Living Longer, Paying More: The Health Cost Dilemma

According to the Swiss Re Institute, over half of Asians report that healthcare costs are “significantly heavier” now than in 2017. In developing countries, out-of-pocket health expenditure remains high, accounting for 35–45% of total healthcare spending—one and a half times the WHO-recommended level.

In Vietnam, this figure stands at 39.5%, meaning nearly 4 out of every 10 healthcare dollars are paid directly by individuals. A year of cancer treatment can cost an average of 176 million VND, with 70% of expenses falling outside insurance coverage. As a result, 37% of cancer patients fall into poverty post-treatment, particularly those from middle- and low-income groups. For many, the choice is often between hiding their illness or delaying treatment to avoid becoming a financial burden on their families.

However, illness is just the tip of the iceberg. The Swiss Re Asia Care Report 2025 reveals that 60% of Asians fear job loss or income reduction—the highest in a decade; 45% feel living costs are rising faster than their earning potential; and over 30% admit to “insufficient insurance knowledge.” Financial risks no longer stem from major events but seep into daily life—a month of unemployment or a hospital bill can destabilize entire families. This reflects Swiss Re’s observation: Asians are living longer but paying a steeper price for health.

Technology Bridges the Health Protection Gap

When treatment costs outpace household savings, the insurance industry’s challenge isn’t “lack of products” but a genuine disconnect from user needs. For years, insurance has been perceived as an abstract commitment, despite its core purpose of risk-sharing and financial security. The issue today isn’t product scarcity but a failure to align with consumer demands.

Modern consumers, especially the youth, are redefining insurance. They seek proactive, transparent, and flexible protection—akin to any digital service—rather than relying on advisors or waiting. Many bypass traditional insurance but invest in small, understandable solutions tied to daily financial habits.

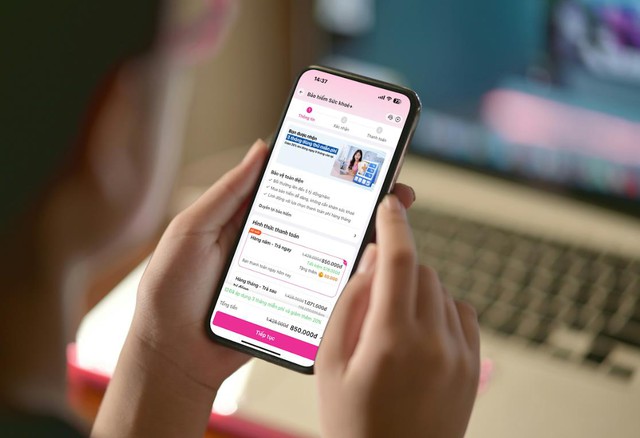

Enter micro-protection: low-cost, digital-first insurance gaining traction. Insurers and fintech platforms are moving insurance beyond counters, embedding it into daily life. Users can now purchase plans for as little as a few hundred thousand VND, with clear benefits and claims processed within minutes.

In Vietnam, this shift is evident as fintech platforms become the new gateway to mass insurance. A prime example is the partnership between MoMo and Chubb Life Vietnam, offering Health+ Insurance.

Unlike traditional models, Health+ is “on-demand”: users register, track policies, and pay via the MoMo app with just two health questions—no medical exams required. Monthly or annual premiums align with real incomes, while coverage includes 37 critical illnesses (e.g., cancer, heart disease) with 100% reimbursement of actual treatment costs. This product aims to alleviate financial strain during crises, not just provide post-risk payouts.

The innovation lies not in technology itself but in how it humanizes insurance. By framing protection as an affordable monthly expense, Health+ makes insurance accessible in a market where it was once deemed out of reach. In a landscape where insurance felt distant, Health+ demonstrates how digital transformation can turn complexity into familiarity, affordability, and relevance for the masses.

Deputy Prime Minister Hồ Đức Phớc Meets with Viettel Group

On the afternoon of November 11th, Deputy Prime Minister Hồ Đức Phớc, Head of the Steering Committee for Enterprise Innovation and Development, held a working session on the implementation of restructuring, innovation, and efficiency enhancement at the Military Industry and Telecoms Group (Viettel).

Digital Transformation in Vietnam: A 5-Year Journey Toward a Cashless Future

After five years of implementing the “National Digital Transformation,” Vietnam has made significant strides in building a robust digital economy. Mastercard stands as a pivotal partner, collaborating with the government, financial institutions, and businesses to advance electronic payments, broaden accessibility, and strengthen trust in the digital payment ecosystem.

Prime Minister Pham Minh Chinh Holds Working Session with Thanh Hoa Provincial Party Standing Committee

On November 9th, Prime Minister Pham Minh Chinh, alongside leaders from various ministries and sectors, visited Yen Cuong commune in Thanh Hoa province. The visit coincided with the groundbreaking ceremony for new boarding primary and secondary schools in border communes. During the trip, the delegation held discussions with the Standing Committee of the Thanh Hoa Provincial Party Committee. The agenda focused on the province’s socio-economic situation, public investment disbursement, the implementation of the two-tier local government model, future directions, tasks, solutions, and addressing outstanding issues.