vietnam’s stock market closed on November 12th with a vibrant green hue, as all three major indices surged thanks to a strong inflow of capital into large-cap stocks. The VN-Index rose by 38.25 points, or 1.63%, reaching 2,104.56 points; the VN30 also climbed over 50 points, while the HNX-Index and UPCoM-Index gained 3.71 points and 1.73 points, respectively.

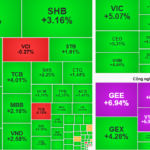

Liquidity on the HoSE reached over VND 21.8 trillion, the highest level in recent sessions, indicating improving investor sentiment. Blue-chip stocks rallied across the board, led by VRE with a 5.6% increase, VIC up 5.1%, and FPT and VHM both rising around 4.5%. Banking stocks also performed well, with TCB, SSB, VIB, and LPB all gaining between 2% and 3.5%.

In the securities group, VIX, VND, SSI, and SHS stocks all surged between 2% and 5%, benefiting from improved liquidity and optimistic Q4 profit expectations. Conversely, only VCI and APG saw minor declines, which were negligible.

The real estate sector also stood out, with NVL, PDR, DIG, and DXG jumping between 5% and 7%, driving the sector’s index to the highest gain on the market. According to securities firms, the even distribution of capital and the return of bullish sentiment are positive signs, indicating a sustainable market recovery after a short-term correction.

Many investors are jubilant as the stock market turns green.

According to the Head of Trading at VPS Securities, the November 12th session benefited from multiple positive developments, particularly the State Securities Commission’s working trip to Australia (from November 10th to 14th). During this visit, the delegation met with Vanguard, one of the world’s largest asset management firms, with nearly USD 13 trillion in assets under management.

“The market’s strong recovery after the correction is understandable, as the supply pressure has been tested and is no longer excessive. The afternoon session’s buying focus on large-cap stocks signals positive momentum for significant capital inflows, aligned with the market’s upgrade prospects by 2026,” he commented.

He added that November typically marks the beginning of a new uptrend, extending into Q1 of the following year, amid a synchronized global market recovery. Vietnam’s stock market is currently in an “absorption and accumulation” phase, preparing for a new growth cycle ahead of positive Q4 earnings reports.

Simultaneously, the Ministry of Finance has issued a decision to implement the plan to upgrade Vietnam’s stock market. Key initiatives include increasing foreign ownership limits, piloting short selling and T+0 trading, and moving towards T+0 or T+2 settlement without margin requirements, bringing the market closer to emerging market standards.

Mr. Nguyen The Minh, Director of Research and Individual Client Development at Yuanta Securities Vietnam, remarked: “This plan has a clearer, more specific roadmap than before, demonstrating a strong commitment to transforming market operations. As these reforms are implemented, particularly at technical milestones like T+0, increased foreign ownership, and new derivatives, investor confidence will strengthen, and the market will become more vibrant.”

Is MCH Poised to Become Vietnam’s Next Blue-Chip Stock Amid Surging Market Capitalization on HoSE?

Masan Consumer’s MCH stock is poised to become a leading representative of the essential consumer goods sector on the HoSE, with the potential to emerge as a new “national stock” favorite.

VN30 Stock Surges to Daily Limit as $190 Million Real Estate Project Takes Unexpected Turn

As a result, the stock price surged to its highest level in two months, with its market capitalization climbing to nearly 38 trillion VND.