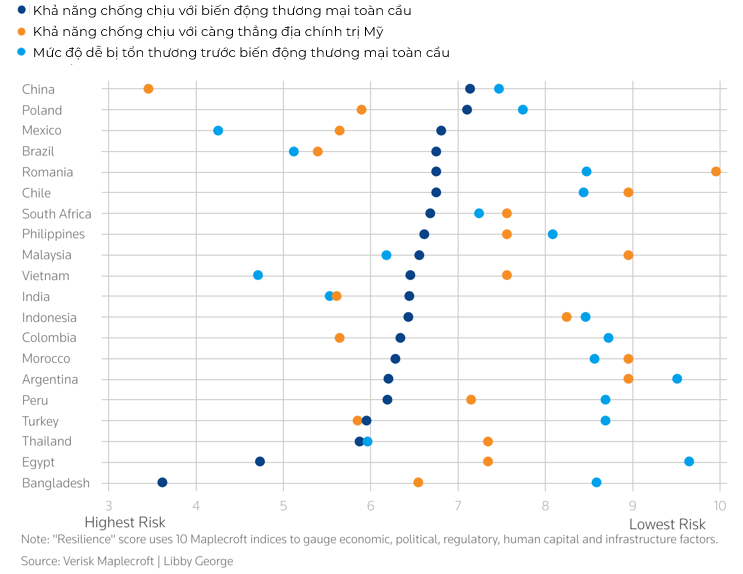

By analyzing the 20 largest emerging markets across parameters ranging from debt levels to export revenue dependency, researchers assessed these nations’ resilience to trade volatility and shifting geopolitical alliances.

“Global manufacturing hubs are far more resilient than conventional wisdom suggests, even in the face of the most aggressive tariff waves from the U.S.,” noted Reema Bhattacharya, Head of Asia Research and co-author of the report.

Despite Mexico and Vietnam being among the most U.S. trade-dependent economies, the report highlights their robust recovery potential, attributed to supportive economic policies, improved infrastructure, and political stability.

Brazil and South Africa are effectively diversifying trade partnerships, a strategy expected to bolster their resilience in the coming years.

Most Emerging Economies Poised to Weather U.S. Tariffs

“Nearly every emerging market recognizes the necessity of engaging with both the U.S. and China without over-relying on either. Hence, the pursuit of a third market is essential,” Bhattacharya explained, citing significant growth in intra-BRICS trade.

China, despite heightened geopolitical tensions with the U.S., is described as “too deeply entrenched to be easily replicated elsewhere,” thanks to its diversified export base and vast labor force.

As a leading manufacturing power, China remains central to the Trump administration’s global trade policy recalibration. Data released earlier this week revealed China’s October exports suffered their sharpest decline since February 2025, shortly after Trump’s return to the White House.

The report commends China’s multi-year efforts to promote the yuan in trade settlements, labeling it a “pragmatic strategy to enhance economic resilience and geopolitical risk diversification.”

Brazil, Argentina, and Chile have inked local currency payment agreements with the People’s Bank of China (PBOC). Meanwhile, Chinese state enterprises and investors are funding numerous lithium and copper projects in Chile, Bolivia, and Peru.

While the report omits Russia, another key BRICS member, it underscores that strengthened trade among developing nations is a viable strategy to mitigate the impact of U.S. tariffs.

– 10:11 14/11/2025

China Halts 24% Tariff, but U.S. Soybeans Still Lose Ground to a Global Agri-Giant Dominating Vietnam’s Market

This nation’s soybeans are gaining global popularity for their affordability, with Vietnam being one of the many countries embracing this trend.

International ‘Hawks’ Eye Vietnam’s Stock Market for a Compelling Reason

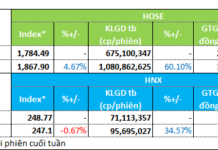

Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission (SSC), revealed that following the market upgrade announcement, numerous international investors who previously showed no interest in Vietnam are now actively seeking information. Many of these investors, managing capital ranging from hundreds of billions to trillions of USD, are expressing significant interest in Vietnam’s stock market.

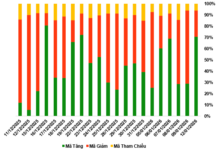

Vietnam’s Stock Market Post-Upgrade: New Opportunities, New Challenges

Following its official upgrade by FTSE Russell, Vietnam’s stock market is entering a transformative phase, marked by heightened expectations for foreign capital inflows, improved asset quality, and enhanced trading infrastructure. However, this evolution also brings new demands for transparency and governance capabilities.